The Federal Reserve has launched official minutes from its September assembly, revealing that half of its members count on two extra rate of interest cuts by the tip of the 12 months.

Bitcoin reaches $124,000 as Fed minutes recommend accelerated easing

President Donald Trump might be smiling someplace after studying the official minutes of the Federal Reserve's September assembly launched Wednesday. The minutes reveal a dovish sentiment amongst Fed officers, with “about half” of Federal Open Market Committee members anticipating two extra fee cuts by the tip of 2025. Bitcoin jumped on the information, briefly retreating from its not too long ago minted all-time excessive of $126,198.07, earlier than as soon as once more topping $124,000.

After retaining rates of interest on the identical stage for practically a 12 months, the Federal Open Market Committee (FOMC) final month agreed to lastly minimize charges by 25 foundation factors, citing weak employment information. President Trump publicly criticized Federal Reserve Chairman Jerome Powell for resisting fee cuts, disparagingly calling him “too gradual.”

In his protection, Mr. Powell is solely following the central financial institution's twin mandate to advertise worth stability and excessive employment. And although the annual fee of inflation in September was 2.9%, effectively above the Fed's 2% goal, the surprising rise in unemployment compelled Powell and the remainder of the FOMC to chop rates of interest.

And it was weak spot within the job market that triggered the shift from hawkish to dovish amongst FOMC members, as mirrored within the minutes launched as we speak. Add to that the continued authorities shutdown that may solely worsen the employment scenario and lift the potential of two extra rate of interest cuts, which ought to bode effectively for the dominant cryptocurrency.

The minutes discuss with a market expectations survey performed by the FOMC's Open Market Desk, which states, “Nearly all of survey respondents count on not less than two 25 foundation level fee cuts by year-end, and about half count on three fee cuts by then.''

Overview of market indicators

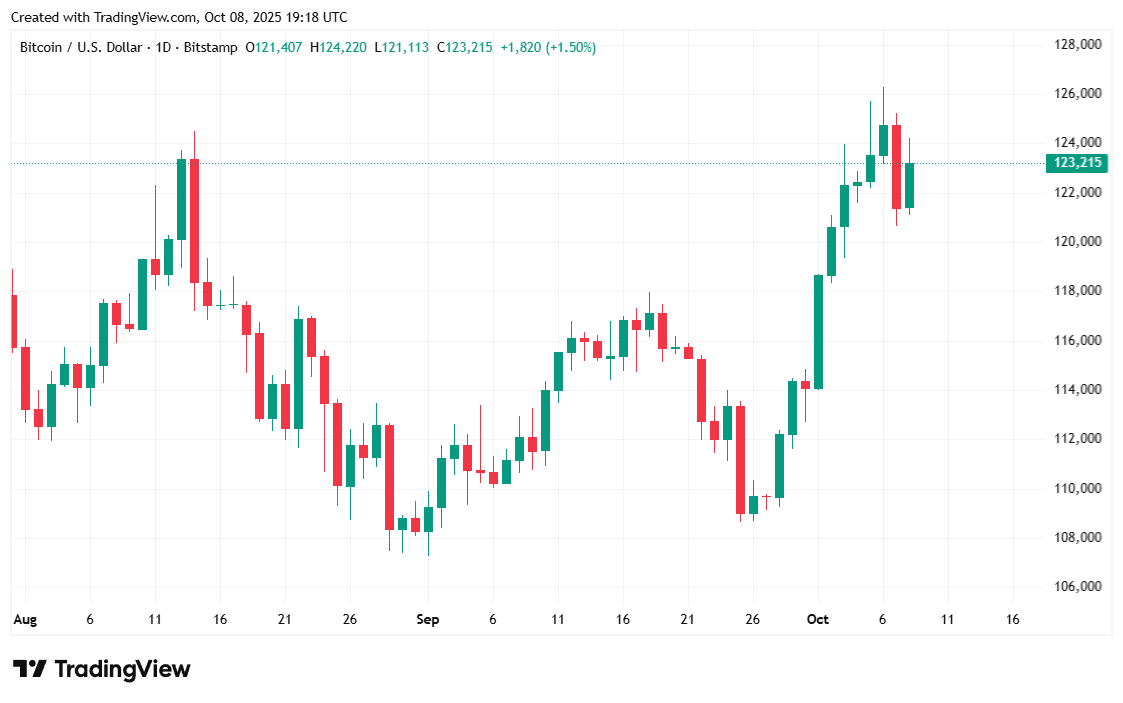

Bitcoin was buying and selling at $123,506.78 on the time of reporting, up 1.7% in 24 hours and 5.19% on a weekly foundation, in accordance with information from Coinmarketcap. The digital asset fluctuated between $121,119.18 and $124,167.09.

(BTC Worth/Buying and selling View)

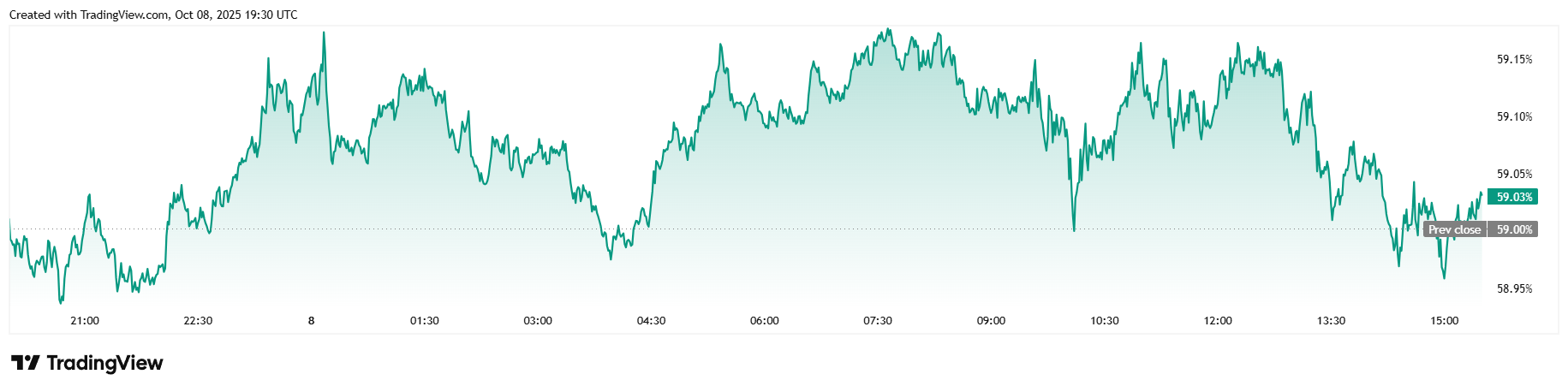

The 24-hour buying and selling quantity decreased by 12.06% to $68.48 billion, however the market capitalization elevated by 1.86% to $2.46 trillion. Bitcoin’s dominance rose by 0.02%, breaking by the 59% threshold, which remained at 59.04% on the time of writing.

(BTC Dominance / Buying and selling View)

Complete open curiosity in Bitcoin futures was practically flat, declining barely by 0.24% to $90.94 billion, in accordance with information from Coinglass. At this time's Bitcoin liquidation quantity additionally fell to $77.77 million. Brief sellers accounted for almost all of whole liquidations, with $52.22 million worn out and the remaining $25.55 million in long-term liquidations.