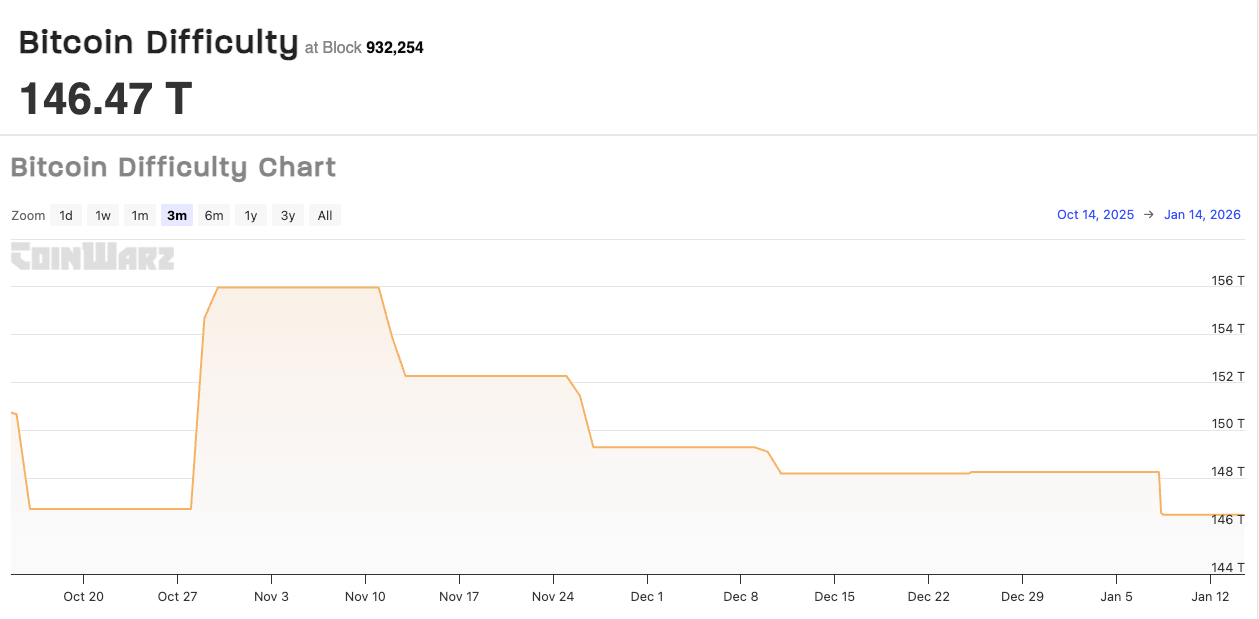

Bitcoin’s first issue adjustment in 2026 was something however dramatic. The community pushed that quantity all the way down to about 146.4 trillion yen, a reasonably small setback after an additional rise in late 2025.

However small doesn't imply nothing in terms of mining. Mining is a enterprise the place income are measured in fractions and the place the principle enter (energy) can go from a cut price to a backbreaker in every week. The problem is the metronome constructed into Bitcoin. Roughly each two weeks, the protocol recalibrates how tough blocks are to search out in order that blocks proceed to reach roughly each 10 minutes.

A lower in issue often means the community realizes what miners are feeling earlier than traders do. That’s, some machines have stopped hashing, not less than quickly, because of financial or operational necessity.

That is essential as a result of in 2026, miners will overcome a two-tier disaster. A typical actuality after a halving is that there will likely be fewer new Bitcoins per block and extra competitors for them. And there's a brand new background. The megawatt market is tightening as AI knowledge facilities scale up and begin bidding for a similar energy entry miners that had been as soon as handled as aggressive moats.

crypto slate Its personal report frames this as an power struggle the place AI's always-on calls for and political momentum collide with miners' versatile load pitches.

To grasp what the 146.4T print really means, we have to translate the mining dashboard into plain English and join it to the components of the story that Wall Avenue typically misses.

Issue is a stress gauge, not a scoreboard

Issue is usually mistakenly regarded as a proxy for worth, sentiment, and even security in a broader sense. It's definitely associated to these, however mechanically it's a lot easier. Bitcoin seems to be at how lengthy it took to mine the final 2,016 blocks. If the block arrives sooner than 10 minutes, the problem will increase. The slower the blocks come, the decrease the problem stage.

