Gold Rallies, Merchants Eye The Terter Correstion, BTC costs slip

Bitcoin (BTC) costs misplaced bullish momentum this week, down 7% from $88,060 on March 26 to $82,036 by March twenty ninth.

The transfer worn out $158 million in a protracted liquidation, highlighting vulnerabilities within the spot and derivatives market.

In the meantime, Gold surged to a report $3,087 on March 28, including strain to Bitcoin's “digital gold” story.

The decoupling between Bitcoin and conventional hedges has sparked concern amongst market individuals.

BTC/USD 1-day worth chart. Supply: TradingView

Dealer and researcher Korsh Ak mentioned Bitcoin fashioned one other decrease excessive (sixth in 2025) that described the latest rally as “lifeless cat bouncing.”

He mentioned Bitcoin has didn’t exceed $90,000 for 5 consecutive days. He posted on March twenty eighth.

“After attempting 5 days in a row this week, the value didn't attain $90,000.”

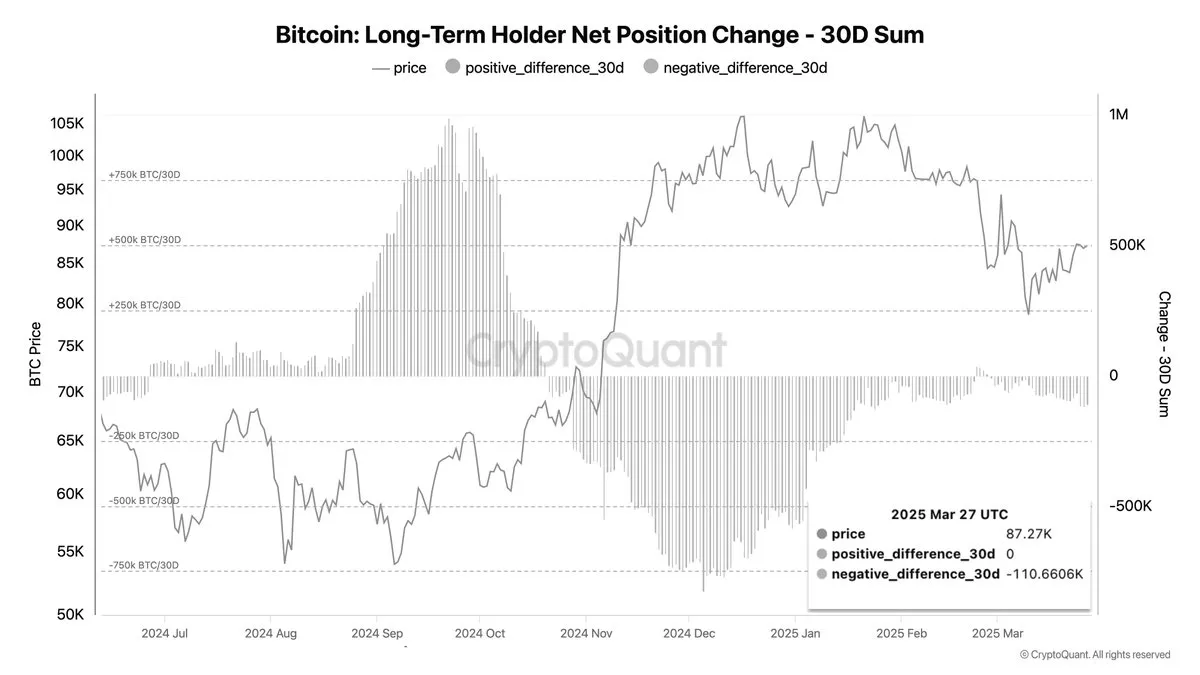

As influxes run out, long-term holders stay on the sidelines

On-chain metrics help bearish tones. Knowledge from encryption signifies that long-term holders have suspended accumulation since November 2024.

Market analyst Ali flagged this on March 30, warning that revitalization of those wallets may point out a change out there course.

Lengthy-term Bitcoin holder. Supply: Ali Martinez/X

In line with Ali

“Lengthy-term #bitcoin $btc holders have been suspended since November 2024. Their return may point out a serious development change.”

