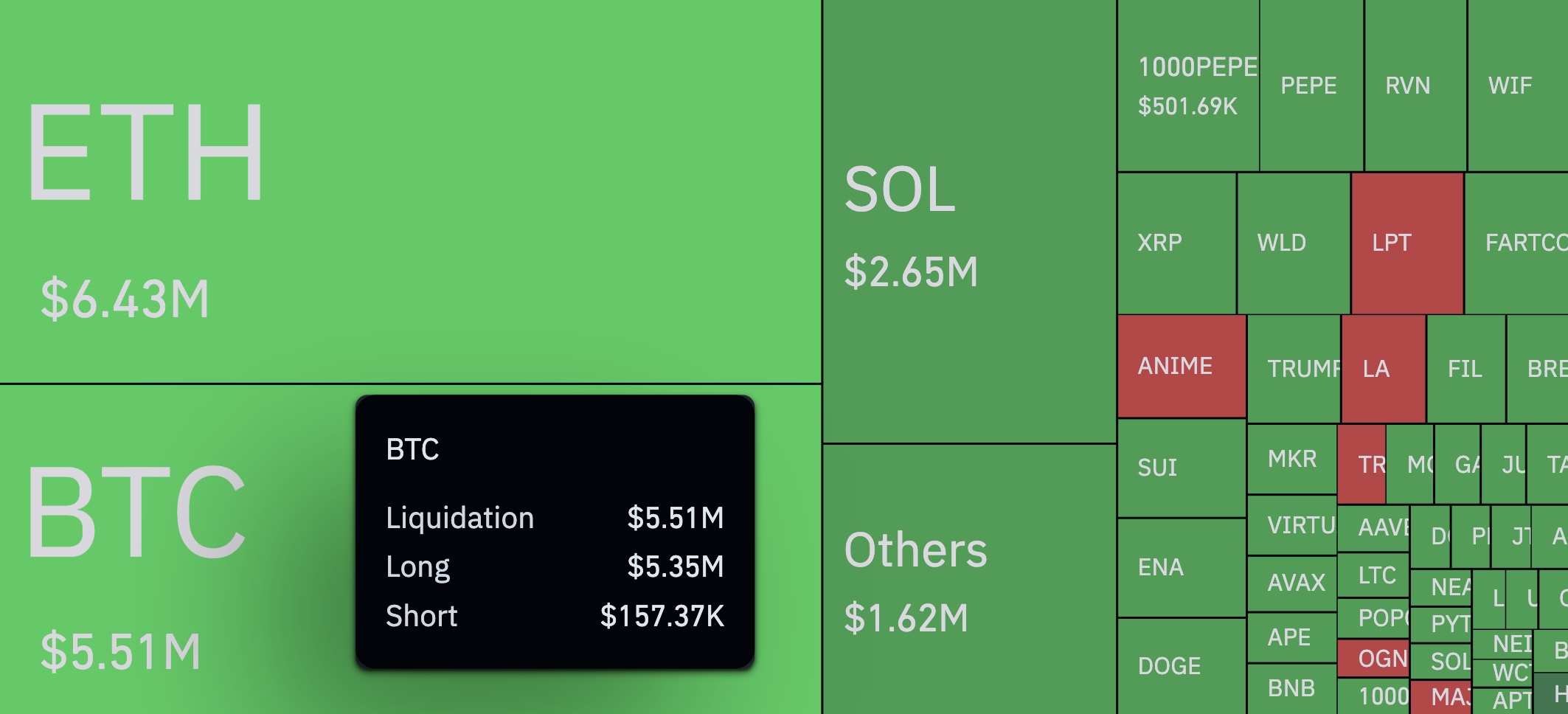

On June fifth, Bitcoin (BTC) futures merchants noticed a serious liquidation imbalance. In simply an hour, the $5.51 million place was cleared, with $5.35 million from the lengthy and simply $157,000 from the shorts. The ensuing 3,399% imbalance is likely one of the most uncommon hourly imbalances seen in latest buying and selling periods.

This occurred throughout a big drop in BTC costs. In simply an hour, Bitcoin skilled a sellout, transferring from over $104,800 to a low of practically $103,800 earlier than a slight restoration. The decrease pattern was proven in succession with a number of purple candles. This isn’t a sudden surge in volatility, however an indication of steady gross sales stress.

And naturally, there was loads of liquidation exercise throughout the market, past Bitcoin. Ethereum (ETH) totaled $6.43 million, adopted by Solana (SOL) at $2.65 million. Small belongings, together with 1000pepe futures, additionally noticed liquidation in tons of of hundreds.

Greater than $22.6 million was liquidated in the identical one-hour window, with 95% of this being long-term publicity, in accordance with Coinglass information. This factors to a really bullish market bias earlier than rewinding.

Previously 24 hours, whole liquidation reached $204.56 million. The lengthy place accounts for that determine of $144.53 million, whereas the shorts account for the remaining $60.03 million. In the meantime, 90,800 merchants had been liquidated.

The most important single order was HTX, which closed its BTC-USDT place value $2.21 million.