Bitwise Asset Administration has launched a brand new exchange-traded fund (ETF) aimed toward hedging in opposition to foreign money declines, following the success of its Bitcoin Spot ETF and highlighting how digital belongings are more and more being included into broader macro funding methods.

On Thursday, Bitwise introduced the Bitwise Proficio Forex Debasement ETF, which is able to commerce on the New York Inventory Alternate below the ticker BPRO. The actively managed fund goals to fight the declining buying energy of fiat currencies by way of a portfolio that features Bitcoin (BTC), valuable metals, and mining shares.

Not like spot Bitcoin ETFs, BPRO permits for discretionary allocation throughout crypto and commodity-linked belongings. The construction seems to be focused at wealth managers in search of publicity to Bitcoin with out committing to a single-asset crypto product, particularly as inflation considerations persist.

The fund maintains a minimal gold allocation of 25% always and has an expense ratio of 0.96%.

Moderately than emphasizing upside potential, the fund focuses on capital preservation, with a framework that displays how the crypto story is evolving within the institutional market.

Regardless of its long-term efficiency, “gold stays a ghost in fashionable portfolios,” stated Bob Haber, chief funding officer at Proficio Capital Companions, citing analysis by Goldman Sachs exhibiting that gold ETFs account for simply 1% of personal monetary belongings.

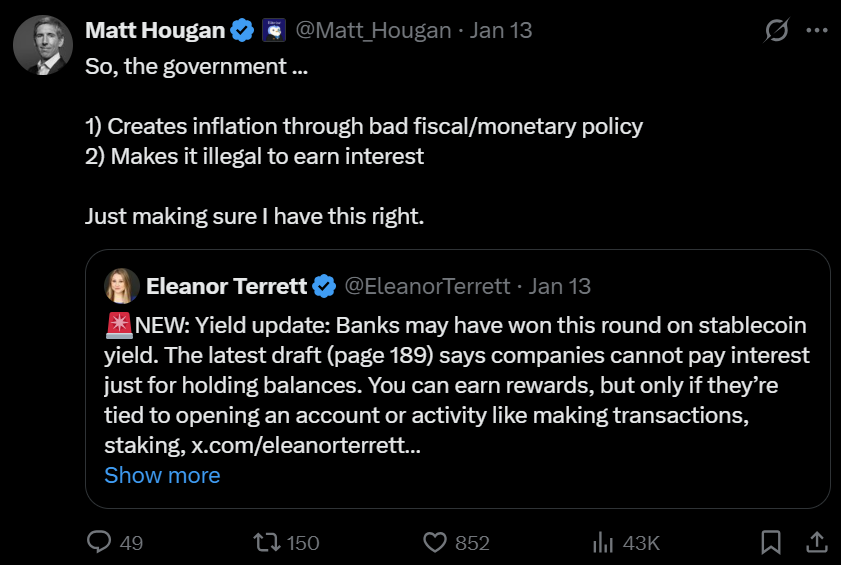

sauce: matt hogan

Associated: US SEC Bitwise File of 11 Single Token “Methods” Crypto ETFs

Deterioration is capturing the crypto creativeness and funding type

Fiat foreign money deterioration, or the gradual decline in buying energy over time, has been a basic concern inside the Bitcoin neighborhood for a few years.

Bitcoin has been regularly touted as a long-term hedge in opposition to falling land costs, given its fastened provide and powerful efficiency since its inception. Nevertheless, regardless of these traits, Bitcoin has not too long ago underperformed gold, elevating questions on its effectiveness as a hedge in opposition to soil degradation within the present macro setting.

Karel Merckx, an funding professional at Dutch advisory agency Belegers Belangen, argued in a current evaluation that Bitcoin has did not function a dependable hedge in opposition to foreign money depreciation.

Merckx stated probably the most telling sign got here when Bitcoin underperformed regardless of US President Donald Trump publicly undermining the independence of the Federal Reserve.

Political strain on central banks can elevate considerations about monetary reliability and long-term inflation dangers, however these circumstances have traditionally benefited belongings which have been seen as shops of worth. Whereas gold reacted to those alerts, Bitcoin didn’t, weakening its place as a short-term hedge in opposition to foreign money declines.

Associated: Bitcoin Mining 2026 Prediction: AI Turnabout, Margin Stress, and Struggle for Survival