The 2 public firms could have purchased over $500 million in Bitcoin on Labor Day, which can have helped them get better on Tuesday.

In-facility purchases will ship again BTC over $111K

Some folks dropped bitcoin underneath $108,000 on vacation weekends, however Michael Saylor's technique and Simon Gerovich's metaplanet took benefit of Cryptocurrency's discounted costs, incomes 4,048 BTC and 1,009 BTC on Labor Day, respectively. These two purchases alone may have restored market confidence, and Bitcoin may have returned over $111K on Tuesday.

(Technique and Metaplanet bought over $500 million in Bitcoin on Labor Day / Michael Saylorx)

As we speak's restoration is extra proof of what seems to be the top of Bitcoin's so-called “four-year cycle.” Digital belongings are programmed to miners with Bitcoin rewards each 210,000 blocks or about each 4 years. The ultimate 50% discount was in April 2024. Often, Bitcoin peaks quickly after, approaching half the occasion, earlier than colliding with the “crypto winter” hunch.

Nevertheless, after the US Securities and Trade Fee (SEC) permitted the primary wave of funds (ETFs) traded on the Bitcoin alternate final January, a sudden inflow of facility capital disrupted the acquainted four-year cycle, with BTC peaking earlier than the programmed program cuts in April, after which remained on a comparatively steady upward trajectory.

And now, with the rise in Bitcoin Treasury firms, growing inventory costs and hedging obsolescence, the four-year cycle appears to have virtually eradicated the artifacts of the previous. And the technique and Monday purchases by Metaplanet are prone to have contributed to Bitcoin's restoration immediately, additional strengthening that concept.

“For this reason Bitcoin's four-year cycle is over,” stated Jason A. Williams, co-founder and normal companion of Crypto funding agency Morgan Creek Digital Property. “The highest 100 Bitcoin financing firms have virtually 1 million Bitcoin.”

Market Metric Overview

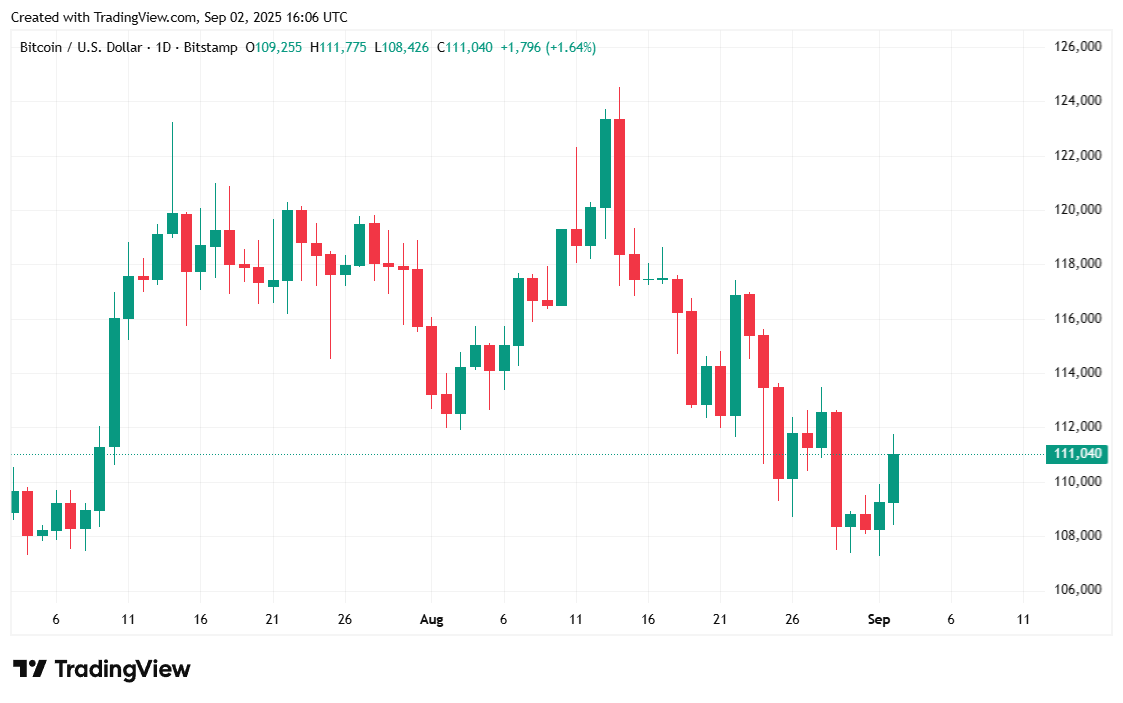

In accordance with Coinmarketcap, Bitcoin was $111,035.88 on the time of writing, a rise of two.06% on the time of writing. Cryptocurrency has traded between $107,480.59 and $111,748.01 over the previous 24 hours, up 1.23% that week.

(Bitcoin Value/Buying and selling View)

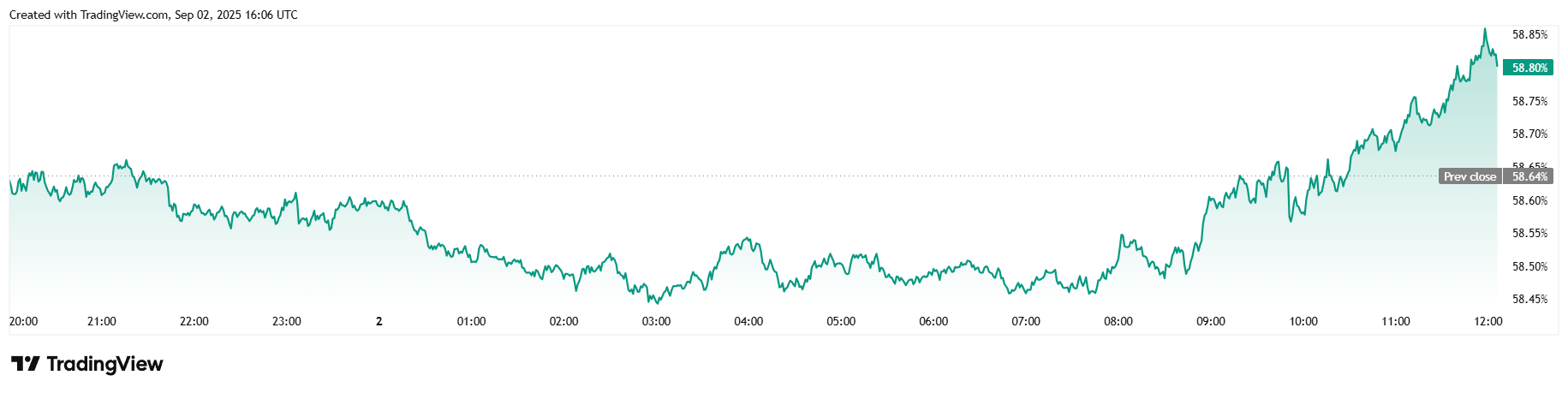

Transaction quantity reached $726.6 billion, a rise of 16.88% from Labor Day. Market capitalization additionally rose 1.81% to $2.21 trillion. Bitcoin's dominance rose to 58.82%, up 0.30% in 24 hours.

(Bitcoin management/commerce view)

Whole Bitcoin futures rose 2.35% to $819.2 billion that day, with Coinglass' Bitcoin liquidation totaling $80.24 million in 24 hours. The liquidation was evenly divided, with the lengthy and shorts showing at $39.5 million and $40.74 million, respectively. The cut up suggests a balanced sentiment amongst merchants concerning the short-term future path of Bitcoin costs.