The US economic system begins 2026 with an disagreeable split-screen state of affairs, complicating the outlook for Bitcoin's restoration in direction of $100,000.

Credit score pricing on Wall Road nonetheless seems calm, however “actual economic system” stress gauges are flashing late-cycle warning lights.

This disconnect is essential for Bitcoin as a result of the trail to $100,000 is not solely a crypto-native catalyst. There may be rising curiosity in whether or not the following macro downdraft will drive a liquidation part that consumes a calendar 12 months.

So buyers hoping for a straight path to 6 digits face a formidable impediment, with the patron and enterprise credit score crunch threatening to dry liquidity from threat belongings earlier than the Federal Reserve steps in to offer aid.

client debt wall

The obvious crimson flag dealing with the market is the deteriorating scenario for American shoppers.

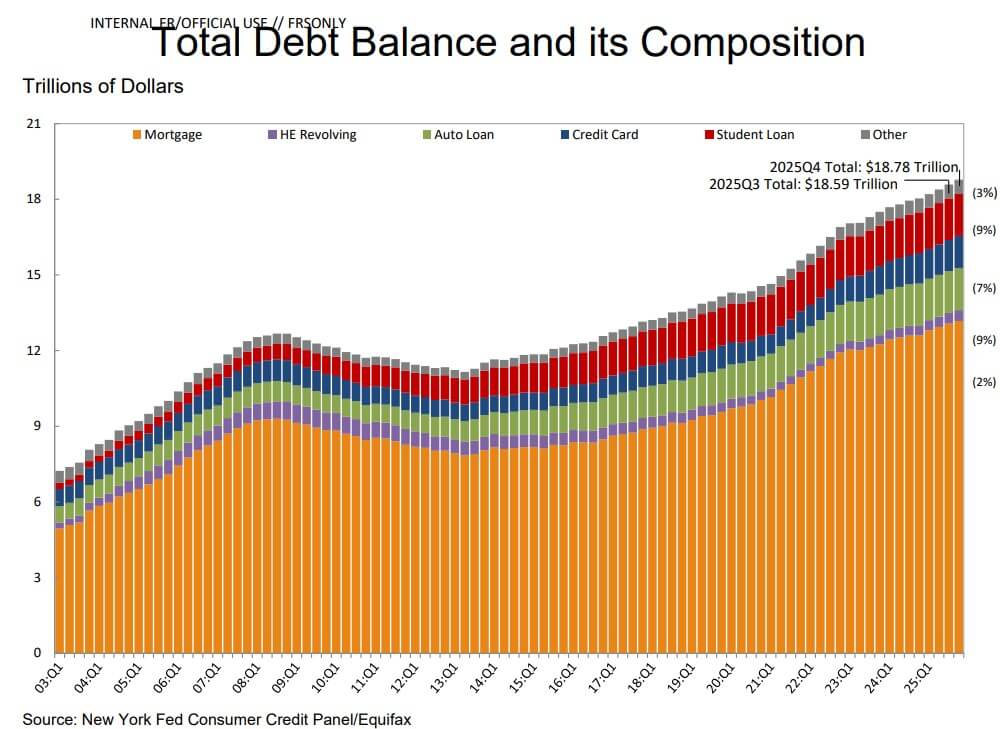

The New York Fed's newest Family Debt and Credit score Report highlights the dire scenario wherein individuals are leveraging themselves to keep up their way of life. Complete family debt elevated to $18.8 trillion within the fourth quarter of 2025.

This is a rise of $191 billion in a single quarter, and complete balances are roughly $4.6 trillion above pre-pandemic ranges.

Whereas the sheer measurement of the debt is a trigger for concern, what is basically alarming is the standard of that debt.

In response to the report, within the fourth quarter of 2025, 12.7% of bank card balances had been greater than 90 days overdue.

This marks a transparent return to the elevated stress ranges seen within the early 2010s and means that post-pandemic financial savings buffers have been utterly eroded for a good portion of the inhabitants.

If you dig into the demographics, the indicators develop into even tougher to disregard.

A chart from the New York Fed that tracks bank card progress towards vital delinquency (outlined as delinquent for 90 days or extra) reveals that youthful individuals are performing considerably worse than older folks.

The 18-29 and 30-39 age teams have considerably larger delinquency charges than households aged 40 and over.

That is greater than only a grim credit score statistic. This serves as a forward-looking indicator of discretionary spending and employment sensitivity.

