Checking Bitcoin over the previous 5 years BTC$87,543.55 Utilizing CME futures buying and selling information, you possibly can assess the place a cryptocurrency has traditionally frolicked consolidating and, by extension, the place help is kind of established.

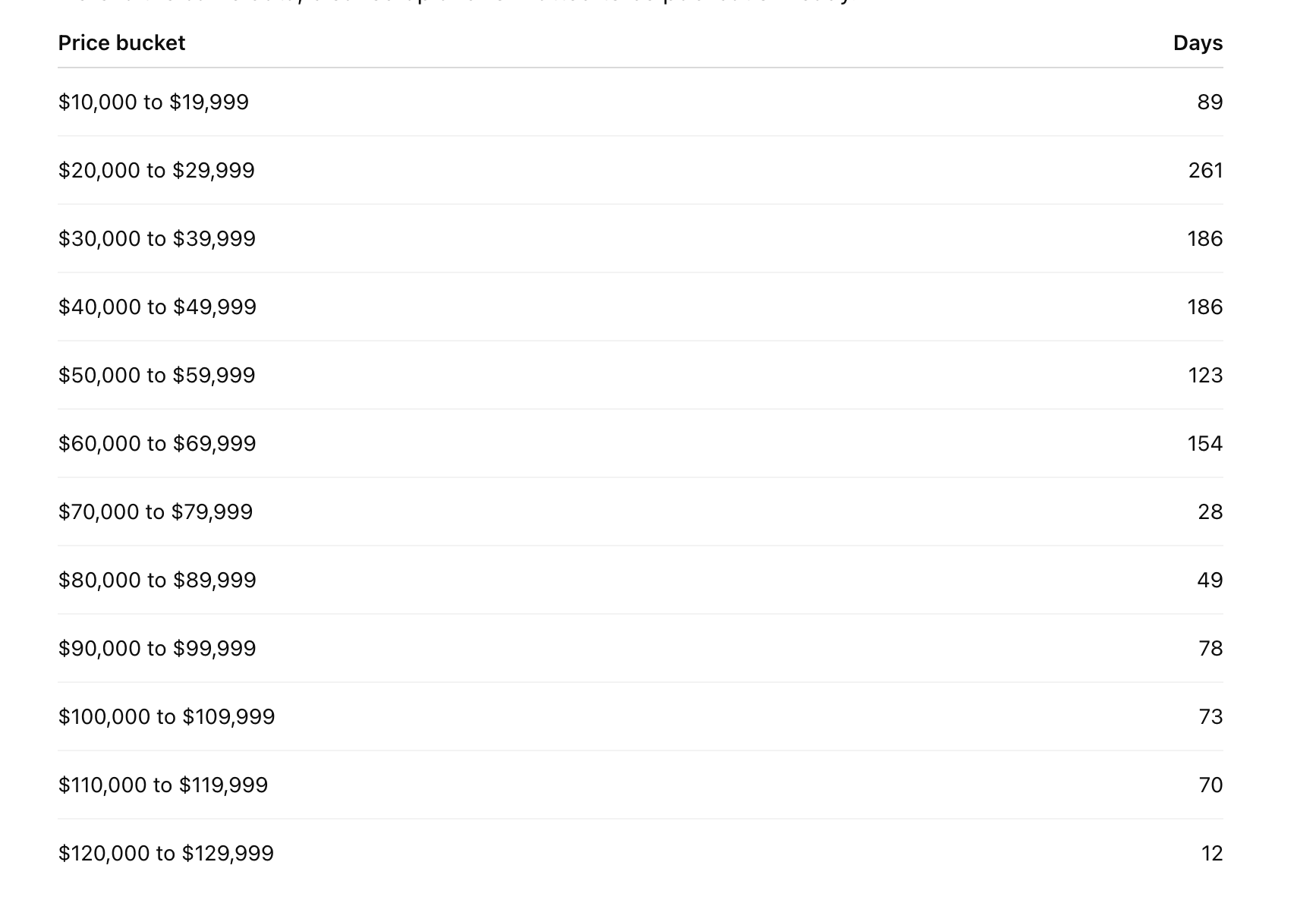

One helpful approach to body that is to take a look at the variety of buying and selling days that Bitcoin spends inside a sure worth vary. The longer the value spends inside a sure vary, the extra alternative there’s to construct a place, which may later result in stronger help.

Knowledge from Investing.com reveals clear variations throughout worth ranges. Aside from the transient interval when Bitcoin traded at all-time highs above $120,000, Bitcoin has spent the shortest time frame within the $70,000 to $79,999 vary at simply 28 enterprise days. Moreover, they spent solely 49 days within the $80,000 to $89,999 vary. In distinction, cheaper price zones reminiscent of $30,000 to $39,999 and $40,000 to $49,999 had roughly 200 buying and selling days, highlighting how extensively examined and consolidated these areas have been.

Bitcoin has been buying and selling within the $80,000 to $90,000 vary for many of December after a major pullback from its all-time excessive in October. This correction has pushed costs again into territory the place the market has traditionally spent comparatively little time, particularly when in comparison with most of 2024, when Bitcoin spent a major variety of days between $50,000 and $70,000. This uneven distribution means that help is much less developed within the $80,000 vary and even between $70,000 and $79,999 than within the decrease ranges.

BTC Buying and selling Day (Investin.com)

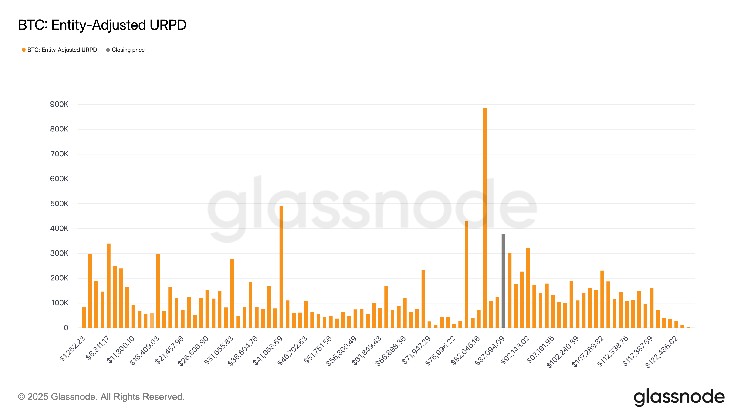

This commentary is supported by Glassnode information. The UTXO Realized Worth Distribution (URPD) reveals the place the present provide of Bitcoin final moved utilizing an entity adjustment framework that allocates every entity's complete steadiness to a median acquisition worth.

URPD reveals a major provide shortfall concentrated between $70,000 and $80,000, in line with futures information. Each information units counsel that if Bitcoin falls into an extra correction, the $70,000 to $80,000 space could signify a logical space the place the value ought to spend extra time stabilizing to determine stronger help.

Disclaimer: This evaluation is predicated on every day opening costs of Bitcoin CME futures, excluding weekends. In different phrases, this quantity displays how usually Bitcoin enters buying and selling classes inside every worth vary, reasonably than intraday or closing worth actions.