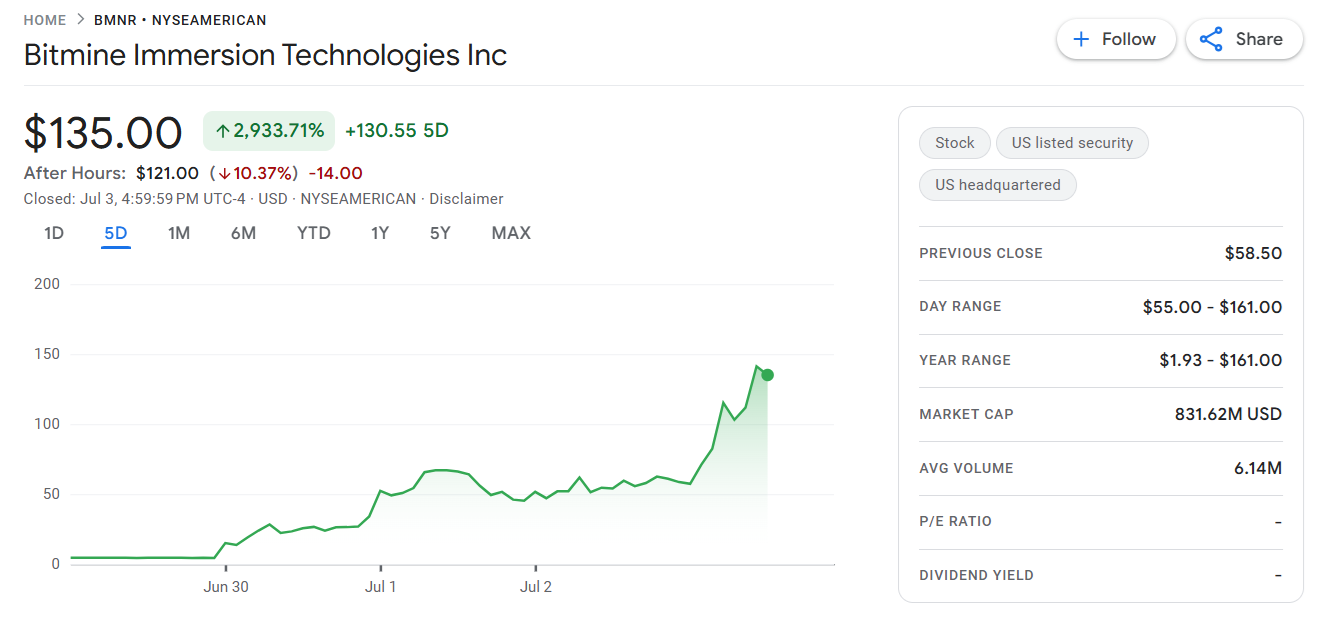

Bitmine Immersion Applied sciences Inc. has peaked its value for 4 years, doubling its value within the final two days. The corporate unlocked the three,000% rally after it introduced a $250 million facility to construct the ETH Treasury Division.

Bitmine was one of many newest finance firms to unlock inventory gatherings. Within the final two days alone, Bitmine has grown by greater than 100%, reaching the value of $135 for the primary time since April 2021.

The newest inventory gathering launched after Bitmine's announcement $250 million Privately owned placement with the objective of incomes and retaining ETH. Costs jumped even additional after the non-public placement ended on July third.

Bitmine gathered prior to now days after the $250 million non-public placement settlement ended with the objective of constructing the ETH Treasury. |Supply: Google Finance

Bitmine started at an all-time low, rising from $1$ mining inventory to greater than $135 over per week. Bitmine continues to satisfy as chief of Ethereum Ministry of Finance Inventoryhas joined the Bitcoin pattern prior to now few weeks.

The expansion pattern additionally noticed Sharplink Gaming shares rise, additional up from $9.50 to over $12.60. SBET's inventory value continues to be falling from its peak, however the latest restoration exhibits ETH's monetary enthusiasm. Bitdigital, Inc. additionally rose to a month-to-month excessive of $2.94.

ETH Treasury additionally permits companies to wager tokens for added passive revenue. Sharplink Gaming has already guess 95% of its ETH, which is over $450 million.

Bitmine Planning Twin BTC-ETH Technique

Bitmine already owns 154.2 BTC and has been acquired since June sixteenth at a value of over $106,000. The corporate can also be hiding hashrates that may generate extra BTC inflow over the following six months.

Bitmine goals to make use of privately owned revenues together with BTC to amass extra ETH and construct a Ministry of Finance. The corporate goals to acquire cryptocurrencies for long run holdings from a mixture of BTC mining operations or elevating extra capital.

Bitmine has direct mining operations, contracts within the artificial market, and hashrates as a monetary instrument. Bitmine additionally serves as a mining guide and owns an information middle in a low-cost location in Texas.

Can Bitmine get up ETH?

Demand for ETH is growing based mostly on the acquisition of ETFs. The latest announcement from the Company Treasury Division has but to be depressed out there. ETH stays a speculatively traded asset, with intentional buying and selling on lengthy positions, with market value buying and selling dropping inside the roughly $2,500 vary.

ETH traded for $2,557.21, removed from the colourful treasury of the treasury firm's inventory. The token stalled at just below $2,700, inflicting gross sales stress.

For bullish merchants, ETH was imagined to be raised to $3,000, however for now the rally has been shortened. Ethereum has seen a rise in staking and chain exercise attributable to elevated demand for obstacles. The community is steadily regaining its exercise, based on the usage of Stablecoin. USDT and USDC drive visitors on Ethereum as a part of each centralized and decentralized actions.

The Ministry of Finance has not but bought on a strategic scale just lately, and has already affected the BTC market. Nonetheless, the emergence of a brand new wave of Altcoin finance firms may lengthen the 2025 crypto rallies. Whereas firms have already introduced SOL and BNB funds, ETH stands out as the main candidate for making ready to ensure assured compensation.