So if it's so easy, why is it displayed like a stress gauge? As a result of hash energy shouldn’t be some form of theoretical amount, however fairly an industrial gadget that actually provides energy on a big scale. If sufficient miners unplug, the block slows down and the protocol responds by making the puzzle simpler, permitting the remaining miners to maintain up the tempo.

In early January, a number of trackers confirmed common block occasions barely under the 10-minute aim (round 9.88 minutes in a extensively cited snapshot). Because of this we predicted that the subsequent correction will likely be again to the upside as soon as hashing energy recovers.

For instance, CoinWarz's public dashboard reveals the present issue stage at round 146.47T, together with a future forecast for the subsequent adjustment date.

The purpose is, the problem doesn't inform you, and that's why miners dropped out. We don't know if it's a one-day energy outage throughout an influence surge, a wave of bankruptcies, a flood, a firmware concern, or a deliberate change in technique. Issue is only a symptom studying of the protocol. Analysis is elsewhere.

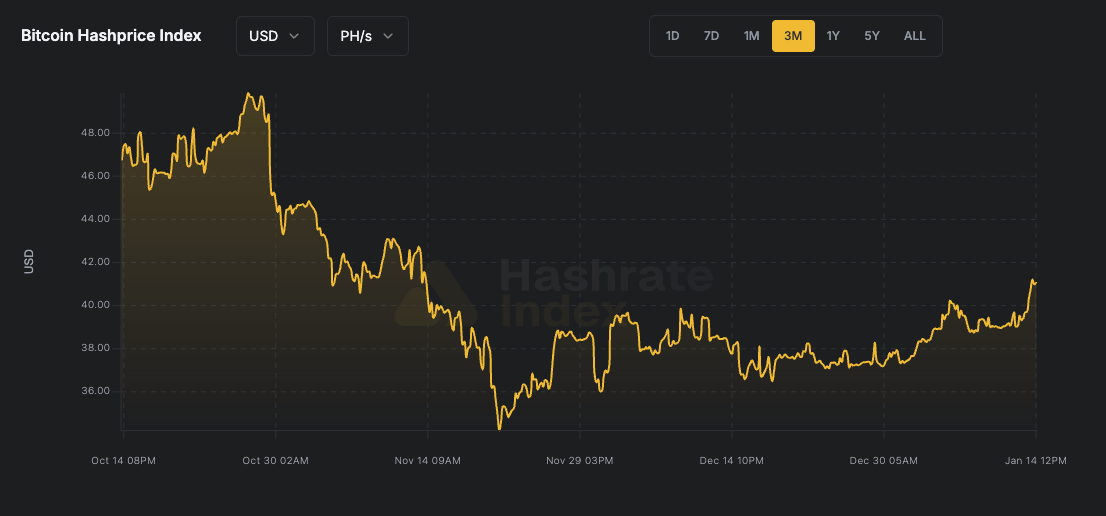

That's why miners and critical traders mix issue with a second metric that behaves extra like a revenue and loss assertion than a thermostat: hash worth.

Hash worth is a single quantity that represents a miner's revenue and loss.

Hashprice is a mining abbreviation that represents the anticipated return per unit of hashpower per day. Luxor popularized the time period, and its hashrate index defines hashprice as an anticipated worth of 1 TH/s per day.

It is a intelligent technique to compress a block's rewards, charges, issue, and worth right into a single quantity to point out the place the cash is.

For miners, that is their life-sustaining heartbeat. If costs are low, charges are low, and the worldwide fleet stays extremely aggressive, miners should proceed to endure at the same time as issue decreases. Conversely, whereas miners are printing cash, issue can improve if: BTC Gatherings and rising costs. The hash worth is the place these variables meet.

An early January commentary on the hash fee index factors out that the futures market has priced the typical hash worth at round $38 (roughly $0.00041). BTC) for the subsequent six months. That is helpful context as a result of it signifies what refined contributors anticipate profitability to be, not simply what it at the moment is.

When you're attempting to interpret a modest issue drop like 146.4T, hashprice can assist you keep away from the frequent mistake of assuming the community has given miners a tough time. The community doesn’t know in regards to the existence of miners. Simply repair the timing.

The discount in issue is barely a reduction within the slim sense that every unit of hashing energy that survives has barely higher odds. Whether or not that gives any actual headroom will rely upon energy prices and financing, that are way more stringent than they was.

That is the place integration comes into play. As a result of if mining is flashed, most individuals with entry to low cost electrical energy and equipment will be capable of survive. As soon as hash costs are compressed, survival turns into a perform of stability sheet, measurement, and contracts.

