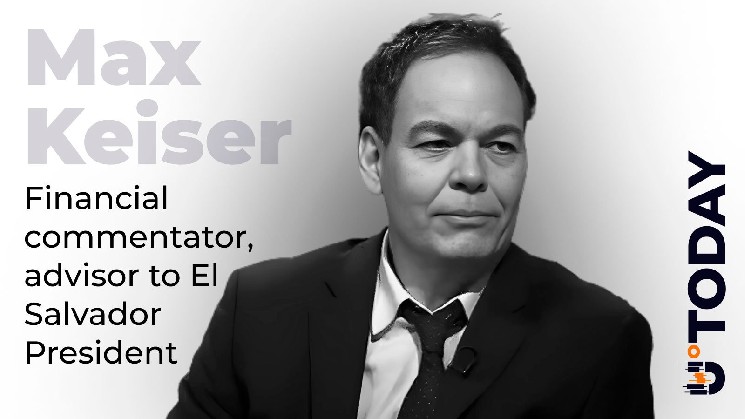

Outstanding Bitcoin evangelist Max Kaiser branded the present market decline as simply the final breath of an extended distribution section, on the identical day that Bloomberg's screens confirmed what the market had all however given up on seeing this month: a uncommon session of web inflows into the Bitcoin ETF advanced, pushing the group to a optimistic day whilst BlackRock's IBIT, the heaviest product within the lineup, additionally closed within the crimson.

The distinction between the bleeding market and the inexperienced ETF column was precisely on show when Bitcoin's weekly chart hit a zone that merchants have been monitoring because the starting of the primary quarter. Bitcoin has now retreated about 32% from its peak of $129,000, touchdown within the mid-price vary between $86,000 and $80,600.

ETF numbers again this up with numbers, not tales. Regardless of shedding greater than $4.3 billion for the complete month, the cryptocurrency funding market recorded a one-day acquire of $238 million. This implies that some traders with actual cash are shopping for the latest dip within the inventory worth fairly than ready for it to fall.

Distribution has ended.

Accumulation begins.

New excessive for BTC in 2025. https://t.co/f0FJgTzonO— Max Keiser (@maxkeiser) November 23, 2025

That is in keeping with Kaiser's assertion that the market has moved in the direction of accumulation, whether or not retail traders prefer it or not.

Featured Bitcoin worth

The chart provides one other layer of context, as under $80,600 lies the ultimate main structural degree at $74,110. That is, coincidentally or not, the common buy worth of Michael Saylor Technique, which at the moment holds 649,870 BTC price $55.96 billion.

If this zone stays untouched on candlesticks over the following few weeks, Bitcoin will preserve a potential path in the direction of its former resistance hall close to $112,000, in addition to a pocket of $120,000-$125,000 that must be recovered earlier than discussions relating to a 2025 all-time excessive get severe.