The current decline in Bitcoin has led to an essential technical fork. There, after a multi-week break from the Rising Channel, we check out key help ranges.

Though the short-term momentum seems to be weak, long-term chain metrics could also be key to understanding whether or not this repair has a extra draw back or whether or not patrons will return quickly.

Technical Evaluation

By Edris Dalakshi

Day by day Charts

On the every day charts, BTC formally destroyed its 200-day transferring common. That is across the $88,000 mark, a key technical component that always defines tendencies. This violation comes after weeks of side-to-down worth motion, with a number of rejections constituted of the $88,000-$92,000 resistance zone.

The asset is at present hovering from round $70,000 to $78,000 within the $77,000-$78,000 vary simply above the robust demand zone of practically $74,000. The RSI additionally immerses close to oversold areas, suggesting bearish momentum in addition to potential fatigue. If $74,000 isn’t held, the following essential help is round $68,000, however a restoration above $80k might open one other $84,000 check, and finally a 200 DMA door.

4-hour chart

The 4H timeframe attracts a clearer image of current failures. After weeks of integration inside the rising channel, the BTC was firmly damaged down on the draw back, inflicting a wave of liquidation and concern.

Costs briefly fell to a low $74,000 drop of $74,000, retesting resistance ranges of $80,000. That rejection has resulted in low highs and enhanced short-term bear management. Moreover, whereas RSI is starting to get better from extremely bought territory, the construction nonetheless helps sellers, except BTC can help and re-claim zones between $80,000 and $82,000 and $84,000.

On-Chain Evaluation

By Edris Dalakshi

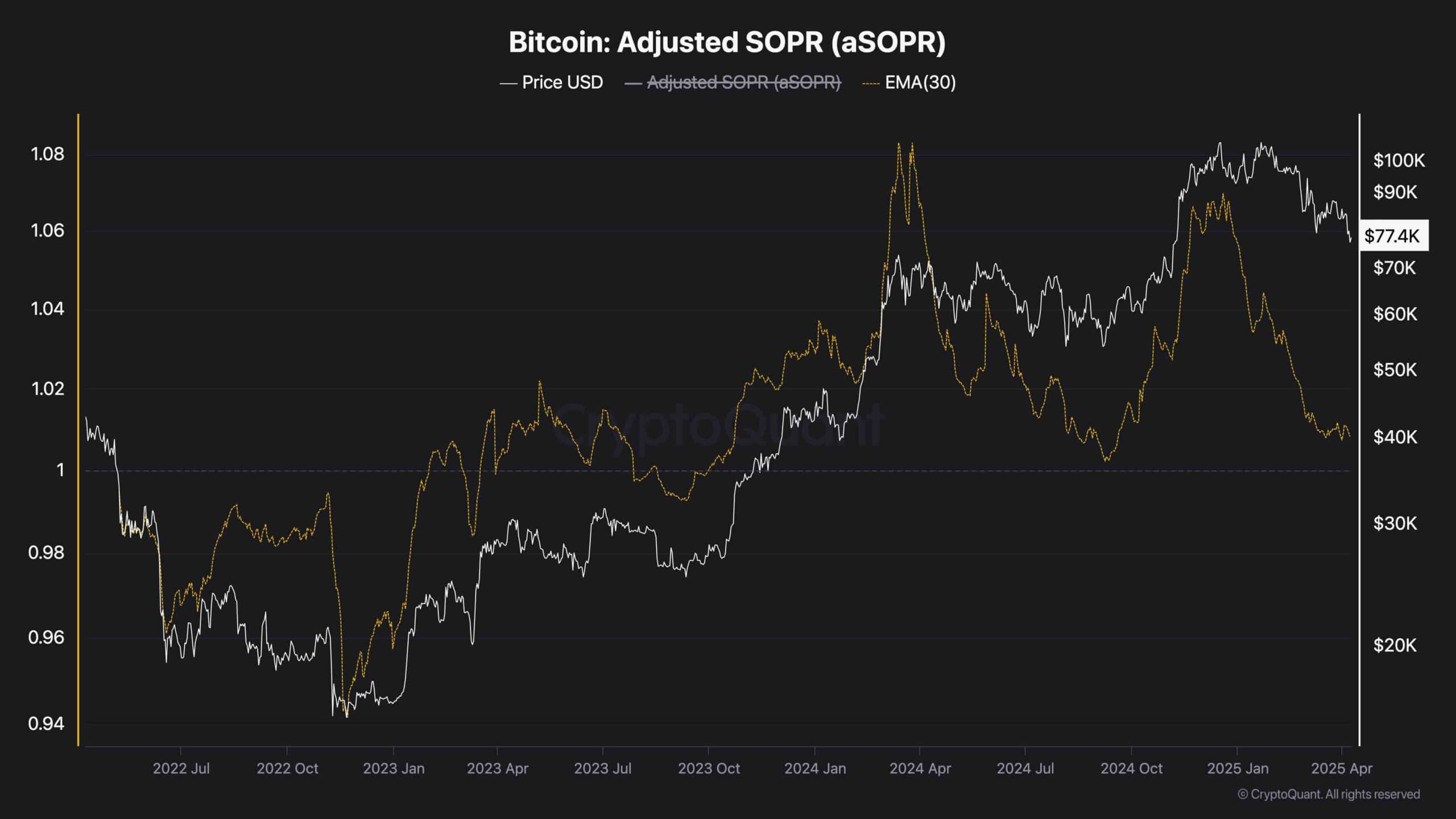

Adjusted SOP (ASOPR-EMA 30)

The adjusted SOPR is barely above the impartial threshold of round 1.1, indicating on common that the holders are nonetheless promoting BTC on income. Nevertheless, the downward development of ASOPR is notable, suggesting that total community profitability is shrinking. This development continues, and as ASOPR approaches or soaks beneath 1, it could possibly replicate rising give up and short-term bearish emotions.

Nevertheless, for now, the market isn’t within the realm of full loss realization, so there may be extra room for draw back strain earlier than potential backside situations. Buyers want to watch how rapidly and regular ASOPR is. Holding it above could help fast rebounds, however drops beneath it might present wider risk-off habits.