The BNB chain reached a report excessive of $332.9 billion in everlasting futures buying and selling quantity in June 2025. This determine displays a 70% improve in month-to-month management of the PERP protocol. Aster Dex and different Defi platforms have helped to drive the surge.

This improve marks an necessary milestone for Binance collateral networks, highlighting its elevated benefit in decentralized derivatives.

Associated: BNB Chain Day by day Lively Customers 26.4% to 1.2 million, 58% income bounce

The Defi protocol drives record-on-chain volumes

On-chain analyst Eljaboom shared X's information. He thought he grew up primarily into Aster Dex. In keeping with Eljaboom, decentralized exchanges helped improve the PARP dominance of the BNB chain by 70% via sustained person exercise and progressive options.

Nevertheless, Binance co-founder Changpeng Zhao additionally confirmed weight and acknowledged that a number of platforms contributed to efficiency.

Within the reply, CZ named 4 folks within the development of the ecosystem, Cake and Alpha, Lista and Venus key gamers. He emphasised that the rising PARP quantity was attributable to collective efforts throughout a number of protocols.

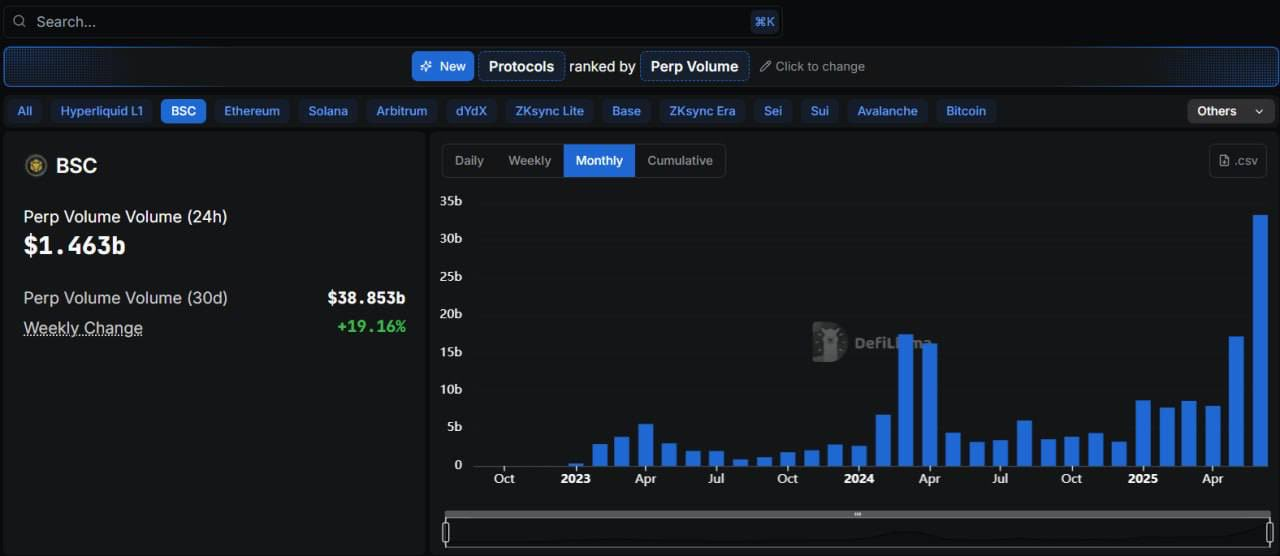

The screenshots shared within the tweet present Defillama's information. The BNB chain's 30-day PARP quantity is listed as $38.85 billion, with each day quantity of $1.463 billion, with weekly development charges exceeding 19%. The month-to-month bar charts present a transparent upward development, with June 2025 considerably surpassing all the previous few months.

Futures exercise is strengthened all through exchanges

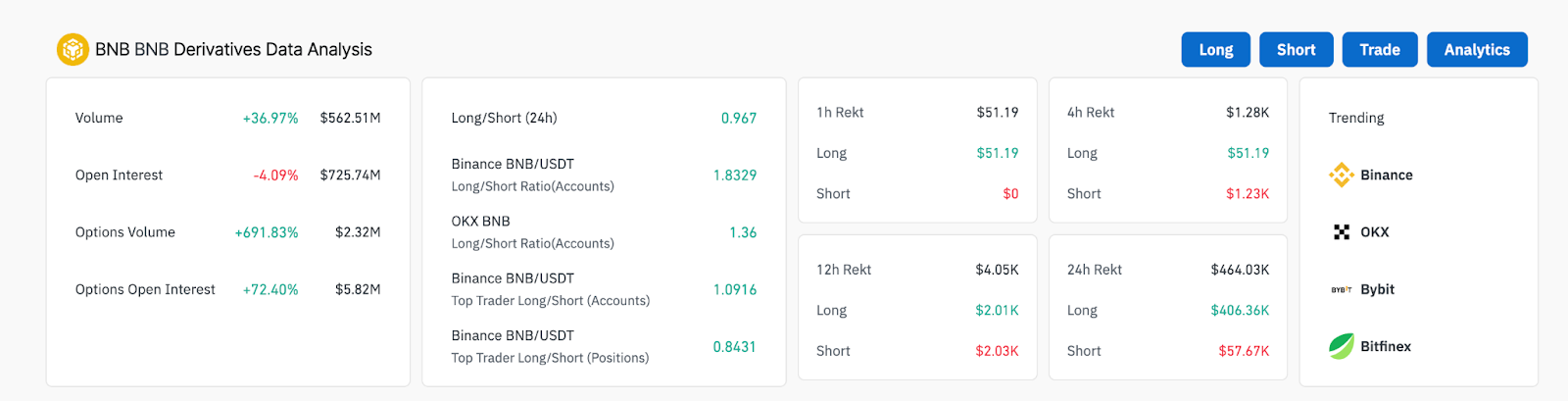

Intensive exchanges noticed a major improve in BNB spinoff buying and selling exercise. BNB's 24-hour spinoff quantity rose to $564.44 million, up 41.65% from the day gone by, in response to Coinglass information.

Nevertheless, open curiosity fell 3.11% to $7257 million, suggesting that some merchants will withdraw positions or safe income throughout risky market actions.

The quantity of BNB possibility contracts additionally jumped sharply. The quantity of choices elevated by greater than 691% to $2.32 million, whereas the amount of choices elevated by 75.69% to $5.82 million. These figures point out an growing demand for different hedging instruments and speculative measures.

Binance maintains market management

Binance led all exchanges when it comes to futures efficiency. It posted the very best BNB futures quantity for $366.06 million and earned the most important open curiosity at $415 million. Binance additionally outperformed its rivals resembling OKX and Bybit, recording 707,000 BNB futures buying and selling in 24 hours.

Binance and OKX person accounts have been primarily lengthy and had a protracted/brief ratio of over 1.3, however sentiment was extra cautious amongst high merchants. Binance's high dealer place ratio is 0.84, indicating that it leaps in direction of a brief place.

Associated: Solana and BNB are placing stress on a market that solely has one thing to do with Bitcoin

On the time of urgent, the BNB worth was buying and selling at $640, down 1.8% over the previous day and elevated month-to-month losses to six.1%.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version is just not responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.