Bitcoin costs at the moment are buying and selling practically $101,200 after a unstable weekend session during which patrons defend a significant liquidity pocket of over $100,000. With the choice expiration date approaching June twenty seventh, worth motion displays tightening of situations as bulls and bears collide close to main know-how zones.

The broader construction stays within the vary on the larger time-frame, whereas the decrease time-frame reveals that it weakens the indicators of bullish momentum and elevated volatility.

What is going to occur to Bitcoin costs?

BTC worth forecast (Supply: TradingView)

As of June 23, 2025, Bitcoin costs are underneath strain following a denial from the $105,200 zone. This suits each trendline resistance and former order blocks. Costs are simply above $101,000 after sweeping out the important thing help cluster on June 21, with sellers remaining underneath $103,000.

BTC worth forecast (Supply: TradingView)

The latest rejection marks a 3rd unsuccessful try this month, exceeding $106,000. On the 12-hour and each day charts, the BTC construction stays impartial to baring, with worth buying and selling under all main EMAs (20/50/100/200). This alignment varieties a bearish cluster that implies that sellers proceed to manage short-term tendencies.

The present Bitcoin worth motion coincides with the large sell-side liquidity seen at round $105,000-$106,000. If the worth can not retrieve this zone previous to the June twenty seventh possibility's expiration date, we can not rule out extra draw back strain on a help base of between $98,000 and $100,000.

Bitcoin worth motion faces rejection with essential resistance

BTC worth forecast (Supply: TradingView)

The four-hour chart reveals a transparent downward development since its peak in mid-June. Bitcoin constantly prints low highs, with costs trapped underneath a drop development line that has been examined a number of instances with out checking breakouts.

A collection of order blocks between $104,200 and $106,400 function a robust overhead resistance. The newest try to interrupt by way of this zone failed, with a pointy core refusal again to $101,000.

Moreover, the Bollinger bands on this time-frame slender down the enlargement following enlargement, a typical precursor to robust directional actions. Value refusals within the higher band on June 21 counsel that sellers are actively defending the rally.

Momentum indicators present bearish strain first

BTC worth forecast (Supply: TradingView)

On the 2-hour and 30-minute chart, momentum indicators proceed to help the bear. The RSI is damaged under 40, remaining within the weak zone, with the MACD histograms for each time frames turning purple, indicating bullish loss. The hidden bearish divergence of RSI may be noticed when evaluating its latest swing excessive of practically $104,000 with earlier peaks.

BTC worth forecast (Supply: TradingView)

The 4-hour tremendous development stays in bearish mode, with resistance pinned at $105,207. The DMI indicator on the 4-hour chart highlights the dominant -DI depth at +DI at 33.18 vs. 15.21 at 15.21, with ADX rising to 25, suggesting a rise in directional bearish momentum.

These alerts are per short-term merchants' issues about future choices expiration dates.

Trade stream and non-compulsory information test for bearish bias

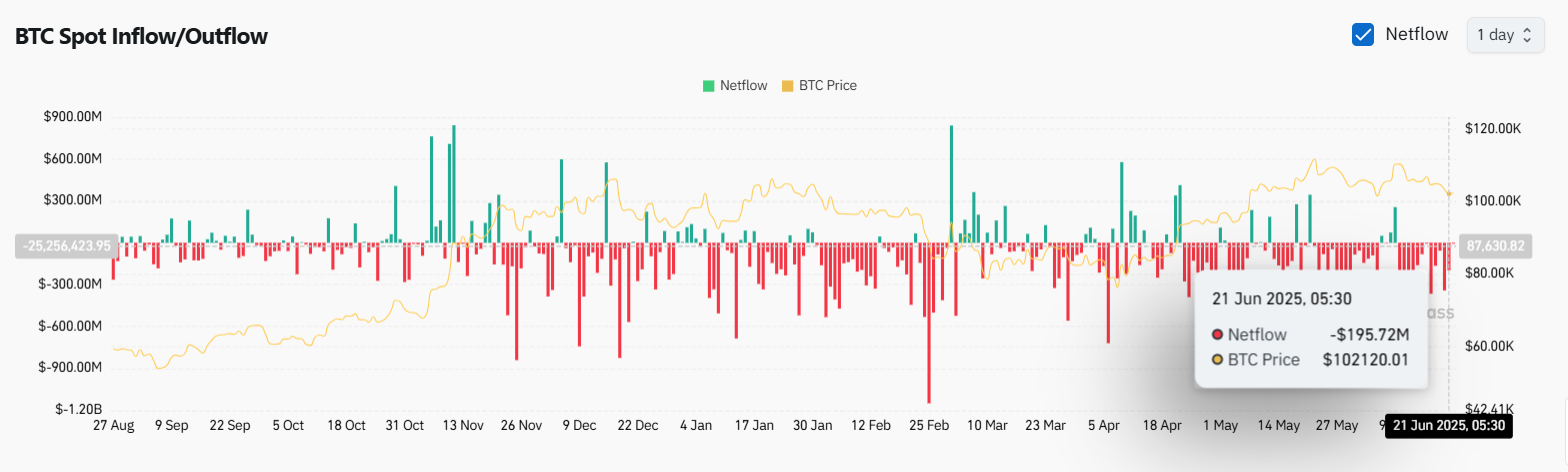

BTC Web Influx/Outflow (Supply: Coinglass)

On June 21, a internet Bitcoin worth leak was recorded in extra of $19,572 million, with BTC priced at round $101,200 on the time, in accordance with on-chain trade information. This unfavourable Netflow displays risk-off sentiment as it’s prone to shift forward of the anticipated volatility on the June twenty seventh possibility expiration date.

