Bitcoin (BTC) stays inside the powerful buying and selling vary, following current pullbacks from the all-time excessive. On the time of writing, the world's largest cryptocurrency worth was $118,570, reflecting a 0.3% enhance over the past 24 hours.

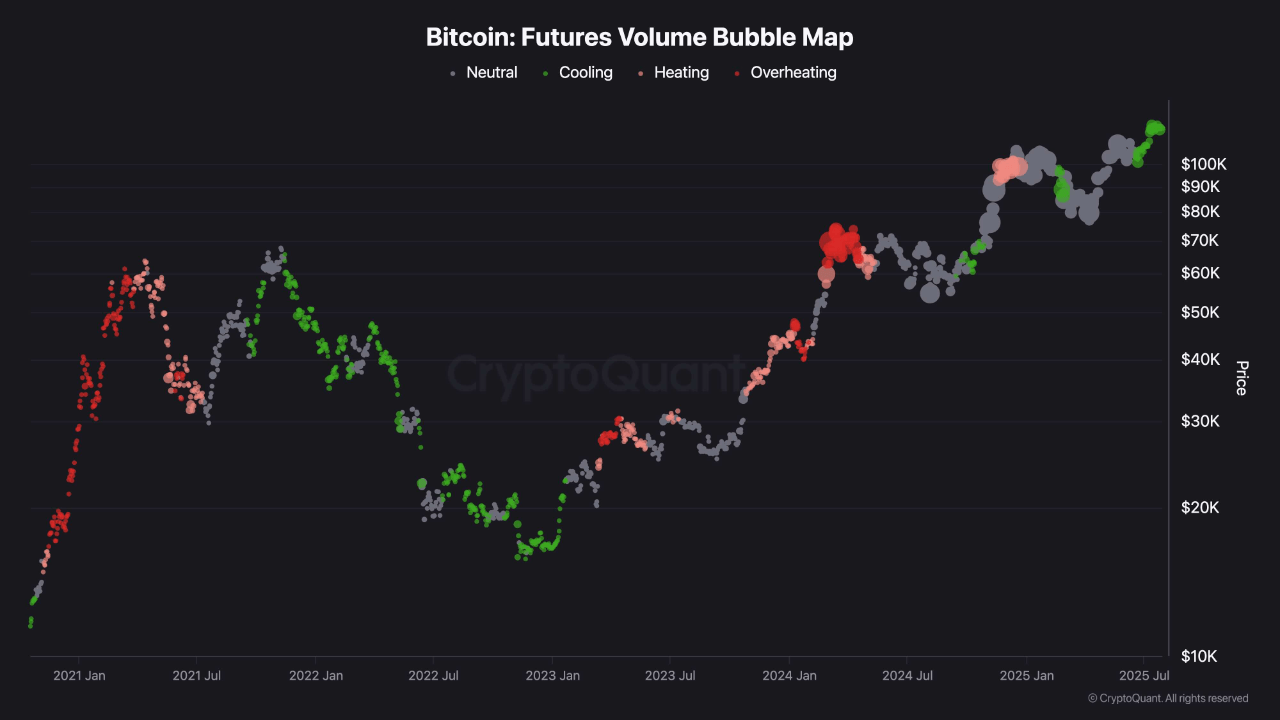

A current evaluation shared by Shayanmarkets, a market contributor on Cryptoquant's Quicktake platform, highlights a major change in Bitcoin's futures market exercise.

Analysts say earlier worth surges within the $70,000 to $90,000 vary had been marked by accumulation of enormous speculative pressures and leverage, however the present development reveals indicators of cooling regardless of rising worth ranges. This shift may play a key position in figuring out Bitcoin's trajectory within the coming weeks.

Bitcoin futures market reveals indicators of normalization

Shayanmarkets defined throughout previous gatherings that the futures market confirmed what he known as the “heating and overheating levels.” These durations often resulted in corrections or momentary worth consolidation as leveraged positions had been rewinded.

Nonetheless, the present information displays a unique setup. Though Bitcoin remained close to report highs, futures market exercise has shifted to impartial and cooling phases, as indicated by the gray and inexperienced bubbles on the chart.

