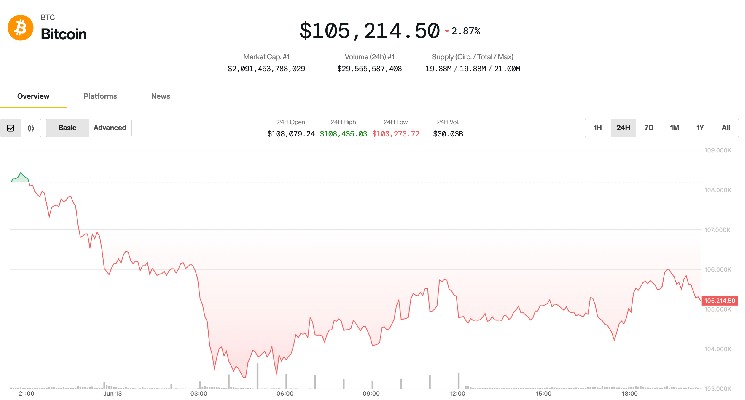

The crypto market has bounced barely from anxiousness earlier on Friday in regards to the escalation of the battle between Israel and Iran.

After slumping to the $102,600 mark, Bitcoin

BTC$105,166.20

Reviews of contemporary waves of airstrikes focusing on Iran rebounded to round $106,000 earlier than fading fades throughout US afternoon hours. The highest cryptocurrency has dropped by 1.6% within the final 24 hours, altering palms at $105,200, falling under the shyness of the best value ever.

In the meantime, Coindesk 20 is the index of the highest 20 cryptocurrencies by market capitalization excluding memokine, stubcoin and change cash – misplaced 4.4% in the identical interval. Tokens reminiscent of ether

ETH$2,525.74

,avalanche

avax$19.01

and Toncoin

Ton$2.98

It had fallen between 6% and eight%.

Nevertheless, crypto inventory will not be too scorching. Most shares are in purple, with Bitcoin Miner Mala Holdings (Mara) and Riot Platform (Riol) particularly falling by 5% and 4% respectively. A notable exception is the Stablecoin Issuer Circle (Circl). Shares are up 13% in the present day, with information from retail giants Amazon and Walmart reportedly exploring momentum.

Conventional markets don’t appear to be closely concerned within the struggle. Gold has risen 1.3% and is getting ready for a doubtlessly new excessive, whereas the S&P 500 and NASDAQ have fallen solely 0.4% every.

What's subsequent for Bitcoin?

“There's been a low scarcity of nice bounces and follow-throughs to date,” Skew, a follow-up crypto dealer, mentioned on Friday's X-Put up. Market individuals are prone to be cautious all through the weekend with BTC, which correlate intently with conventional markets amid rising geopolitical dangers, Skew added.

Within the longer time-frame, some analysts see the danger of a deeper pullback.

Markus Thielen, founding father of the 10x Analysis, famous that BTC's drop under $106,000 could be transformed to a failed breakout, and merchants must look ahead to a extra favorable setup earlier than buying the DIP.

He highlighted the $100,000 to $101,000 zone as key help, warning that the break under might mark a return to a broader integration part just like final summer season.

Bitcoin Lender Ledn Chief Funding Officer John Glover claimed that Bitcoin might enter the correction part from file highs, with its largest digital property dropping from $88,000 to $93,000.

In keeping with John Glover, potential corrective phases of Bitcoin at a much bigger uptrend (LEDN/TRADINGVIEW)

He mentioned the $90,000 stage might present favorable entries for opportunistic traders earlier than BTC resumes its upward pattern.

“If this sample unfolds, the subsequent transfer is anticipated to rise to the $130,000 space,” he mentioned.