Welcome to US Crypto Information Morning Briefing. A necessary abstract of a very powerful developments in future cryptography.

Seize your espresso whereas analyzing the placement of Bitcoin in mainstream finance. The story of pioneer's crypto separating from the normal inventory market has attracted lots of consideration, however are you prepared for the subsequent step?

Crypto Information of the Day: Bitcoin remains to be a diversifying machine and never a dependable hedge, Redstone executives say

Beincrypto's latest US Crypto Information sequence in April regarded into whether or not the digital gold narrative is damaged as gold rose to a brand new excessive whereas Bitcoin was behind.

The report has been introduced by many as a secure inventory asset towards unfavorable market worth actions after intensive advocacy for Bitcoin as digital gold.

“The primary use case for Bitcoin seems to be a helpful retailer, which is completely different from 'digital gold' on this planet of decentralized finance (DEFI),' the US Treasury not too long ago stated.

Nevertheless, a latest discovery asks the query: Will the time lastly be right here? Beincrypto contacted Redstone and requested: Is Bitcoin a hedge within the conventional market?

The response was insightful and there was a key level from Marcin Kazmierczak, co-founder and COO of main cross-chain information Oracle Supplier Redstone. In response to Kazmierczak, the information helps Bitcoin's position as a Portfolio Diversifier.

Kazmierczak cited an evaluation of Bitcoin and S&P 500 information from Open American Market Days over the previous 12 months. They analyzed weekly and month-to-month time frames.

