Bitcoin's BTC$68,900.75 The sharp rebound from final week's plunge to $60,000 was accompanied by a delicate however essential change in a single carefully watched indicator of U.S. demand.

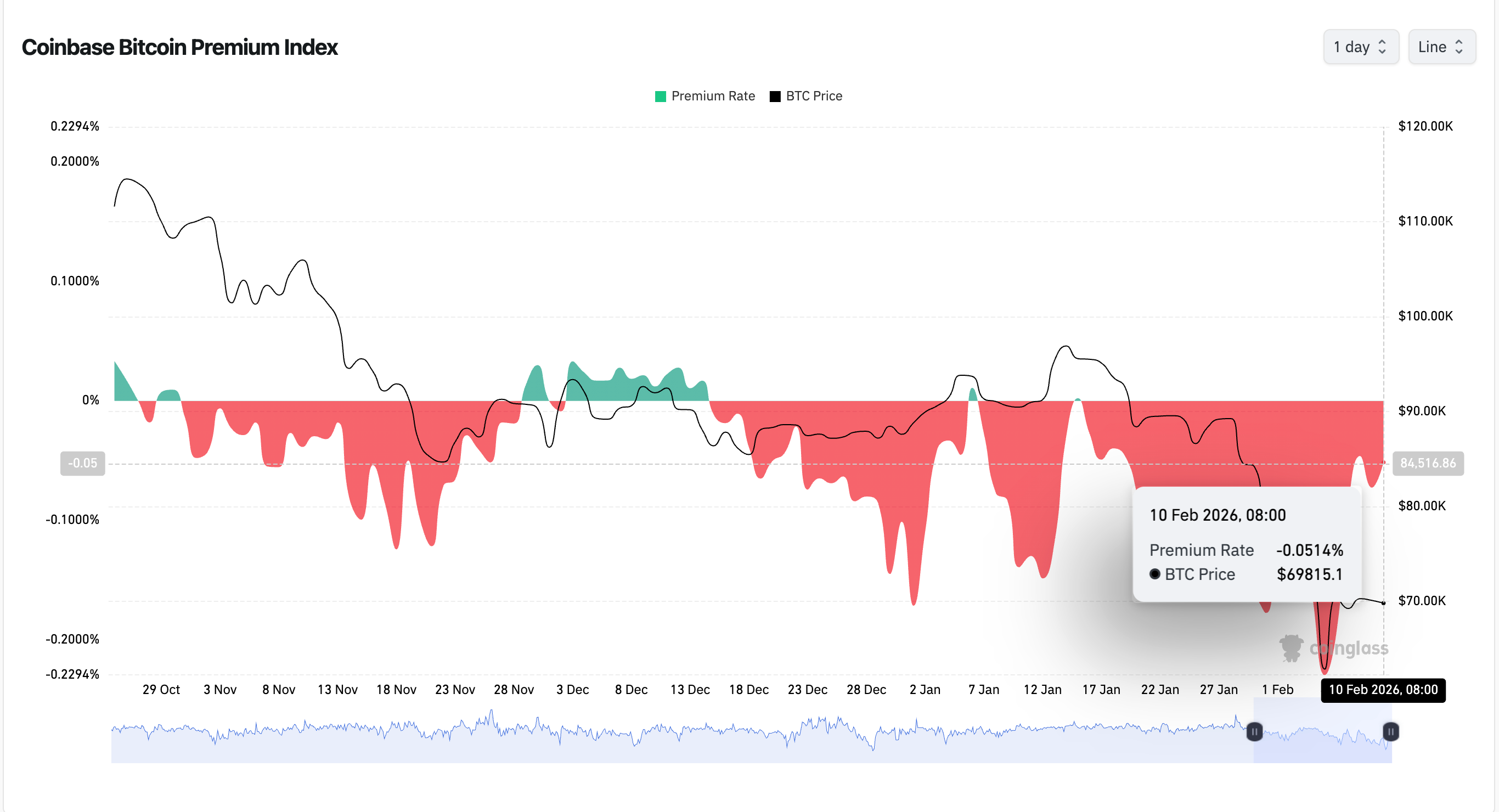

The Coinbase Bitcoin Premium Index, which tracks the value distinction between Bitcoin traded on Coinbase and the worldwide market common, has surged from deep unfavorable territory to about -0.05% by Tuesday from about -0.22% on the top of the decline.

Though the index stays beneath zero, the rebound means that pressured promoting stress has eased and U.S.-based traders have begun shopping for the dip.

Coinbase is broadly considered as an company for institutional traders and dollar-based flows. Considerably unfavorable premiums normally point out that U.S. traders are actively promoting or are fully on the sidelines. The return to impartial signifies that some consumers noticed worth in decrease ranges, particularly as Bitcoin stabilized after the quickest drawdown for the reason that FTX collapse in 2022.

Nonetheless, the premium has not turned optimistic, a threshold that traditionally coincides with sustained accumulation and new danger urge for food in US funds. Somewhat, the present transfer signifies selective shopping for reasonably than broader conviction.

Market construction knowledge helps that cautious interpretation. Kaiko mentioned whole buying and selling quantity on main exchanges stays effectively beneath the highs reached in late 2025, and spot buying and selling is displaying indicators of gradual decline reasonably than a definitive surge in demand.

Skinny liquidity means costs can soar as soon as the exhaust itself is offered, however the market may fall once more if consumers don't comply.

Bitcoin is presently buying and selling slightly below $70,000, having recovered greater than 15% from its intraday low, however remains to be down greater than 10% this week.