Ripple's Swell 2025 convention in New York could have marked one of the vital defining moments within the relationship between the digital asset trade and Wall Avenue. The XRP neighborhood specifically acquired some long-awaited validation.

Maxwell Stein from BlackRock’s digital property workforce instructed the viewers in his keynote that “the market is prepared for blockchain adoption at scale” and that Ripple’s infrastructure may quickly transfer trillions of {dollars} on-chain.

BlackRock Validates Ripple in Swell 2025 — Cheers to the XRP Neighborhood

Stein praised early trade builders like Ripple for proving the real-world utility of blockchain, not simply as a speculative idea however as a practical layer of economic infrastructure.

“They're already tokenizing bonds, bonds, stablecoins…that's a begin. However this can be a rail for trillions of capital flows,” Stein mentioned.

BlackRock executives publicly praised Ripple for serving to show blockchain's real-world performance, marking a milestone in a narrative that XRP holders have championed for years.

The remark got here like a thunderclap for a neighborhood that has lengthy argued that Ripple's know-how helps institutional liquidity.

The XRP neighborhood has lengthy held to the assumption that Ripple's know-how acts as a bridge between conventional finance and the decentralized economic system.

Following Mr. Stein's remarks, XRP supporters throughout Twitter considered the remarks as a much-needed validation from the world's largest asset supervisor.

🚨Breaking information: BlackRock exec on Ripple swell: “The market is prepared — trillions of {dollars} coming on-chain” 💥

This may need been probably the most emotional second of @Ripple Swell 2025.

Maxwell Stein, president of @BlackRock, took to the stage and spoke candidly about what everybody has been as much as… pic.twitter.com/OpuysMrq47— Diana (@InvestWithD) November 4, 2025

“Now we have seen what the early adopters of cryptocurrencies have finished. They confirmed us what is feasible, and now the market is prepared for broader adoption,” he added.

His assertion highlighted a shift in tone from TradFi that blockchain is now not an experiment. Quite, it’s the new regular.

Authorized warning and institutional readability tempers the hype

However the ensuing pleasure was tempered by authorized warning. Invoice Morgan, an Australian lawyer and outstanding XRP supporter, was one of many first to query Stein's feedback. He puzzled in the event that they mirrored BlackRock's official place or have been merely Stein's private opinions.

“Very attention-grabbing…however was he talking in a private capability or on behalf of BlackRock?” Morgan posted on X.

What’s at stake? This query resonated deeply. If Stein’s assertion alerts BlackRock’s strategic confidence in tokenized finance, it may very well be one of many clearest indicators but that institutional adoption is imminent.

Personally, this stays a robust however unofficial endorsement of Ripple and the course of blockchain.

On the similar occasion, Nasdaq President and CEO Adena Friedman mentioned the digital asset market is clearly maturing. Nevertheless, she additionally acknowledged that regulatory readability is important for severe institutional participation.

He famous that banks are already experimenting with tokenized bonds and stablecoin frameworks, and burdened that “we want regulatory readability to permit banks to totally take part available in the market.”

Collectively, Stein and Friedman’s feedback painted an image of convergence the place TradFi, blockchain, and regulation work collectively.

Ripple’s “Swell 2025” convention, as soon as an trade occasion primarily for crypto insiders, turned the stage for a few of the most influential voices in international finance to sign preparations for consolidation.

Regardless of these developments, Ripple's value stays depressed because the community's institutional buying and selling expands and XRP's adoption explodes.

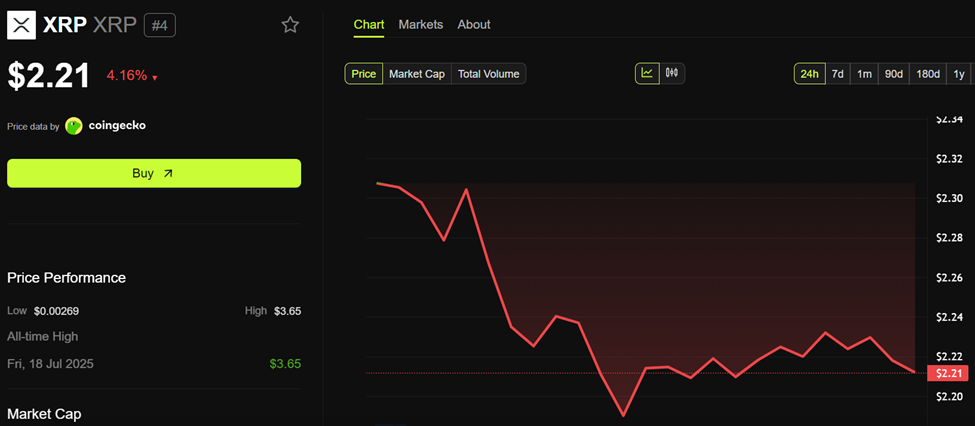

Ripple (XRP) value efficiency. Supply: BeInCrypto

Prior to now 24 hours, XRP value has fallen by greater than 4%. On the time of writing, it was buying and selling at $2.21.

The put up What BlackRock has in retailer for the XRP neighborhood appeared first on BeInCrypto.