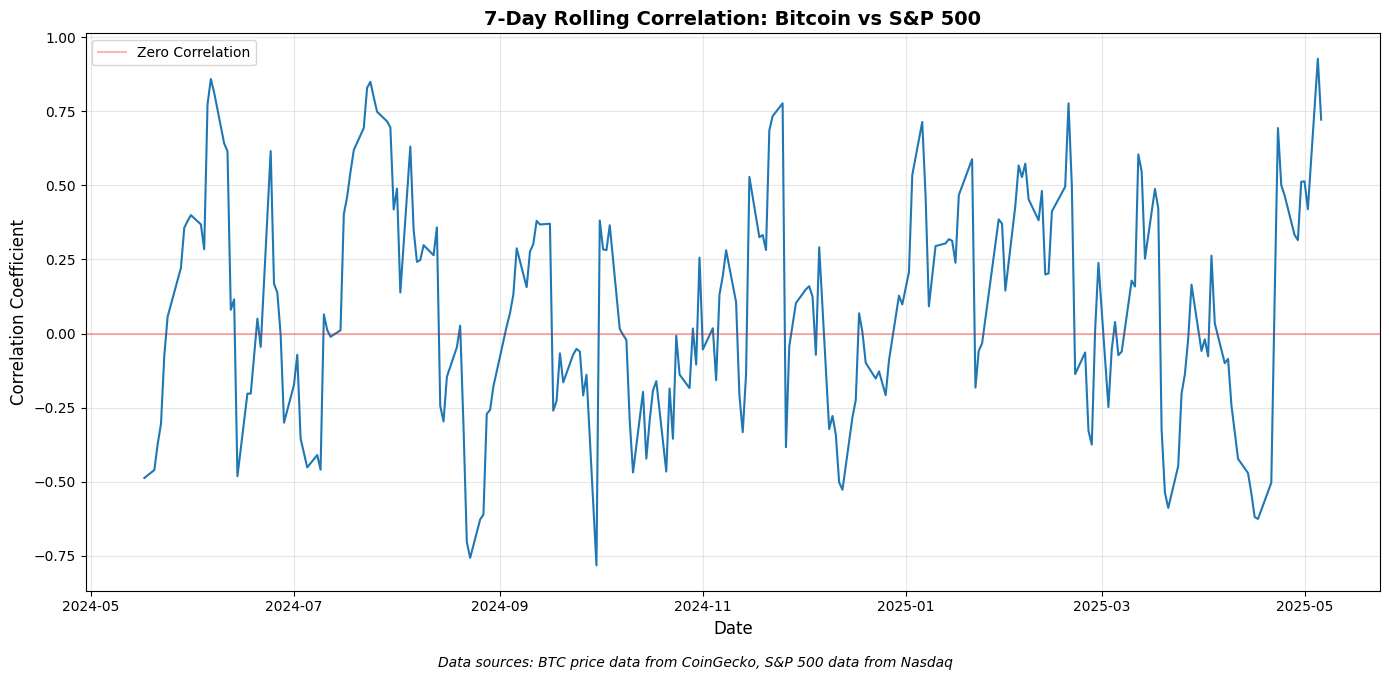

Bitcoin correlation over a 7-day time-frame. Supply: Redstone

For a seven-day correlation that gives a short-term outlook, they famous when BTC confirmed a powerful unfavorable correlation with the US inventory market.

“These are instances when many individuals wished decoupling BTC from the broader market,” he defined.

Nevertheless, seven-day aggregation is a short-term metric and is extra vulnerable to market noise. The 30-day chart offers a clearer expression.

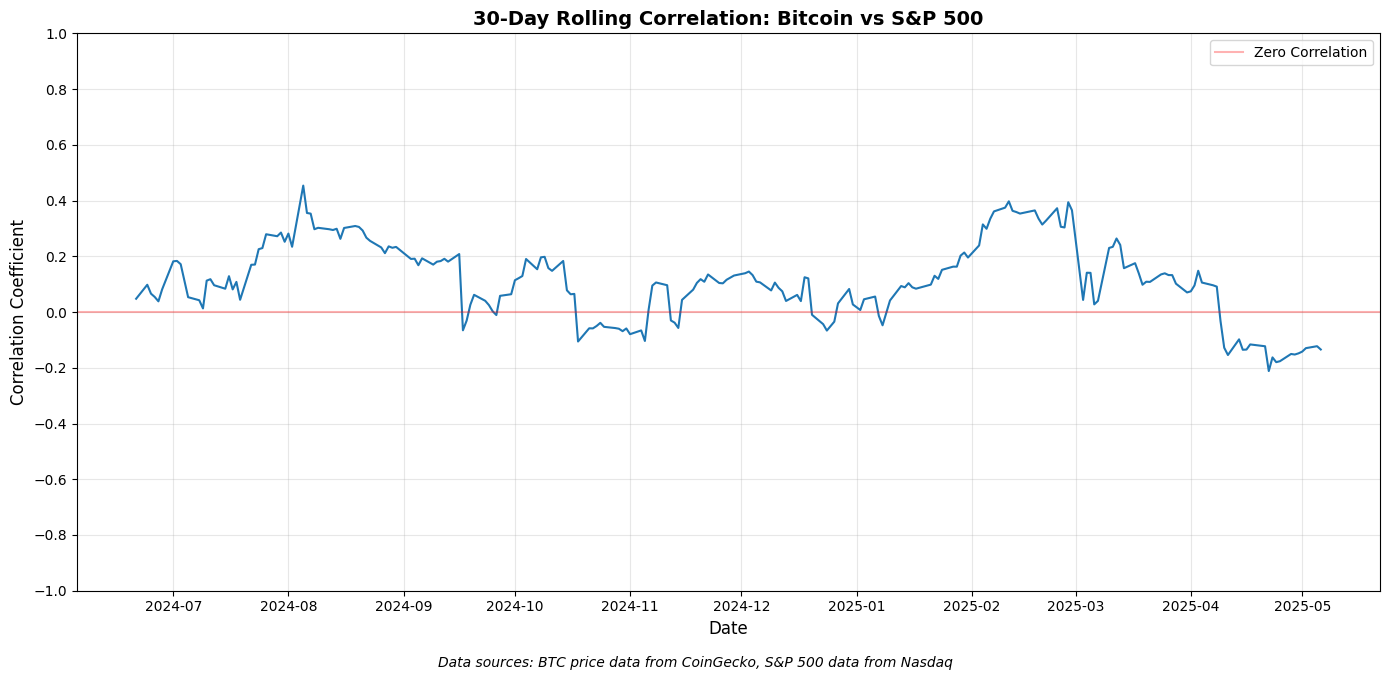

Bitcoin correlation with S&P over a 30-day time-frame. Supply: Redstone

This time-frame reveals a number of shifts between reasonably constructive, close to zero, and barely unfavorable correlations all through the 12 months.

