Analysts say Bitcoin is now out of “overbought situations” and is predicted to proceed on a gentle upward trajectory regardless of hitting a brand new all-time excessive on Monday.

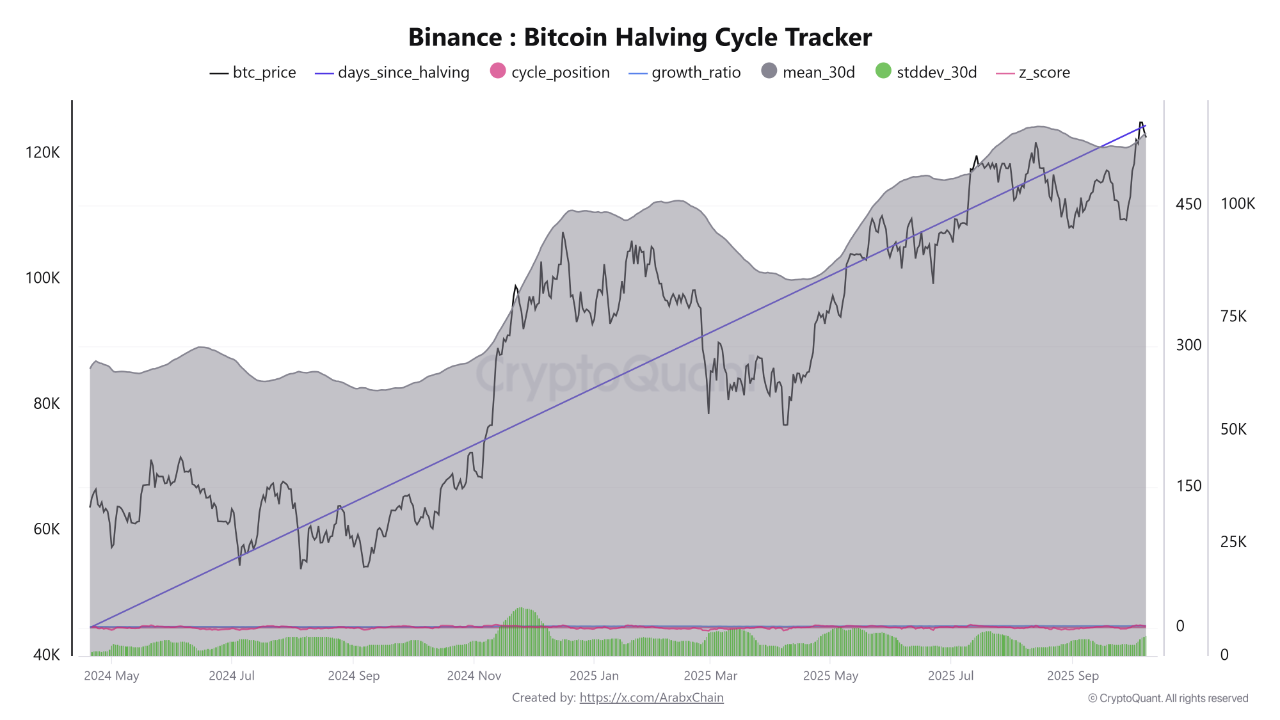

Bitcoin (BTC) hit an all-time excessive of over $126,000 on Monday, putting it “roughly halfway by way of a four-year worth cycle,” CryptoQuant investor Arab Chain mentioned on Wednesday.

“Regardless of this robust efficiency, technical indicators recommend that costs are nonetheless transferring inside a steady vary, removed from the overbought situations that preceded the historic peak,” it added.

Bitcoin reveals indicators of “upward momentum”

Arab Chain mentioned that Bitcoin “seems to be in a section of balanced upward momentum,” and that the typical closing worth over the previous 30 days, the 30-day transferring common, is just below $116,000, “suggesting a steady upward development with no sharp deviations.”

He added that Bitcoin's 30-day commonplace deviation, or dispersion of returns, was additionally “comparatively low at $4,540, reflecting lowered volatility, which is often seen earlier than wild worth actions, particularly on an upward development, when supported by new liquidity inflows.”

The expansion charge of Bitcoin has been on an upward development since Could 2024. supply: cryptoquant

Analysts mentioned that Bitcoin tends to succeed in cycle peaks as much as 600 days after the halving, when mining rewards are lower by 50%, and that if this sample continues, Bitcoin is now “within the vital window that has beforehand led to main bull market tops.”

