As Bitcoin (BTC) reveals an edge close to the psychologically important $100,000 milestone, some technical and chain metrics counsel that main breakouts could also be on the horizon. One such metric, the plain demand for Bitcoin – reveals robust rebounds, exhibiting robust rebounds out there, renewed curiosity and sustained accumulation.

Bitcoin is seeing a fast rebound in apparent demand

In response to a current encrypted Quicktake put up, IT Tech pointed to a big enhance within the apparent demand for BTC. Most notably, this key indicator has been spent a number of weeks within the crimson for a row earlier than returning to constructive territory.

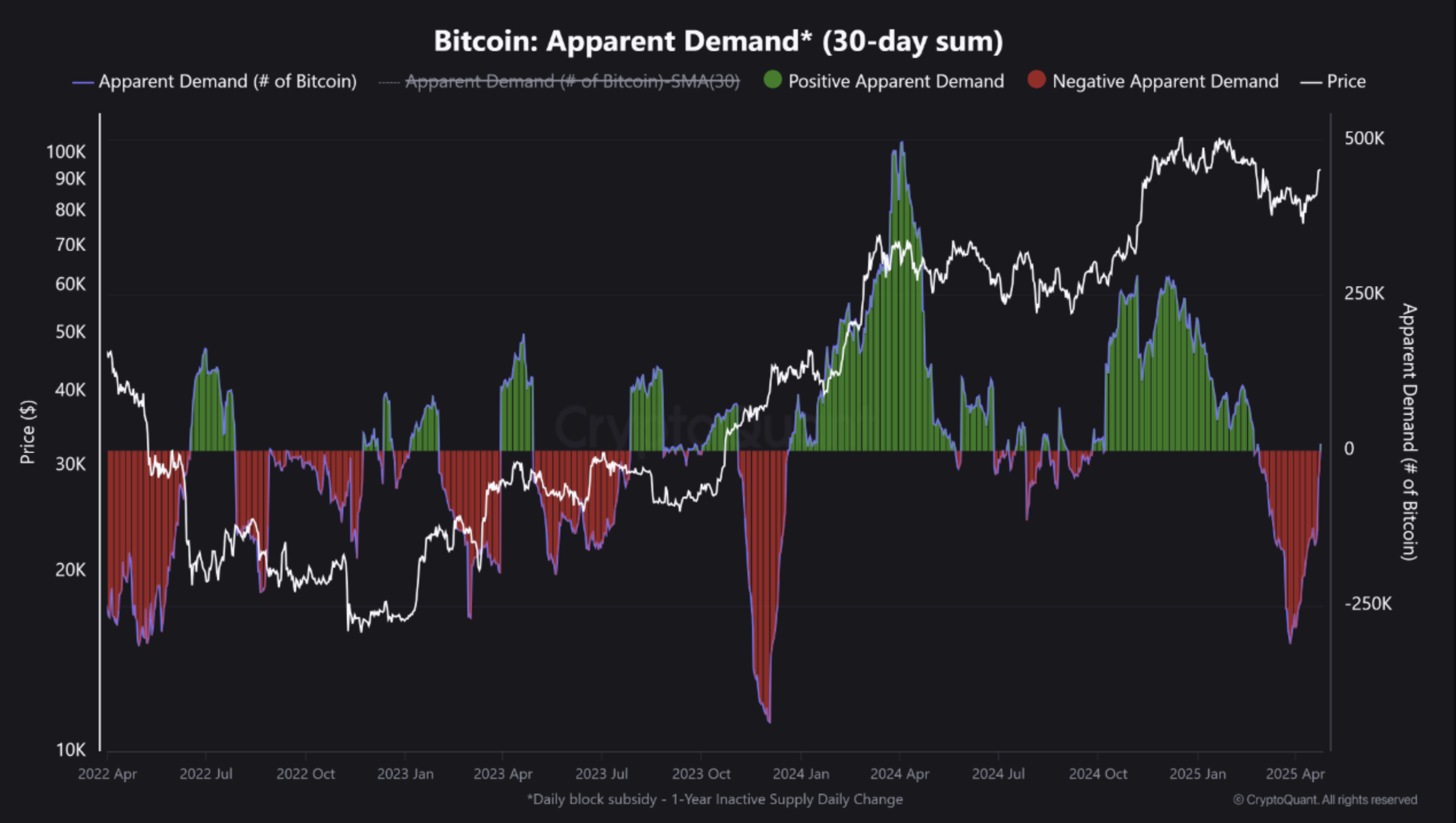

For freshmen, the obvious demand for Bitcoin (30-day whole) measures the cumulative web demand for BTC over the previous 30 days by monitoring pockets accumulation and trade outflows. This fast enhance in metrics suggests robust and sustained buying strain. This could present bullish sentiment and potential value will increase.

The next chart reveals this rebound within the apparent demand for BTC. This basically displays the online change in inactive provide over the yr adjusted by each day block rewards.

Beforehand, this metric had fallen deep into destructive territory – under -below 200,000 (highlighted in crimson) – suggesting a decline in demand. Nevertheless, current reversal to constructive territory suggests long-term capital has flowed into the market. As talked about within the put up:

Demand pivots are intently matched with current value rebounds above $87,000, that means this restoration is supported by precise on-chain conduct slightly than purely speculative circulate.

This marks the primary constructive obvious demand studying since February, in line with a rise in circulate into Spot Bitcoin Alternate Funds (ETFs) and a rise in accumulation by long-term holders.

Information from SOSOValue reveals that the US-based Spot BTC ETF has recorded web constructive inflow for 5 consecutive days, totaling over $2.5 billion. The cumulative web influx into Spot BTC ETFs is presently spectacular at $38.05 billion.

Are you able to see the BTC rally?

IT Tech famous that previous reversals in obvious demand have preceded both traditionally important gatherings or robust value assist. If the present development continues, BTC may have the momentum wanted to problem the $90,000 degree within the quick time period.

Nevertheless, analysts ought to observe that Bitcoin must preserve its present assist at round $91,500. Upwards Momentum. This degree is especially essential as it’s near the realised value of short-term BTC holders. In response to Encrypted contributors to CrazzyBlock.

Along with this outlook, the well-known crypto analyst Rect Capital Emphasised That Bitcoin must safe a weekly deadline of over $93,500 and accumulate it as assist to determine a transparent cross to $100,000. At press time, BTC trades at $94,492, a rise of two% over the previous 24 hours.

Featured photographs from Unsplash, Cryptoquant and TradingView.com charts