Bitcoin will not be able to change conventional hedges

He defined that Bitcoin has proven a variable correlation with the S&P 500 (SPX) over the previous yr.

He stated the fluctuations don't assist the position of Bitcoin as an alternative choice to conventional hedges like gold and ties.

“With a correlation starting from -0.2 to 0.4, Bitcoin exhibits a volatility relationship with shares reasonably than offering the constant unfavorable correlation required for efficient portfolio safety,” Kazumiertzak advised Beincrypto in an interview.

He noticed that institutional gamers nonetheless essentially classify Bitcoin as a risk-on asset. In response to Kazmierczak, this vary exhibits that Bitcoin operates with common independence from the normal inventory market.

He believes that correlations are typically modest sufficient to supply the advantages of portfolio diversification. Nevertheless, this diversification disables Bitcoin from performing as a dependable countermovement hedge.

“This relationship locations Bitcoin in a diversifying class reasonably than a shelter asset… Bitcoin can add range to its portfolio, nevertheless it doesn’t constantly transfer in the other way, so it doesn’t assure that it’ll shield it from inventory market crashes,” he added.

However, Redstone executives stated that if Bitcoin really transitions to being handled as a really secure, risk-off asset, it might mark a change of the deepest asset narrative in trendy monetary historical past.

“I consider that’s attainable, nevertheless it's not a Instances span as brief because the coders would need it,” concluded Kazumiertzak.