Youthful renters are extra uncovered to lease inflation, depend on revolving credit score to bridge the hole, and have extra unstable incomes.

These are the very demographics driving retail crypto adoption, and their financial hardship might speed up the market downturn as layoffs unfold.

Accelerating company recession

Whereas family funds are in dire straits, companies are additionally dealing with growing hardships.

The variety of public chapter filings in the USA elevated by 11% within the 12 months ending December 31, 2025, in response to knowledge from the US Workplace of Courtroom Administration.

However the extra market-moving improvement is the accelerating tempo of litigation for big corporations.

At the very least six main corporations sought safety from the courts each week for 3 weeks beginning January 10, Bloomberg reported.

This represents an depth of company failures not seen because the early months of the pandemic and means that the “extended excessive rate of interest” setting is lastly destroying zombie corporations which have survived on low-cost capital.

Commentary on the beleaguered market highlights much more worrying numbers. Some observers have famous that 18 corporations with money owed exceeding $50 million filed for chapter in three weeks.

This tally is greatest handled as an unofficial tracker somewhat than a standardized authorities collection, however it’s in line with a broader pattern of worsening company well being.

liquidity lure

Given these occasions, the query for crypto buyers is why these conventional monetary points will stop Bitcoin from reaching $100,000 in 2026.

The reply lies within the mechanism of disaster. The “deepening disaster” part sometimes impacts Bitcoin first within the least flattering manner: as a high-beta liquid asset.

When credit score will get tight and defaults enhance, buyers sometimes prioritize money. They shorten period and promote liquid and unstable positions to cowl margin calls or construct defensive buffers.

Within the case of cryptocurrencies, that liquidation impulse is at the moment passing by way of a really particular and extremely responsive funnel of exchange-traded funds (ETFs) and different institutional merchandise.

This dynamic is already mirrored within the move of funds. In response to knowledge from SoSo Worth, the Spot Bitcoin ETF recorded over $600 million in internet outflows prior to now two days alone.

In the meantime, the promoting strain just isn’t restricted to some days, as 12 Bitcoin ETF merchandise have recorded internet inflows in simply two weeks because the starting of the 12 months.

If the macro setting is favorable, this sort of sustained outflow might nonetheless be absorbed by the market.

Nonetheless, such constant promoting might emerge as a reflex when the macro setting deteriorates.

On this case, redemptions put strain on costs, worth declines set off additional threat discount fashions, and volatility itself turns into a purpose for threat managers to additional scale back publicity.

coverage paralysis

Bitcoin bulls, in the meantime, counter that crises finally appeal to coverage assist, and that the flagship digital asset has traditionally responded explosively when liquidity situations enhance.

Nonetheless, the timing for 2026 is difficult as a result of the Federal Reserve just isn’t but in a “panic state.”

The central financial institution saved its coverage rate of interest unchanged at a spread of three.5% to three.75% at its January assembly. Though that is decrease than the height rate of interest of the earlier 12 months, it’s nonetheless restrictive sufficient to place strain on debtors.

On the similar time, the New York Fed is conducting “reserve administration” purchases. It has been buying about $40 billion in Treasury payments and short-term authorities bonds every month by way of mid-April.

These purchases are clearly framed as technical operations somewhat than crisis-era quantitative easing.

If monetary stress worsens considerably, that technical line might rapidly blur available in the market's thoughts. Nonetheless, timing is essential for Bitcoin.

When easing is obvious, the market typically sells first and solely rebounds later. If the Fed waits for credit score spreads to flatten earlier than reducing charges aggressively, Bitcoin might undergo a big decline earlier than liquidity aid arrives.

Draw back goal and forecast revision

It’s exactly this timing threat that has some main financial institution analysts warning.