'The celebs aligned' on report ETF inflows in This fall: Bitwise

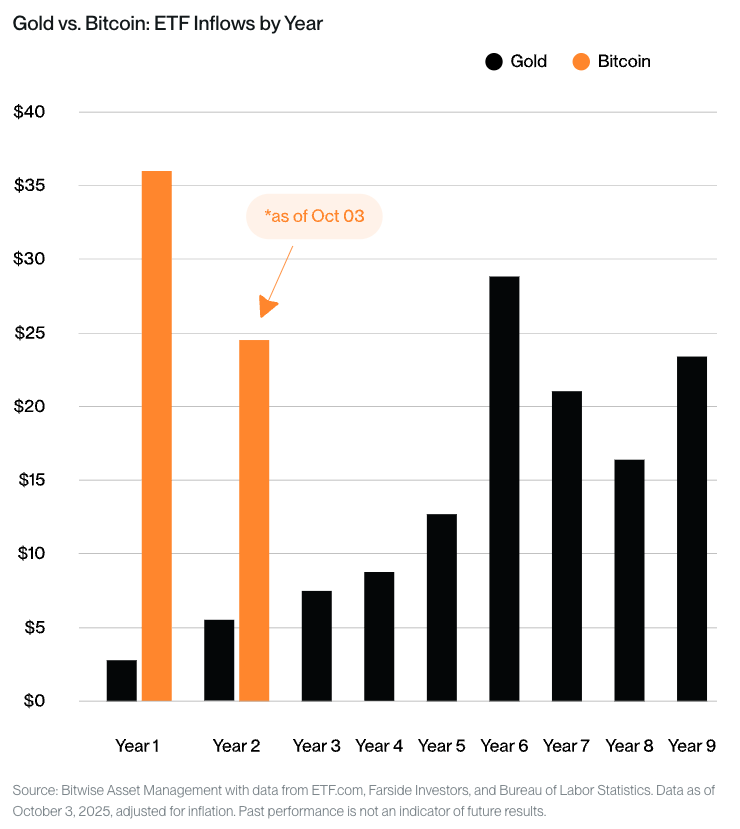

This comes after Bitwise Chief Funding Officer Matt Hogan predicted on Tuesday that inflows into Bitcoin exchange-traded funds (ETFs) would surge within the fourth quarter.

Hogan mentioned the excessive worth of Bitcoin is one purpose why inflows into U.S. Bitcoin ETFs “set a report” within the fourth quarter and “can have extra inflows in 2025 than within the record-setting first yr, which attracted $36 billion.”

ETFs have attracted $22.5 billion in inflows within the first 9 months of this yr, and are on observe to develop to round $30 billion by the tip of 2025.

“That's the new take. I'm not apprehensive,” Hogan mentioned. “From the place I sit, the celebs are aligned for a really robust fourth quarter flow-wise, which is greater than sufficient to push us to a brand new report.”

He mentioned the “most basic” purpose he expects massive flows to happen by 2025 is as a result of he’s “bullish on Bitcoin returns within the fourth quarter.”

Gold (blue) and Bitcoin (orange) ETF inflows by yr since inception. sauce: little by little

“It might appear a bit counterintuitive, however rising costs typically improve demand for Bitcoin ETFs because the media, companies, and on a regular basis buyers deal with Bitcoin,” Hogan mentioned.

He added that in every quarter that Bitcoin skilled double-digit development, Bitcoin ETFs additionally noticed “double-digit billion-dollar inflows.”

'Downgrade Transaction', Platform Approval Promotes Robust Begin to 4th Quarter

Hogan mentioned his prediction can be primarily based on a wider vary of buyers changing into capable of put money into ETFs as asset managers confide in them and merchants look to put money into property that do effectively in a weaker US greenback.

Associated: Bitcoin rebounds in the direction of vary highs as knowledge reveals 'true liquidity'

Hogan mentioned a weaker U.S. greenback will trigger Wall Avenue to search for “downgrade trades” to purchase high-performing property, however each gold and bitcoin have carried out effectively up to now this yr.

“Why is that this vital? As a result of when advisors sit down with their purchasers and do their annual evaluations, they need their year-end print to indicate that they’re making probably the most profitable investments. There is just one method to try this: by shopping for gold and Bitcoin.”

Hogan mentioned this drop in buying and selling shall be helped by some massive asset managers “ultimately altering” to open their platforms to Bitcoin ETFs.

He pointed to a report launched by Morgan Stanley earlier this month wherein 16,000 advisors recommended an allocation of as much as 4% for “high-risk tolerant buyers” and mentioned they “have the flexibleness to allocate to cryptocurrencies as a part of a multi-asset portfolio.”

Hogan added that the fourth quarter is “off to an awesome begin” with the ETF receiving $3.5 billion in internet flows within the first 4 buying and selling days.

“We’ve got 64 days left to boost one other $10 billion,” he mentioned. “As soon as I've accomplished that, I'll strive some.”

Commerce secret: Bitcoin sees 'one other huge push' to $150,000, ETH stress will increase