Analysts stated this cooling part could possibly be an indication that robbed merchants of threat. In a press release on Fast Take, Shayan Market stated:

This leverage reveals a more healthy market scenario as BTC shifts to natural purchases somewhat than high-risk speculative bets, regardless of its over $100,000.

Analysts added that if speculative strain is sustained, it may present one other vital base for worth will increase, doubtlessly breaching Bitcoin at its report excessive above $123K.

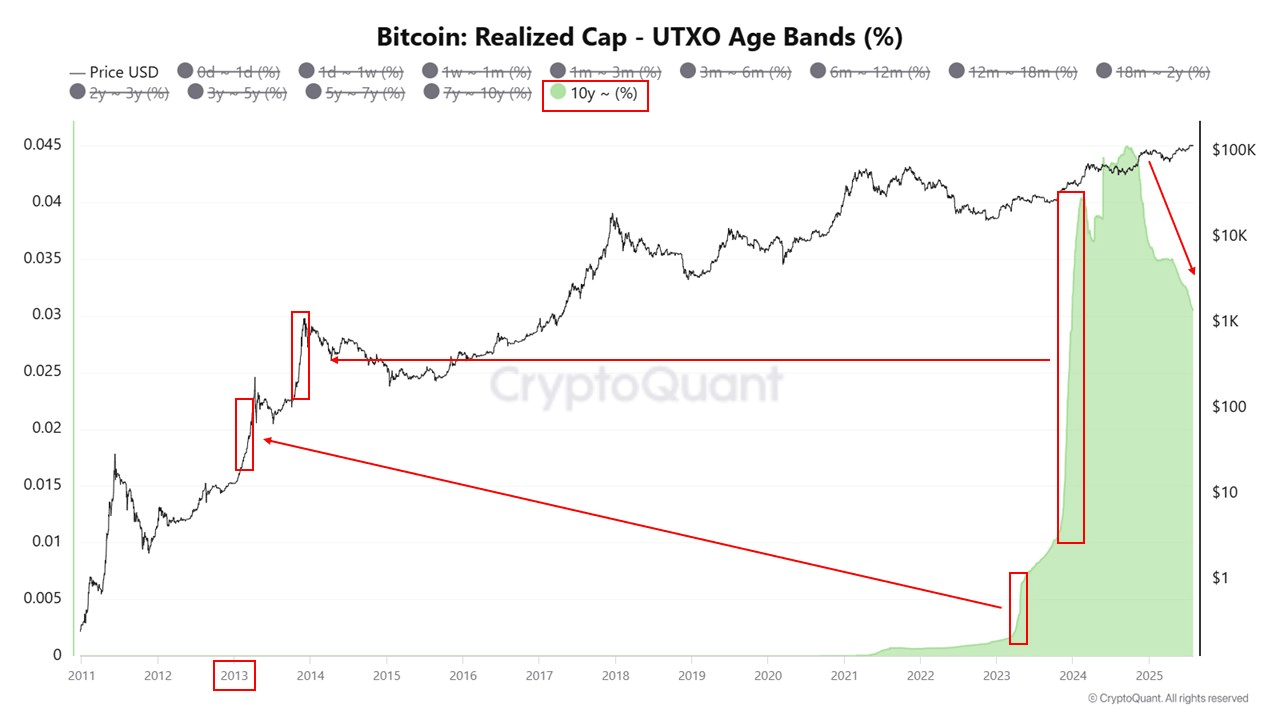

Lengthy-term whales profit from worth stability

In the meantime, one other evaluation from the coincidence of crypto-contributors revealed gross sales actions from long-term Bitcoin holders generally known as “whales,” who’ve maintained their place for over a decade.

By coincidence, a few of these holders, together with those that first gathered Bitcoin round 2013, started liquidating a few of their holdings.

This gross sales exercise rose to about $1,000 with a historic timeline of Bitcoin's speedy rise over that interval, representing a 117,900% return for early adopters.

Such returns from early traders will not be unusual in periods of worth rise and don’t essentially point out long-term modifications in market sentiment.

Traditionally, whale actions have influenced short-term volatility, however have additionally contributed to market redistribution, permitting new individuals to enter the market.

Particular photographs created with Dall-E, TradingView chart