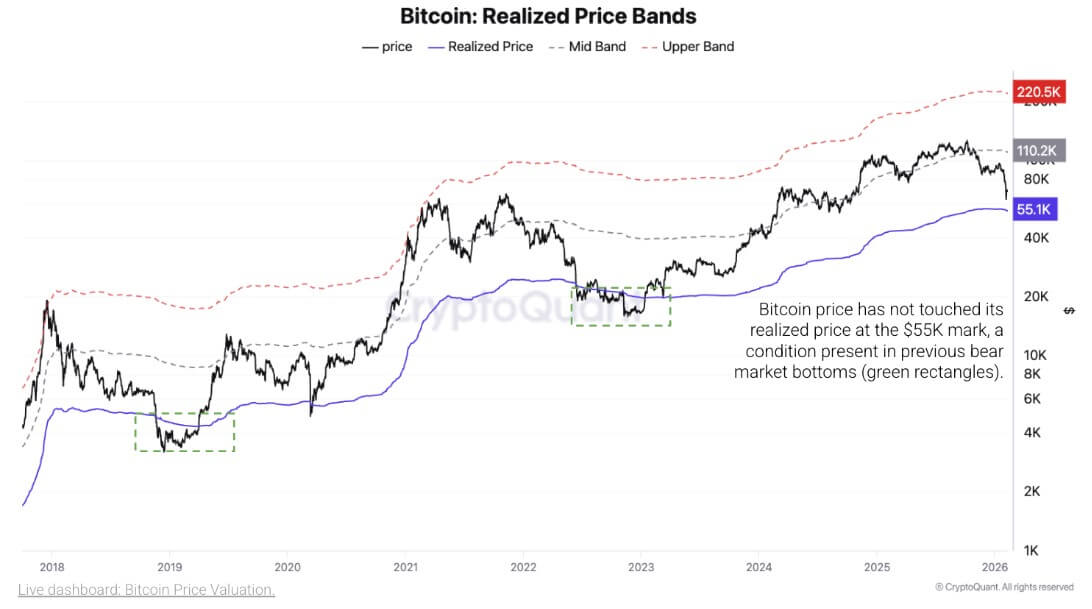

Normal Chartered’s Jeff Kendrick warned that cryptocurrencies might see a “final wave” of promoting strain first. He warned of draw back threat in direction of $50,000. $BTCwhereas claiming that this stage represents a “purchase zone” for a later restoration.

Notably, CryptoQuant knowledge reveals that the last word backside of Bitcoin's bear market is round $55,000.

In the meantime, Kendrick additionally reduce on his year-end plans. $BTC The purpose is $100,000 (down from $150,000).

He stated the message was not considered one of “perpetual bearishness” however somewhat a recognition that the trail to larger costs is prone to first undergo a big drawdown.

Basically, the story is $BTC It might attain $100,000 this 12 months, however that worth has been tempered by deepening U.S. fiscal constraints which can be weighing down runways.

If Bitcoin takes the following few months to digest the macro-driven deleveraging part, the timing of the “reflationary rally” will shift to the second half of 2026.

On this case, reaching $100,000 turns into much less essential. $BTC After the washout, there might be a gathering to debate, amongst different issues, whether or not there’s sufficient time left to take action earlier than the tip of the 12 months.

Three paths to Bitcoin’s $100,000 downside

A approach to clearly body the 12 months forward is thru a three-case state of affairs mannequin that focuses on timing.

The essential state of affairs is a comfortable touchdown in credit score turmoil, with delinquencies growing however no employment shocks.

Right here, company misery stays extreme however contained, and ETF flows have stabilized after a interval of outflows.

In that world, Bitcoin could be broadly tradable and $100,000 could be a year-end coin toss somewhat than a basic anticipated worth. A rally is feasible, but it surely depends upon whether or not the market regains confidence earlier than the calendar runs out.

“Laborious touchdown” eventualities embody enterprise failures and client stress impacting unemployment. Spreads will widen and compelled promoting will prevail.

In that case, Bitcoin might attain the draw back zone flagged by Kendrick earlier than a sustained rally begins. A subsequent restoration remains to be attainable, however reaching $100,000 in a calendar 12 months appears unlikely because the washout part consumes the interval of regular momentum.

The third state of affairs is “quick pivot.” On this state of affairs, knowledge degradation happens quickly, resulting in quicker reductions and extra seen liquidity assist. This might lead to a 2020-style sequence of first a pointy drop after which a pointy decline, however nonetheless probably requiring a capitulation low earlier than a rally.

The underside line is that macro stress can have an effect in each instructions. That would finally justify the easing of insurance policies and improved liquidity situations which have traditionally supported Bitcoin.

Nonetheless, related stresses might stop Bitcoin from reaching $100,000 on schedule. It’s because the primary stage of a deepening squeeze is usually the least favorable for cryptocurrencies.

Except coverage assist arrives early sufficient and ETF inflows flip into sustained inflows, the trail of least resistance in early 2026 is prone to be considered one of draw back and disruption first.

So the $100,000 print will probably be much less about whether or not Bitcoin can rise and extra about whether or not the market will undergo a washout quick sufficient for the rally to subside by the tip of the 12 months.