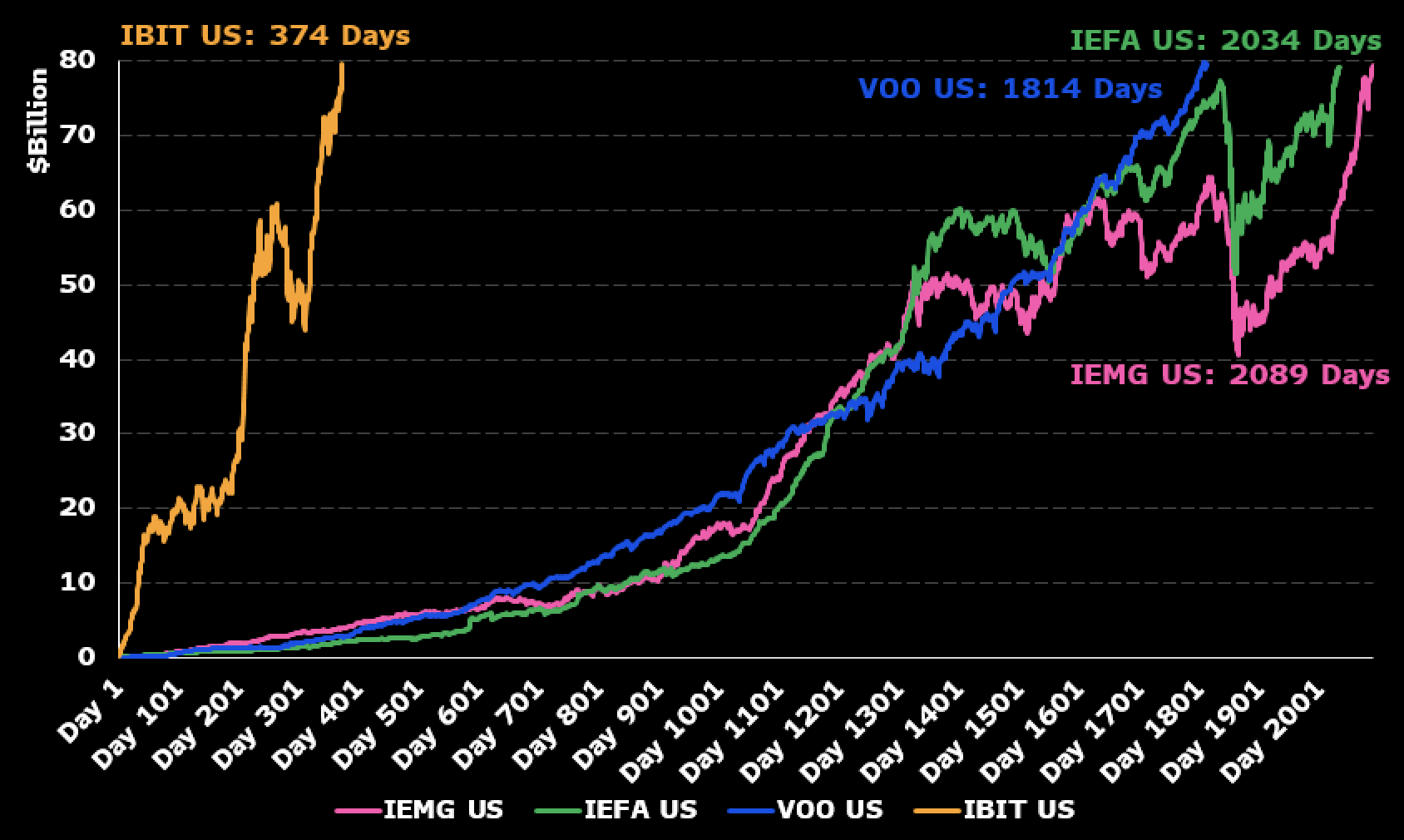

BlackRock's iShares Bitcoin Belief (IBIT) has grow to be the quickest rising ETF thus far, formally gaining $80 billion in managed belongings simply 374 days after its launch. This milestone is a brand new report for the ETF trade, says Eric Balknath of Bloomberg.

To place it into view, it took Vanguard's $VOO to achieve the identical stage, nearly 5 occasions greater than 1,814 days. Not solely did ibit beat that tempo, it additionally utterly rewritten the script. As of July tenth, IBIT's cumulative web influx had a web value of $81.1 billion, 4 occasions the closest competitor within the Bitcoin ETF house.

Additionally, the every day move offers you a very good image of what's occurring. ibit made $448.49 million in simply at some point, far forward of all different Spot Bitcoin ETFs. Constancy's FBTC has a every day inflow of $324.34 million, with Ark 21Shares' ARKB bringing $268.7 million.

Wanting on the large image, all US-registered spot Bitcoin ETFs have reached $140 billion for the primary time. ibit is the one one which accounts for greater than half of that quantity.

The massive listing contains funds from Constancy ($235 billion), Grayscale's secondary BTC Belief ($5.13 billion), Bitwise ($4.62 billion), and Vaneck ($1.8 billion).

IBIT is surged due to a mixture of strong Bitcoin worth efficiency and a gentle influx from each institutional and retail buyers. It's not simply the product. This can be a signal of the place you're large cash to make your Bitcoin bets extra comfy.

From $80 billion over a 12 months since its launch, BlackRock's Bitcoin presence appears to pay for all of the hopes that have been there earlier than January 2024. The brand new $118,000 all-time excessive displays that.