On the identical time, change inflows have been declining, suggesting a lower in investor participation. Ali mentioned decrease inflows often preceded the bigger worth motion, however didn’t predict the course.

Analysts spotlight bearish targets as macro outlooks deteriorate At BTC worth

Altcoin Sherpa described the present construction of the weekly chart as a confirmed bear market. Relying on how macroeconomic situations evolve, costs may drop to the $50,000-60,000 zone.

Supply: AltCoin Sherpa/X

The analysts up to date March twenty ninth.

“We see the chop period, but it surely's nonetheless a bearish development.”

Supply: Cryptocapo/X

Crypto Capo outlines an analogous outlook, saying that BTC costs are vulnerable to falling to $62,000.

In his view, if it falls beneath the $84,000 to $85,000 vary, it may result in give up in direction of help ranges in April and November 2024.

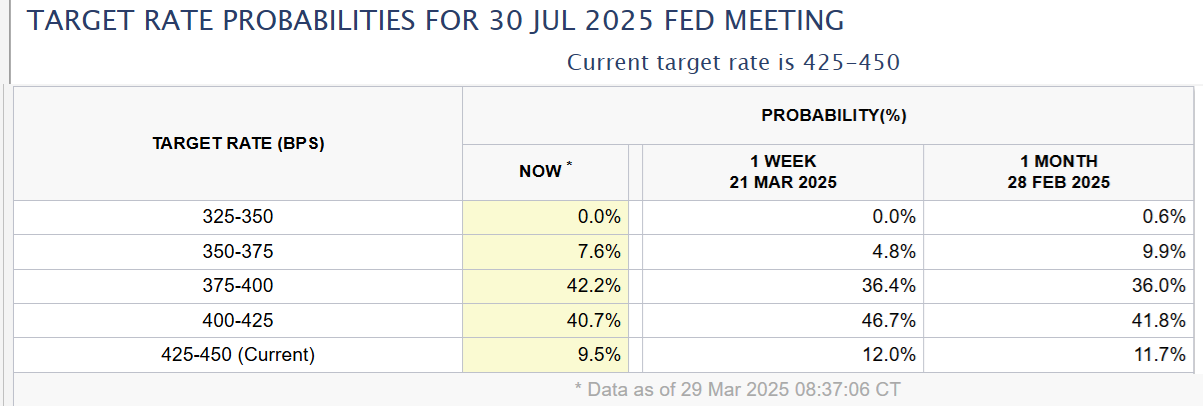

ETF spills, inflation knowledge compound gross sales strain

On March 28, Bitcoin Spot Trade-Traded Funds (ETF) recorded $93 million in internet spills.

The timing coincided with rising worry of the US Federal Reserve and lowered delay charges.

Federal Reserve implicit charges on July thirtieth. Supply: CME FedWatch

The CME FedWatch software has a 50% probability of lower than 4% by July thirtieth, down from 46% a month in the past.

Whereas mitigation will help with asset danger, latest ETF flows recommend that enormous gamers are cautious.

The US Greenback Index (DXY) fell to 104 from 107.4 a month in the past. Nonetheless, Bitcoin didn’t capitalize, not like the historic sample through which the weaker greenback boosts the code.

I hope that fluidity will emerge, however the bull might be quiet

X's market commentator Mihaimihale mentioned the US authorities may introduce tax cuts and low rates of interest to offset the slowdown.

Nevertheless, he added that final yr's enlargement was pushed primarily by authorities spending.

Supply: Mihaimhale | x

He posted,

“As we kickstart the financial system, we’d like actual liquidity, not coverage optics.”

Nonetheless, some see room for restoration when central banks shift their insurance policies. Alexandre Vasarhelyi, founding associate of B2V Crypto, mentioned Bitcoin stays within the adoption section and volatility displays early stage progress. He mentioned,

“There's little or no drawback with Bitcoin flooring being $77,000 or $65,000… 2025 remains to be the muse yr and never a turning level.”

Bitcoin costs, coupled with inactive long-term holders and rising macro strain, will fail to push past $90,000, growing the probability of breakdowns.

Merchants are aiming for $62K as their subsequent main help, however up to date purchases from long-term holders or central financial institution dovish may change that outlook.