The BTC (Bitcoin) monetary firm faces a considerably necessary market premium for BTC Holdings' primary market premium on account of a lower in volatility and a fast slowdown in new purchases.

Particularly, these firms' month-to-month BTC purchases have mirrored very cautious market strategy in latest months with 97% collapse since November 2024. However latest information in Cryptoquant suggests the necessity for quick technique adjustments.

Bitcoin volatility falls threaten the worth of the Bitcoin Treasury.

On the whole, Bitcoin Treasuries is traded as a premium. In different phrases, the market worth exceeds the precise worth of their BTC. Traders consider that these firms can improve their stakes, manipulate volatility, and play a secure position in one of the best cryptocurrency. Subsequently, the market web asset worth (MNAV), which compares the corporate's inventory worth with NAV owned by Bitcoin, is all the time larger than 1.

Nevertheless, Julio Moreno, Cryptoquant Analysis Director, has eliminated the principle driver of the premium as a result of the Treasury's volatility has fallen to the bottom stage of a few years yearly, and the Treasury has decreased the chance to make the most of worth fluctuations and justify the worth of the fundamental BTC.

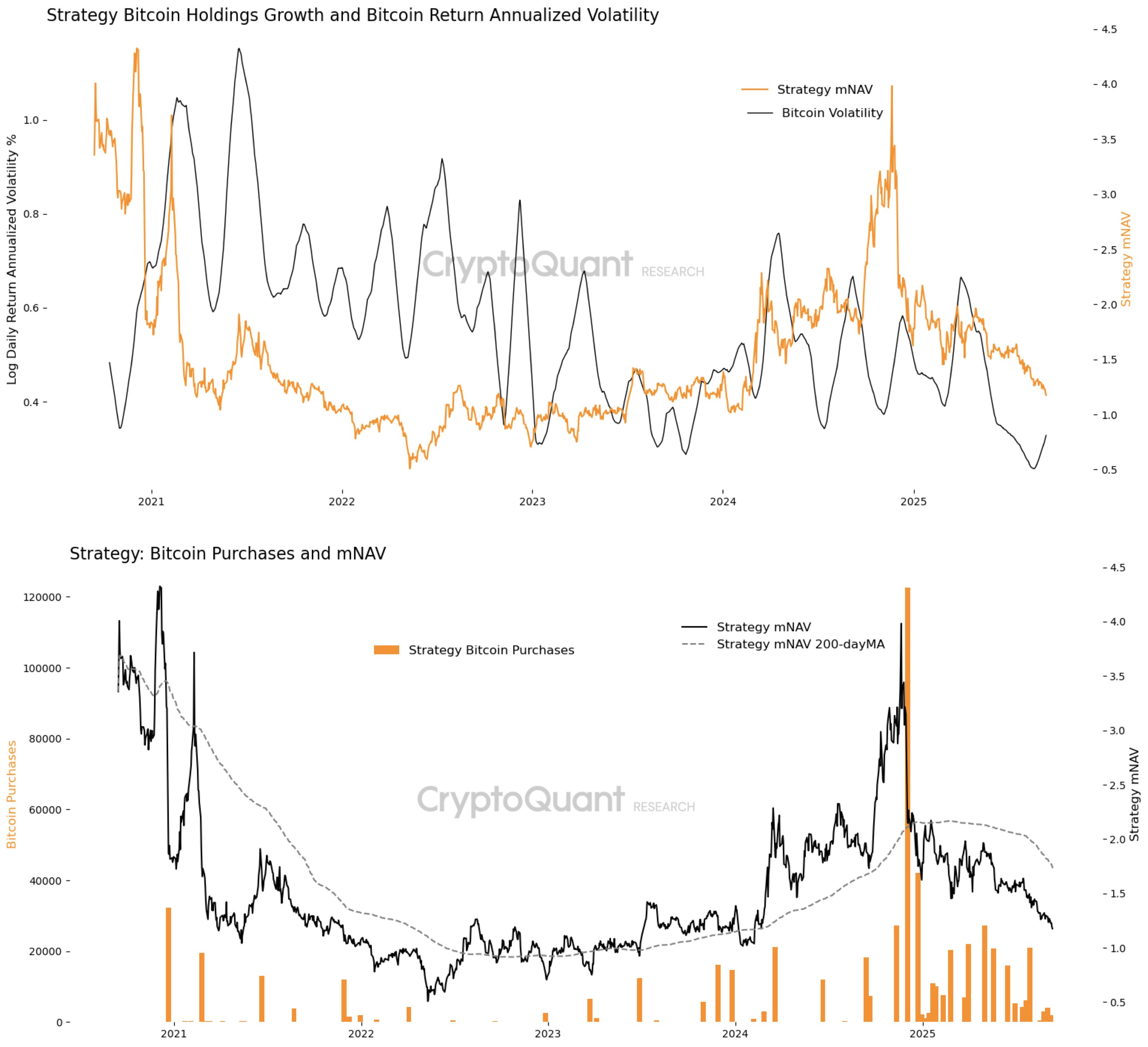

When analyzing strategic market information, the biggest firm BTC proprietor, it may be noticed that MNAV has produced a surge in MNAV in early 2021, particularly in mid -2024, particularly in mid -2024, particularly in mid -2024. In these home windows, monetary firms had been capable of generate volatility, increase capital or liabilities with premiums, and place the proceeds in a fast BTC buy.

Nevertheless, the present volatility has reached the bottom stage since 2020, compressed into lower than a every day return of 0.4 logs yearly. The flat volatility curve has fallen to 1.25 according to the regular decline of MNAV. This slim premium means that buyers now not see the monetary firm as merely offering a significant leverage for proudly owning Bitcoin.

Demand weakening weakens the issue of the Advanced Treasury.

If there is no such thing as a “gasoline” of the worth swing, Bitcoin Treasury Firm is attempting to increase its stake by justifying premium analysis. Within the late 2024 and early 2025, there was an remoted rupture of the acquisition, however the general exercise was nonetheless muted.

Because of this, the MNAV of the technique has been down since early 2025, even if BTC itself has been traded in a comparatively excessive worth vary lately. The information means that when the Treasury is actively buying, the investor's ardour pushes the MNAV larger to strengthen the premium difficulty and the BTC accumulation.

Julio Moreno explains that to ensure that the MNAV premium to proceed, demand is required instantly via the rebound of BTC volatility and enormous -scale purchases. Till then, monetary corporations are getting increasingly more troublesome to justify greater than Bitcoin web asset worth, so buyers can pressure them to be straight uncovered to Bitcoin for earnings, not company methods.

Bitcoin is $ 115,810 within the press time, reflecting a 4.72percentprofit final week.

PEXELS's major picture, TradingView chart

Editorial course of focuses on offering thorough analysis, correct and prejudice content material. We assist the strict sourcing customary and every web page is diligent within the prime expertise consultants and the seasoned editor's staff. This course of ensures the integrity, relevance and worth of the reader's content material.