The chart of the day

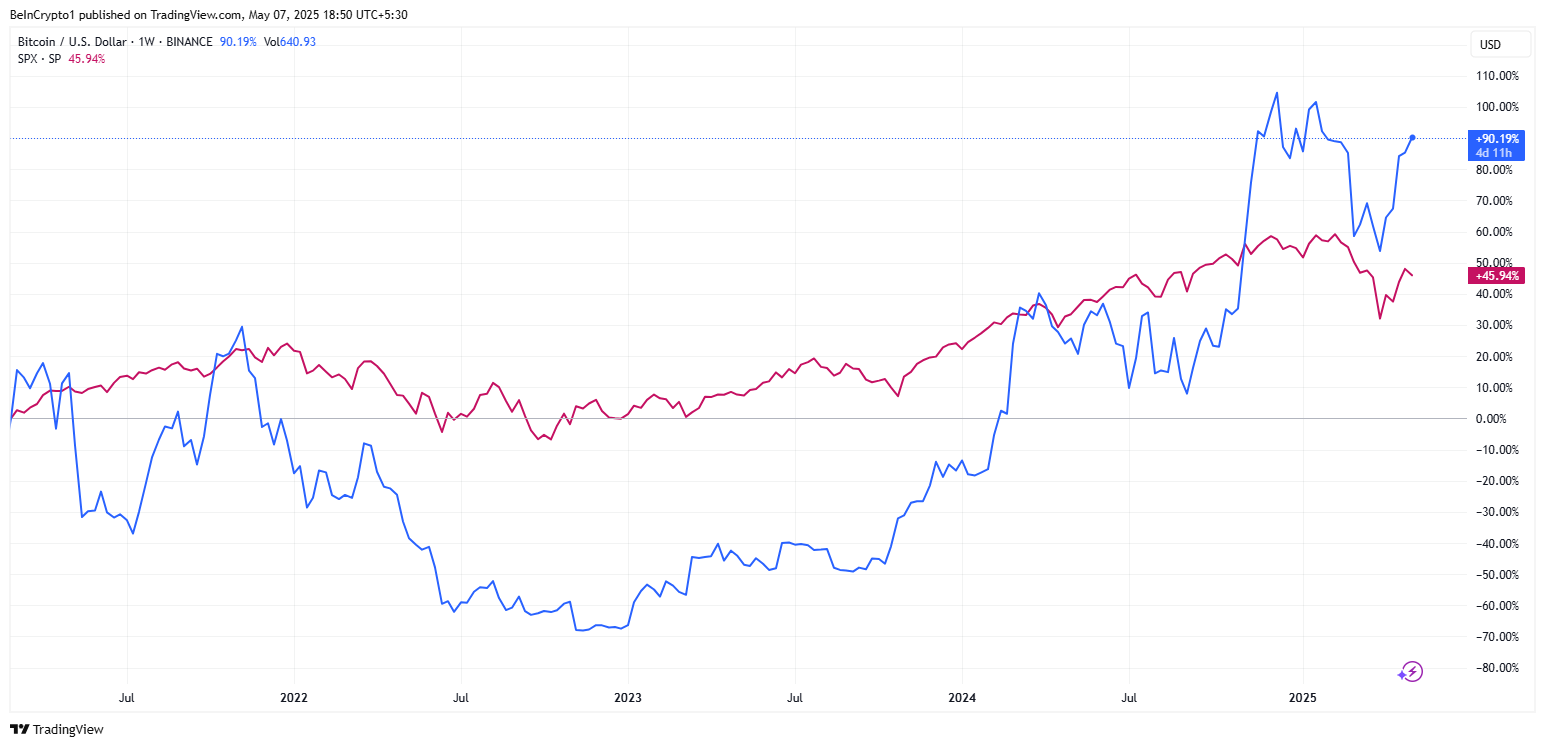

Bitcoin vs S&P 500 Efficiency: Supply: TradingView

The chart means that Bitcoin's efficiency usually diverged from conventional inventory markets, notably from 2024 to 2025.

Nevertheless, this doesn’t clearly point out a constant unfavorable correlation with everlasting decoupling or fairness.

Bitcoin has typically outperformed, nevertheless it nonetheless exhibits the length of its correlation with the S&P 500, and its position in portfolio safety stays unsure and context-dependent.

Current US Crypto Information publications have proven what might be handed because the context for these variations. Beincrypto cited political tensions and issues over the independence of the Federal Reserve.

Byte-sized alpha

Right here's a abstract of extra US crypto information that continues in the present day:

- The US Senate PSI is investigating President Trump's cryptocurrency enterprise because of potential moral violations and conflicts of curiosity.

- The Pectra Exhausting Fork hit the mainnet at 10:05 UTC and was finalized 12 minutes later. That is the most important change for Aetherium since 2022.

- Bitcoin surged past $97,000 after China's $138 billion stimulus package deal and withdrew to $96,000 amid the uncertainty of the Fed.

- Changpeng Zhao (CZ) proposes as much as 10 instances reductions in Binance Sensible Chain (BSC) gasoline charges to enhance the person expertise and cut back prices.

- The Bitcoin ETF noticed a $85.64 million outflow, snapping a string of influxes as institutional traders lowered publicity earlier than the FOMC.

- Motion Labs fires co-founder Rushi Manche throughout a third-party evaluation on market maker points, inflicting neighborhood nervousness.

- World Liberty Monetary has launched a governance vote to approve the USD1 Stablecoin Airdrop to approve the pressing deployment of 99.97% voter assist.

- Litecoin (LTC) surged 10% regardless of the SEC delayed within the Litecoin ETF, buying and selling at $91.68 on a powerful day by day quantity.

- Solana Title Service launches social media tokens and aligns the incentives with the wants of .SOL area customers and the expansion of the long run ecosystem.

Overview of Crypto Equities Pre-Market

Crypto Equities Market Open Race: Finance.Yahoo