Ether Lee is as soon as once more buying and selling at a decisive stage after returning the $ 4,000 mark, the realm that merchants and analysts are intently watched. Bulls defended the $ 4,100 space, exhibiting a couple of weeks of risky value change. Nevertheless, the quantity of train stays weak and the ETH is required to advertise greater than a better resistance stage to substantiate that the pattern is in progress. With out such a failure, the chance of recent integration stays on the desk.

Regardless of the uncertainty of value behaviors, heat chain information supplies extra constructive views available on the market. Recent figures present that whales maintain accumulating ETH whereas wider feelings are shaken. This regular capital influx from giant -scale holders enhances the concept Ether Leeum's lengthy -term outlook and the latest modifications can present alternatives reasonably than weaknesses.

This accumulation has been preceded throughout the traditionally renewed depth, as deep -fixes traders have a tendency to construct positions on the stage of market doubt. If ETH can preserve greater than $ 4,100 and construct momentum, whale actions can present the help wanted to create extra highly effective restoration. At the moment, all gaze stays within the potential to keep up this vital stage and problem larger resistance zones.

Whale actions point out belief in Ether Leeum

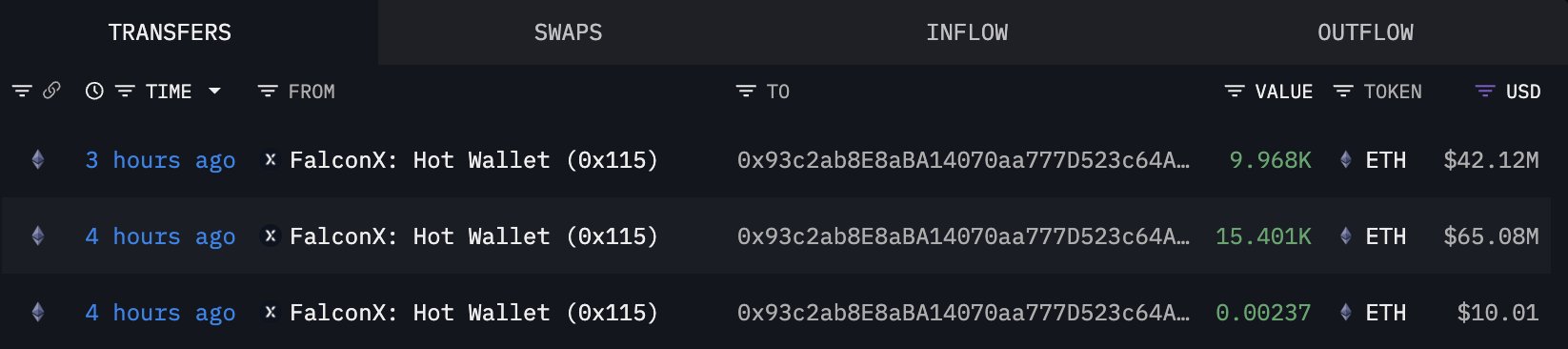

Ether Lee's latest value conduct is unsure, however whale conduct tells totally different tales. In response to Lookonchain's chain information, giant -scale holders proceed to build up ETH regardless of the latest decline. In the previous couple of hours, two main transactions have emphasised this steady pattern.

0x93C2, a newly created pockets that analysts can belong to Bitmine, acquired 25,369 ETHs of about $ 178.74 million from Falconx three hours in the past. This huge inflow of contemporary wallets suggests strategic accumulation and might be for lengthy -term holding or staying reasonably than brief -term transactions. On the similar time, one other new pockets, 0x6F9B, withdrew 4,985 ETH (about $ 21 million) from OKX one hour later. This motion is commonly thought of optimistic as a result of it reduces the provision of the trade and limits instant gross sales strain.

This sample emphasizes wider market mechanics. Retailers and small individuals reply to brief -term volatility, however whales appear to see modifications as a possibility. Their accumulation not solely exhibits the boldness in Ether Lee's elasticity, but additionally alerts preparations for future value audits. Traditionally, constant whale inflows with contemporary wallets coincide with the timing of structural help and closing restoration.

ETH is having problem in reclaiming $ 4,200.

Ether Lee is traded close to $ 4,138 after a number of fluctuations, which was traded at lower than $ 4,000 earlier than the worth was wanting $ 4,000. The 8-hour chart emphasizes restoration makes an attempt, however the ETH is now going through a big resistance of about $ 4,200, the place the typical of 100-period and 200-period (crimson) shifting common converges. This confluence creates a heavy provide space the place the bull wants to beat to test the larger momentum.

Lately, the decline within the vary of $ 4,600 to $ 4,800 has been weak in Ether Lee, and the strain has been strengthened throughout the fall. Rebound exhibits elasticity, however value conduct retains the emotion fastidiously on account of overhead resistance. Returning the earlier 50 -period shifting common (blue) is having a tough time reversing the brief -term weak momentum.

Within the disadvantages, the $ 4,000 mark performs the primary vital function. The failure under that stage might be uncovered to ETH once more for $ 3,800 or $ 3,600, whereby the demand could also be extra highly effective. At the moment, Etherrium transactions are traded on the integration stage, and the subsequent decisive motion will rely upon whether or not the bull can power a brake out of $ 4,200 or extra. The upper the cleaner motion, the extra you open the door for $ 4,400, and the chance of rejection can have a renewed downward strain.

DALL-E's foremost picture, TradingView chart

Editorial course of focuses on offering thorough analysis, correct and prejudice content material. We help the strict sourcing customary and every web page is diligent within the prime expertise specialists and the seasoned editor's staff. This course of ensures the integrity, relevance and worth of the reader's content material.