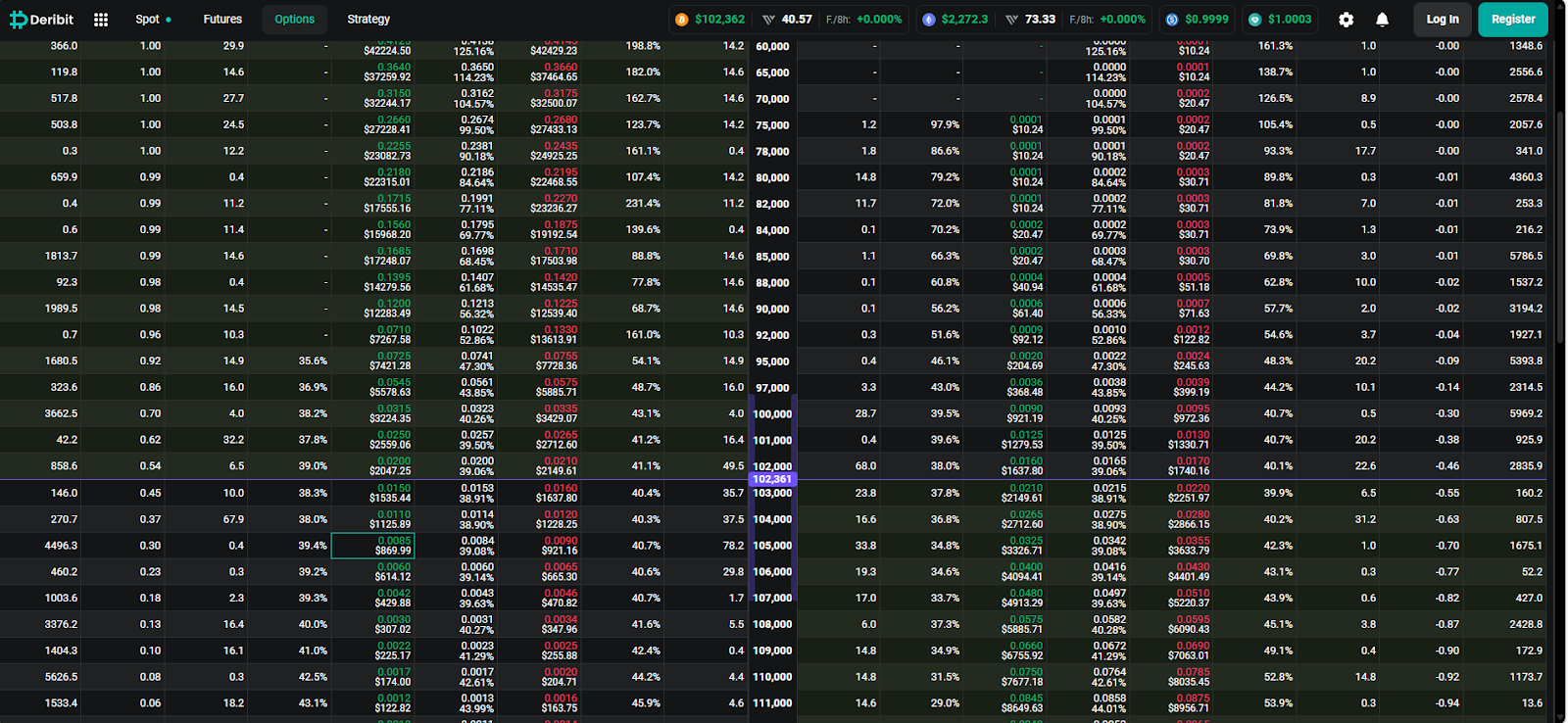

BTC possibility chain information (supply: DELIBIT)

From a derivatives perspective, Open Curiosity stays closely skewed in the direction of Places on a $100,000 strike, giving robust market forecasts for additional downsides until BTC can shortly get better its $105,000 zone. This provides strain to the bull to arrange a significant bounce early within the week.

Why is Bitcoin worth dropping at the moment?

BTC worth forecast (Supply: TradingView)

Bitcoin costs at the moment are declining because of a number of compounding elements. First, the technical resistance between $104,200 and $106,000 stays stable. Second, key momentum indicators comparable to RSI and MACD modified bearish over a number of time frames. Third, the June twenty seventh possibility Expiry will introduce latest volatility and promote the place of threat aversion.

Lastly, bearish domination over the stream of DMI indicators and unfavourable spot exchanges provides weight to potential short-term pullbacks.

Till BTC is ready to help $105,200, the rescue return may very well be met with new gross sales strain.

Brief-term outlook and technical forecasts

BTC have to be decisively broken past $105,200 and disable the bearish setup past trendline resistance. In any other case, the unfavourable facet objective will stay at $100,000 and $98,400 play. A breakdown under $98,000 may open the door to retesting demand zones between $95,700 and $96,300. If a breakout happens, the upward targets stay at $106,400 and $108,000.

Disclaimer: The data contained on this article is for info and academic functions solely. This text doesn’t represent any type of monetary recommendation or recommendation. Coin Version shouldn’t be chargeable for any losses that come up because of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.