All eyes are within the Fed's financial outlook, as rates of interest are anticipated to stay untouched. This might have some impression on the value of BTC.

The Fed's choice can be that Bitcoin can be upward

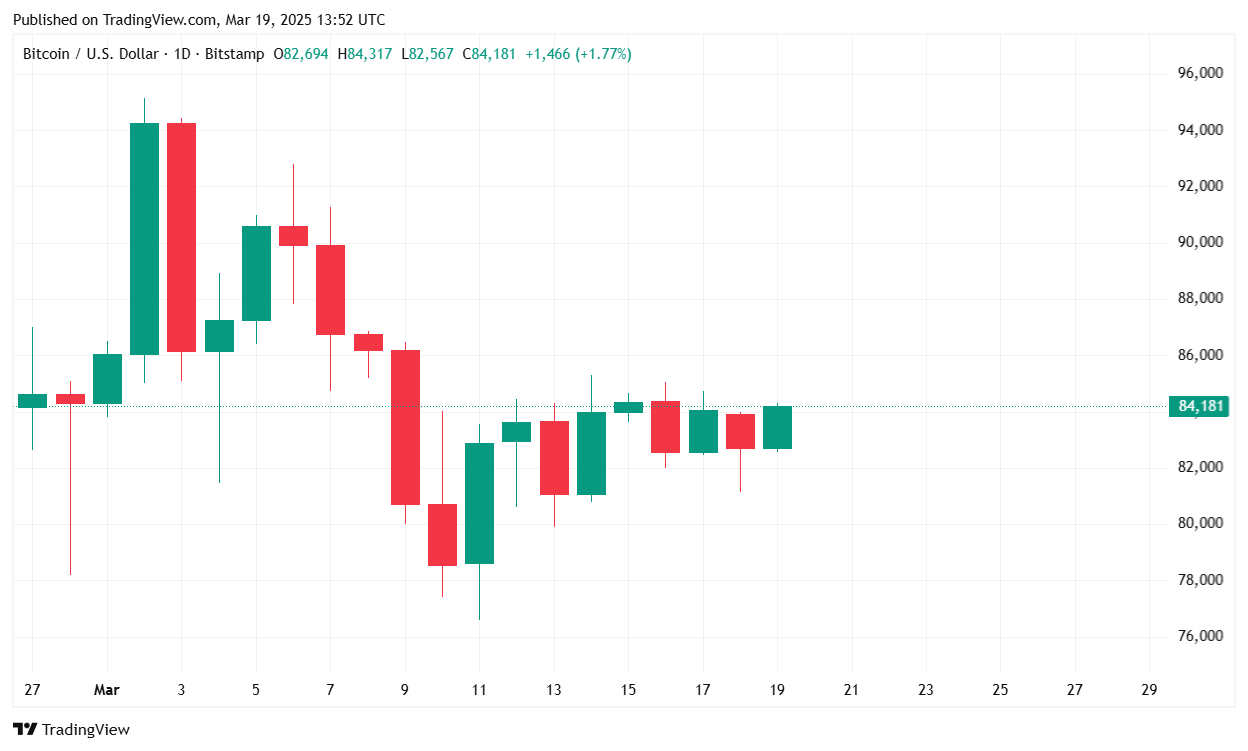

In response to CoinmarketCap, Bitcoin (BTC) rose 3.49% within the final 24 hours, reaching $84,191.67 on the time of reporting. Regardless of this each day improve, the best cryptocurrency prior to now seven days has risen by simply 1.20%, as market uncertainty meets right this moment's Federal Open Market Committee (FOMC) conclusions.

(BTC Worth/Commerce View)

Necessary Bitcoin Metrics

- 24-hour value vary: $81,179.99 to $84,303.97

- 24-hour buying and selling quantity: $242.9 billion reflecting a slight improve of 0.83%

- Market Cap: $1.67 trillion, down 3.54% from yesterday

- BTC dominance: 61.20%, 0.45% lower over the previous 24 hours

- Whole BTC futures open curiosity: $4.971 billion, down 2.43%

- 24-hour Bitcoin liquidation: $38.34 million (lengthy liquidation: $9.89 million, brief liquidation: $28.45 million). Liquidation knowledge exhibits that bear merchants confronted a significant loss as BTC's upward value motion violates the bets of brief sellers.

Centered Federal Reserve Convention

Traders are eagerly monitoring the conclusions of the FOMC assembly, with an official assertion anticipated at 2pm right this moment, adopted by a press convention by Federal Reserve Chair Jerome Powell at 2:30pm, however the markets are extensively anticipating that rates of interest will stay the identical.

A mix of steady speeds from the central financial institution and fewer hawk prospects might present a bullish catalyst for BTC. Nonetheless, alerts of excessive charges and financial uncertainty can replace gross sales stress.

Bitcoin outlook

With BTC exhibiting resilience of over $84,000, merchants will carefully monitor Powell's remarks and the broader macroeconomic scenario. If sentiment stays in its favor, BTC can try to maneuver to current ranges of resistance above $85,000. Conversely, Hawkish's rhetoric from the Fed may very well be a pullback under $82,000.