- Bitwise's Spot Solana ETF recorded constructive inflows for eight consecutive days, totaling $312.

- Solana worth is poised for a bullish rebound from the $150 ground.

- Solana surpassed Ethereum in app income, producing $4.34 million within the final 24 hours.

SOL, the native cryptocurrency of the Solana blockchain, made a bullish rebound from the $150 assist on Friday, posting an intraday achieve of 5.3%. The rally comes as a broader market correction slows, with Bitcoin displaying resilience above the $100,000 stage. Nevertheless, Solana gained much more momentum because the Bitwise SOL Spot ETF continued to obtain inflows and Solana's app income elevated considerably. Will this set off be sufficient to gasoline a sustained restoration for this altcoin?

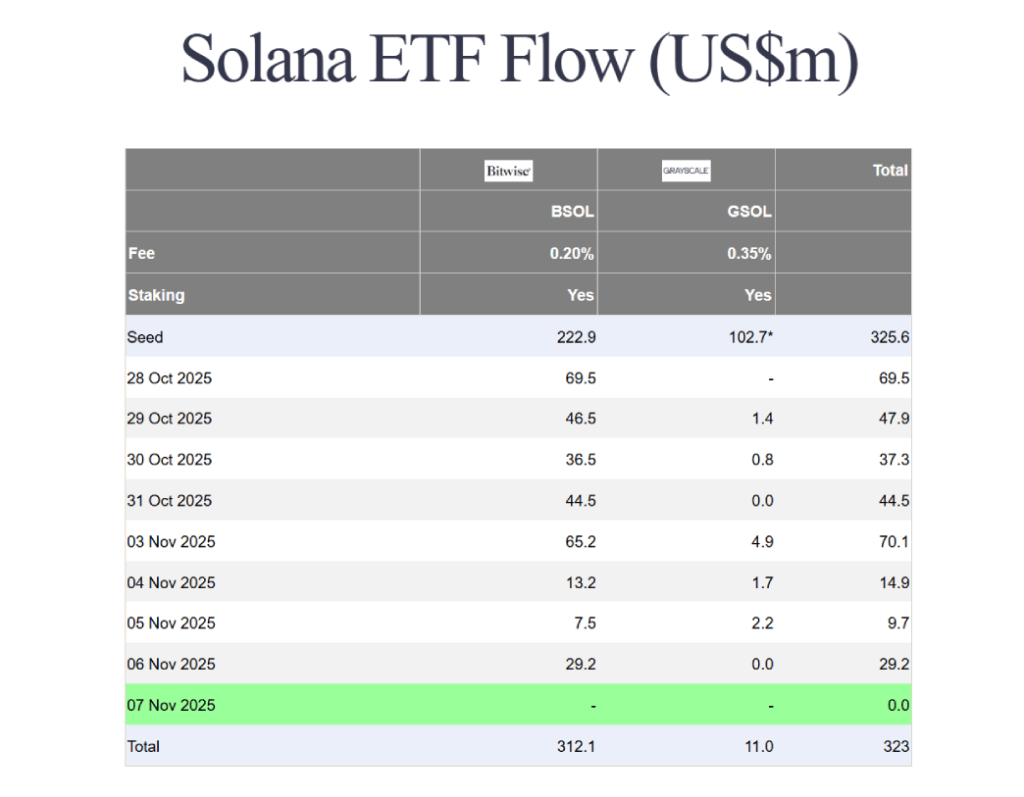

Bitwise Solana ETF data 8 consecutive days of inflows

Following the crypto market decline on November third, Solana worth moved sideways above the $150 assist. Since then, worth motion has proven a number of failed makes an attempt to interrupt out of this assist, however a long-tail rejection has introduced it again down, indicating that demand strain stays intact.

Along with the slowing market correction, Solana worth resilience will be attributed to constant investor demand for the not too long ago launched Bitwise Solana ETF (ticker: BSOL).

In keeping with information shared by Farside Traders, the Bitwise Solana ETF has recorded eight consecutive days of internet inflows, bringing the whole quantity invested for the reason that ETF's inception to $312 million. The product did very effectively throughout this era, attracting roughly $39 million in new funding per day. This reveals curiosity from institutional traders and retailers regardless of the general market volatility.

Whereas asset flows are displaying constructive indicators, on-chain efficiency information reveals that Solana is outperforming its closest rival Ethereum in stunning areas. In keeping with DeFiLlama, decentralized purposes on the Solana community generated an estimated $4.33 million in income previously 24 hours, in comparison with $1.82 million for Ethereum-based purposes.

Over a 30-day interval, the distinction is much more dramatic, with Solana persevering with to guide by way of whole app income. This can be a uncommon reversal of the long-term development during which Ethereum dominated in protocol and utility income metrics.

Ethereum has persistently outperformed its rivals by way of community exercise and developer income in earlier quarters, however Solana's fast progress in DeFi and shopper purposes is prone to change that dynamic.

Solana worth poised for short-term rebound in direction of $180

Over the previous two weeks, Solana's worth has seen a notable correction from $205 to its present buying and selling worth of $163, a 20% loss. In consequence, the asset market capitalization plummeted to $90.5 billion.

Throughout this pullback, the coin worth decisively broke away from the assist development line of the channel sample on the every day chart. Since March 2025, the altcoin has adopted a gentle restoration development inside this channel, with the value resonating between two parallel development traces.

The latest breakout due to this fact indicators a change in market dynamics, reinforcing sellers' management over this asset. Nevertheless, with right now's 5.32% improve, Solana worth reveals a rebound from the $150 assist and a doable retest of the damaged development line at $180.

The damaged trendline is now according to the 200-day exponential shifting common, offering a powerful protection in opposition to worth will increase. If sellers proceed to stick to this barrier, the correction might transfer under the $150 ground and prolong in direction of the $125 assist.

SOL/USDT-1d chart

Conversely, if the coin worth manages to make a bullish breakout at $1.80 and re-enter the channel vary, the bearish thesis shall be invalidated.