The BTC (Bitcoin) market turned out to be a bit turbulent final week after the value drop of lower than $ 75,000 final week rebounded to greater than $ 83,000. Whereas one of the best cryptocurrency reveals a steady rise, the blockchain evaluation firm Cryptoquant has recognized two potential key resistance areas.

Bitcoin reveals potential highly effective limitations of $ 84,000 and $ 96,000.

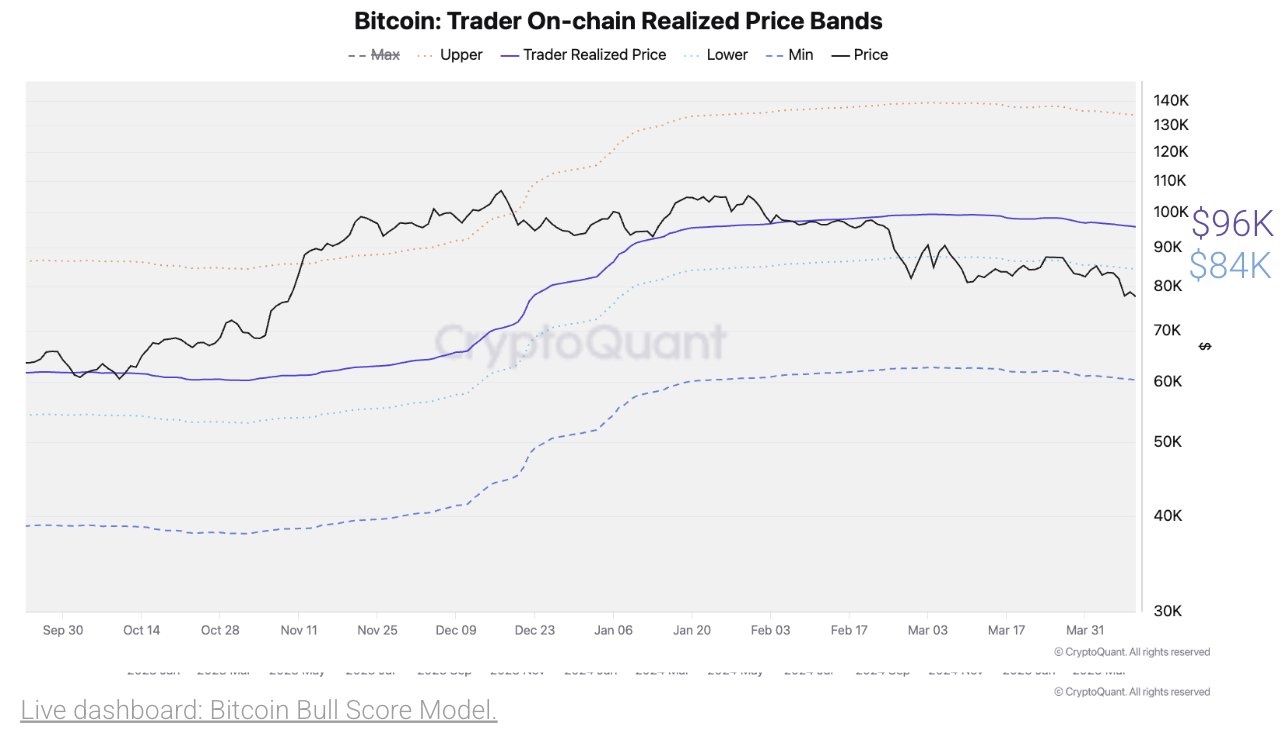

On April 11, within the X submit, Cryptoquant shares an on -chain report on the BTC market, displaying two main resistance when Bitcoin maintains the present upward trajectory, indicating a possible assembly of $ 84,000 and $ 96,000. These worth limitations are revealed by realized worth indicators that decide the general market requirements by reflecting the final common worth of BTC's provide.

When Bitcoin trades above this stage, it reveals a wholesome optimistic propulsion to profit most of most holders. Quite the opposite, when the BTC is lower than a threshold, most traders have losses, suggesting underwater emotions. Due to this fact, realized costs typically function an necessary market pivot that acts as a powerful assist within the bull market and a powerful resistance within the bear stage. In line with Julio Moreno, the analysis director of Cryptoquant, BTC's present on -chain realization worth is $ 96,000 and a direct low worth band is $ 84,000.

Curiously, these two worth ranges have been a serious assist zone within the preliminary power of the market cycle. Nevertheless, each areas might act as a resistance within the ongoing market revision. But when Bitcoin can exceed $ 84,000 and $ 96,000, the Premier Cryptocurrency can imply the resumption of Bull Market, which is more likely to make a excessive deal of $ 130,000. This anticipated revenue is a rise of 55% of the present market worth.

BTC worth define

Bitcoin continues to commerce at $ 83,180, reflecting 3.65percentof the final day. In the meantime, every day buying and selling quantity decreased 11.99% and $ 391.9 billion.

The encryption market continues to indicate sturdy ranges of uncertainty within the steady macroeconomic growth led by the US authorities tariff change, and belongings don’t set up clear momentum. Nevertheless, Blockchain Analytics GlassNode reported that Bitcoin Buyers had a robust assist space of $ 79,000 and $ 82,080 collected with 40,000 BTC and 51,000 BTC, respectively.

Within the emergence of all decline, the 2 costs ought to present brief -term assist and stop extra costs. Bitcoin, which has a market cap of $ 1.66 trillion, stays the most important digital asset, which accounts for greater than 60% of the market cap.

CNN's essential picture, TradingView.com chart

Editorial course of focuses on offering thorough analysis, correct and prejudice content material. We assist the strict sourcing commonplace and every web page is diligent within the high expertise specialists and the seasoned editor's workforce. This course of ensures the integrity, relevance and worth of the reader's content material.