Built-in waves are an actual issue adjustment

Bitcoin mining is usually described as decentralized, however the industrial layer is brutally Darwinian. Tighter profitability not solely reduces the earnings of weak managers; They lose the power to refinance equipment, pay down debt, and safe energy at aggressive charges.

Consolidation then accelerates via bankruptcies, the sale of distressed property, and the acquisition of websites with helpful grid entry.

That is the place the story of the mine diverges from the story of the market. Within the period of ETFs and macros, BTC It trades like a threat asset with catalysts and flows. In distinction, miners reside in a world of power spreads, capital funding cycles, and working leverage.

When the world will get tight, they make selections that unfold outward. It means promoting extra. BTC To fund working prices, hedge manufacturing extra aggressively, renegotiate internet hosting contracts, or shut down older rigs earlier than deliberate.

A lower in issue might be one of many first on-chain hints that this course of is underway. Not as a result of miners are capitulating to dramatic one-day occasions, however as a result of sufficient marginal machines are quietly going darkish to maneuver the typical. Though their numbers could also be small available in the market, the trade sees aggressive shakeout beginning on the edges.

And in 2026, these edges will likely be pushed by one thing larger than a single HashPrice print: the rise within the worth of electrical energy itself.

AI is altering unit economics that miners took without any consideration

Mining has all the time been an power enterprise disguised as a cryptocurrency enterprise. The argument is easy: discover a low cost, interruptible energy supply. Deploy machines rapidly, swap them off when costs spike, and arbitrage energy fluctuations into a gentle stream of hashing energy.

crypto slate A January report argued that AI knowledge facilities essentially problem that mannequin as a result of they need certainty, not cuts, and include a political narrative (jobs, competitiveness, “vital infrastructure”) that miners typically lack.

The identical article highlighted BlackRock's warning that AI-driven knowledge facilities may eat an enormous share of US electrical energy by 2030, turning grid entry right into a scarce asset that traders are underpricing.

Even for those who deal with high-end predictions as mere provocative headlines, course is essential right here. This implies elevated baseline demand, elevated interconnection bottlenecks, and elevated competitors for the most effective websites. In that world, miners' earlier benefits (mobility and pace) may flip into disadvantages if the gate components are transmission upgrades, transformer capability, and securing long-term contracts.

crypto slate Our November characteristic takes this a step additional. AI isn’t simply competing for energy, it’s competing for capital and a focus, drawing liquidity to computing infrastructure and forcing miners to pivot from hashing to internet hosting.

The article defined that miners are repositioning themselves as knowledge middle operators and “energy platforms” exactly as a result of megawatts have gotten extra helpful than machines.

None of that is an summary story. What adjustments the problem of studying is actual knowledge and actual results.

It's one other factor for miners to restrict their work for an hour throughout worth spikes. Some miners are suspending their websites as a result of AI tenants can command larger costs per megawatt with multi-year contracts.

Within the first state of affairs, hashing energy is restored when situations normalize. Second, it’s possible you’ll not get any hashing energy again in any respect. This isn’t as a result of Bitcoin is “dying”, however as a result of the best worth use of its energy has modified.

That's the refined stress constructed into the 146.4T print. The community continues to regulate. As a result of that's the aim. The query is, what is going to occur to mining after repeated changes in an atmosphere the place power is repriced by AI?

For traders and critical market observers, the sensible worth lies in studying mining tapes like a set of linked alerts fairly than particular person indicators.

Issue signifies whether or not hashing energy is steadily increasing, or whether or not the restrict machine is stalled and flashing briefly. Hashprice, however, interprets that very same atmosphere into the one factor miners can't negotiate on: whether or not the fleet is making sufficient income to maintain it working.

From there, the trade's response tells its personal story. Tightening economies are likely to speed up consolidation, figuring out who can proceed to play and whether or not the commercial base of the community turns into extra concentrated.

And behind all of this lies a brand new constraint: power competitors. The power race will decide whether or not “low cost energy” stays a everlasting moat for miners or an edge that disappears as AI knowledge facilities safe long-term capability.

Bitcoin is not going to cease producing blocks as the problem has modified by a couple of factors, however mining may nonetheless fall right into a regime shift whereas the protocol continues in silence and indifference.

If 2025 is the yr the sector learns to reside with a leaner baseline of halving, 2026 stands out as the yr miners study their actual competitors shouldn’t be one other pool, however the knowledge facilities they by no means need to energy down sooner or later.