Bitcoin ETF continued its successful streak, securing 9 consecutive days of inflows with an extra $90 million, whereas Ether ETF continued its development of outflows on the $6 million exit.

Bitcoin ETF marks 9 consecutive days of inflows, together with $90 million inflows of funds

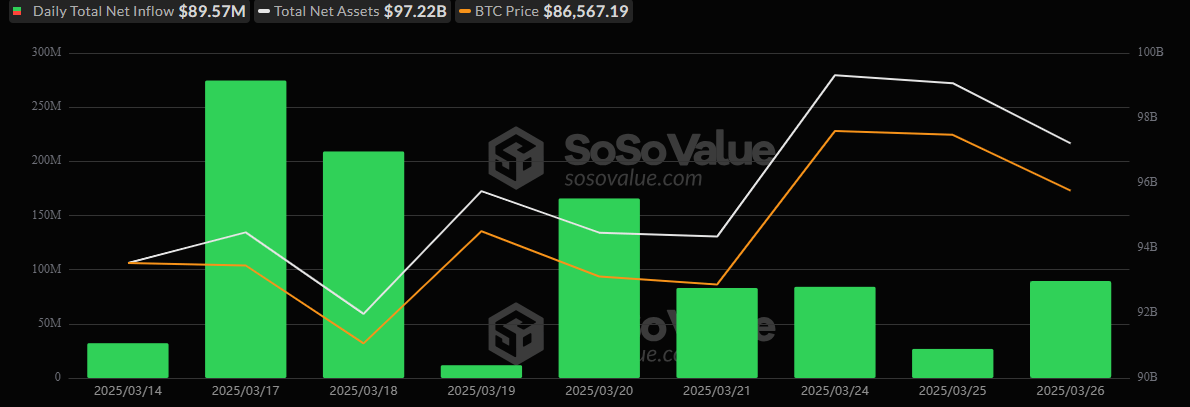

Bitcoin ETF continued its successful streak, securing its ninth day in a row with an extra $89.57 million. BlackRock's Ishares Bitcoin Belief (IBIT) was the only real recipient of the brand new funds, attracting a major $107.89 million.

Nevertheless, Bitwise's BITB noticed an exit of $18.32 million, barely damping the online influx that day. The remaining 10 Bitcoin ETFs had been held stably with no exercise. The full buying and selling quantity of Bitcoin ETFs skyrocketed to $1.87 billion, strengthening robust investor engagement. Nevertheless, the whole internet value of Bitcoin ETFs fell to $97.22 billion, down $1.788 billion from the tip of yesterday.

Supply: SosoValue

In the meantime, Ether ETF struggled as soon as once more, extending the development in spills with a internet lack of $5.89 million. Grayscale's ETH led the recession with a $4.9 million outflow, whereas Constancy's Feth lowered its withdrawal by $996,090. Consequently, the whole internet value of Ether ETFs fell beneath the $7 billion threshold, reaching $6.844 billion.

As Bitcoin ETFs preserve etheric ETFs dealing with constant inflows and sustained outflows, the venting of buyers' sentiment is obvious, and buyers are leaning fully in direction of Bitcoin at the moment.