Bitcoin (BTC)’s restoration in early 2026 might not final lengthy as new knowledge factors to potential growing promoting strain. Merchants holding lengthy positions may have to contemplate hostile circumstances to reduce danger.

On-chain knowledge exhibits that Bitcoin whales are growing their exercise on exchanges. This habits is particularly harmful in low quantity environments.

Bitcoin whale influx fee sharply elevated in January

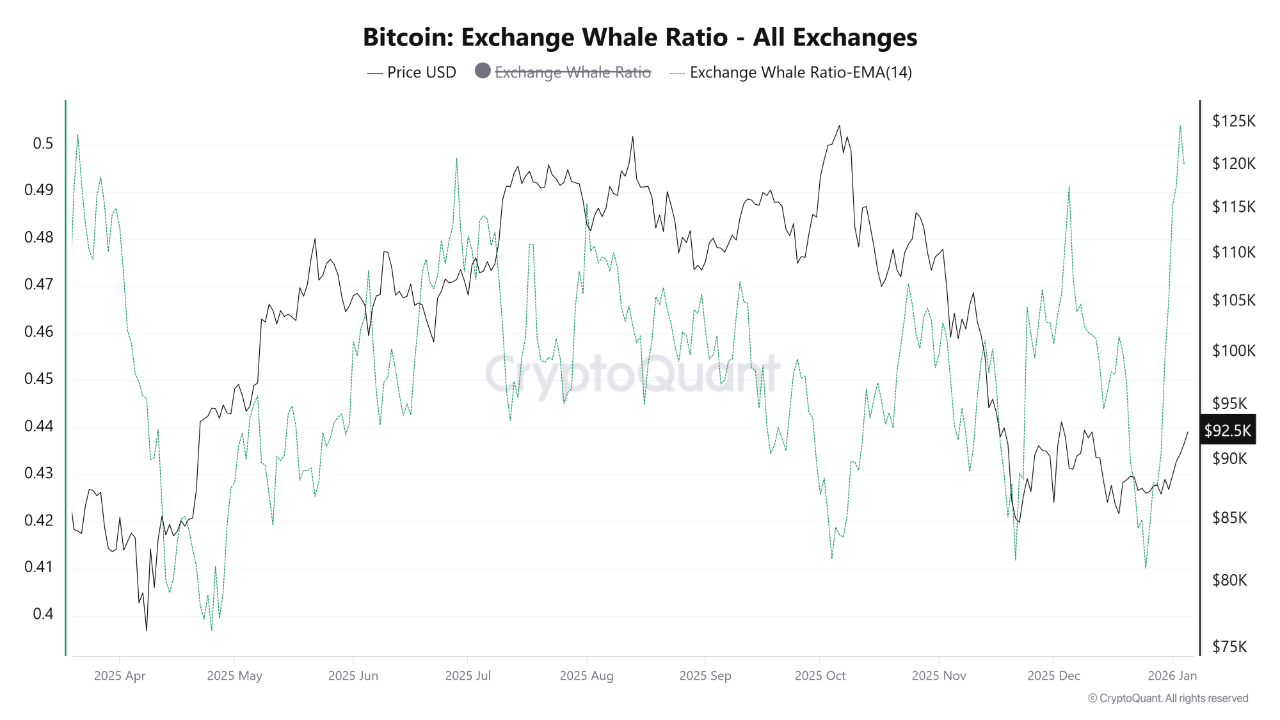

Some of the alarming alerts is the all-exchange whale ratio (EMA14), which has risen to a 10-month excessive.

This metric represents the ratio of prime 10 inflows to complete alternate inflows. A excessive worth signifies that whales are utilizing the alternate regularly.

Bitcoin alternate whale ratio. Supply: CryptoQuant

Whereas Bitcoin international alternate reserves proceed to say no as a consequence of demand from DATs and ETFs, a sudden rise on this ratio may function an early warning. This means that BTC balances on exchanges might begin growing once more.

“This growth is per Bitcoin costs trying to get better after a correction section,” mentioned CryptoQuant analyst CryptoOnChain. “This sample suggests a possible technique for whales to make use of buy-side liquidity to e book income and use the present market as exit liquidity.”

Moreover, market liquidity has develop into more and more fragile, growing the chance of speedy worth adjustments and elevated volatility.

