Bitcoin's worth conduct was very highly effective final week and confirmed good indicators of restoration on the low final weekend. Premier Cryptocurrency has traveled to $ 108,000 for the previous couple of days, however now it's about $ 107,000. In keeping with the newest on -chain information, the investor group has been out of the market regardless of the worth elasticity of Bitcoin in current months.

BTC retail demand decreases by 10% in June. Analyst

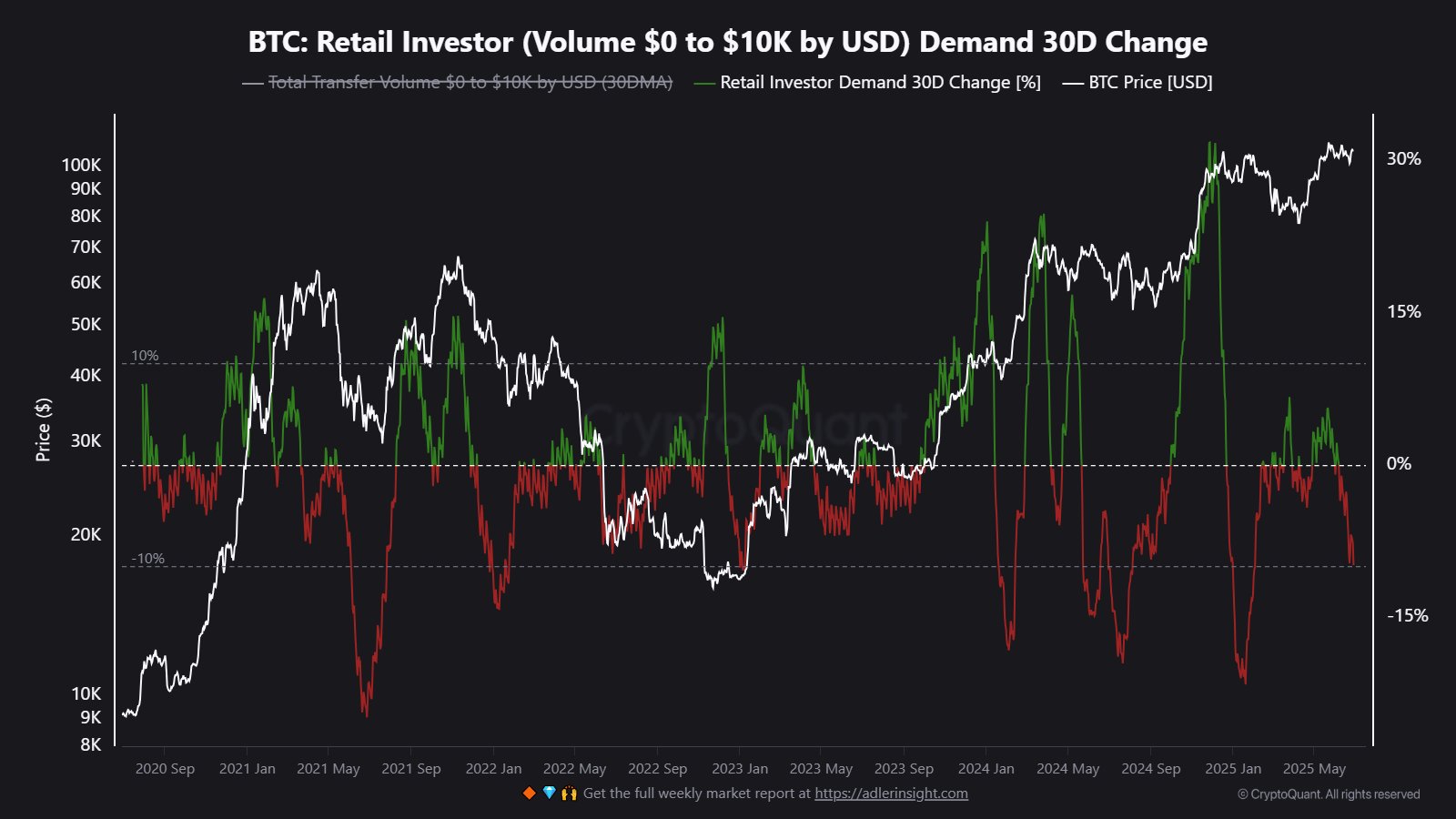

MAARTUNN, a sequence analyst from the June 28 put up of social media platform Z, stated that cohorts of market members, often known as retail traders, have been comparatively disabled for the previous couple of months. This heat -chain is predicated on the symptoms of retail traders, which estimates the demand for BTCs amongst small traders.

In essence, this heat -chain metric normally tracks the exercise of a small pockets concerned in a small sized transmission. Particularly, this retail investor demand indicator measures the cumulative fluctuations of small buying and selling quantity (worth of lower than $ 10,000) for 30 days.

Supply: @JA_Maartunn on X

On the chart emphasised by Maartunn, the 30 -day change of Bitcoin retail investor calls for has plunged into destructive territory, remaining pink from early June. Extra not too long ago, this metrics have dropped to 10%, which is the bottom degree for greater than six months.

Contemplating that the bitcoin worth measures are fairly regular at the moment, it’s stunning that small traders haven’t entered the market. The market appears to be dominated by institutional traders via the Bitcoin Alternate buying and selling funds.

Establishments and Bitcoin ETF traders are chargeable for

Burak Kesmeci, a sequence analyst from the X platform, has attracted consideration, and institutional traders and ETF traders have a powerful need for accumulation of bitcoin. Final week, the US-based BTC Alternate-Traded Funds recorded a complete of $ 2.2 billion.

KESMECI additionally talked about that Bitcoin costs have turn out to be near the underside if the retail demand continues to lower. Because of this, the principle cryptocurrency can get pleasure from optimistic momentum and rising costs for the subsequent few weeks.

On the time of this text, the worth of BTC is about $ 107,244, which is mirrored by a rise of 0.1% during the last 24 hours. In keeping with Coingecko's information, market leaders have elevated greater than 4% over the weekly interval.

The value of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Istock's predominant picture, TradingView chart

Editorial course of focuses on offering thorough analysis, correct and prejudice content material. We assist the strict sourcing commonplace and every web page is diligent within the high expertise specialists and the seasoned editor's staff. This course of ensures the integrity, relevance and worth of the reader's content material.