Bitcoin and altcoin spot quantity. Supply: Glassnode

Based on a put up by X's Glassnode, spot buying and selling quantity for Bitcoin and altcoins has fallen to its lowest degree since November 2023.

“This weakening in demand is in sharp distinction to the broader market bull run, highlighting the diluted liquidity scenario behind latest worth will increase,” Glassnode reported.

In an illiquid surroundings, solely restricted shopping for strain can push costs larger. Then again, reasonable promoting strain can simply trigger a big draw back worth motion.

If alternate whales begin promoting as steered, coupled with skinny liquidity, Bitcoin's greater than 6% rally and 10% restoration in altcoin market capitalization may finish shortly.

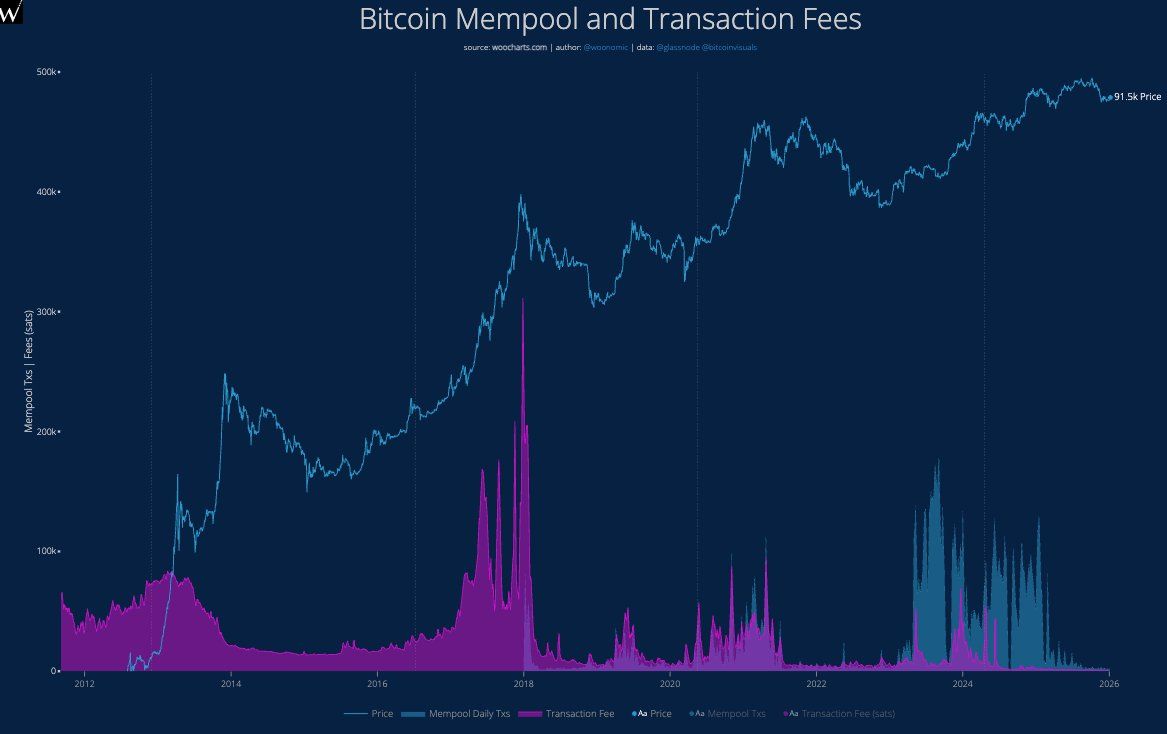

Moreover, analyst Willy Wu pointed to the sharp decline in Bitcoin transaction charges, describing the market as a “ghost city.”

Charts monitoring reminiscence swimming pools and transaction charges present on-chain exercise at file lows. Each indicators declined considerably, reflecting the decline in transactions. Lowered on-chain exercise means weaker capital inflows and outflows, making the market much less dynamic.

Bitcoin menpool and transaction charges. Supply: Willy Wu

Wu expects a short-term pump may happen in January as liquidity reaches an area backside. Nevertheless, the long-term outlook stays bearish as a consequence of lack of precise exercise.

Within the quick time period, some analysts count on Bitcoin to appropriate in direction of the $90,000 and $88,500 zones. These ranges additionally coincide with the newly shaped CME hole.

The article “Bitcoin Whales Speed up Buying and selling Exercise in Early 2026 as Liquidity Turns into More and more Fragile” was first printed on BeInCrypto.