Swiss francs and gold have turn into a part of one of the best protected stock property as inventory and bond market turmoil continues.

The USD/CHF alternate charge fell to 0.8100 on Friday, 12% beneath its 2024 excessive. This efficiency has made the Swiss franc the most effective performing currencies this yr.

The Swiss Franc's efficiency was that of the US greenback, which fell to its 2018 low. Its efficiency is essentially as a consequence of Swiss neutrality and financial institution secret legal guidelines, and has at all times been a shelter.

The Swiss Nationwide Financial institution (SNB) is a number one investor within the US market and holds appreciable positions in lots of American corporations, together with widespread names comparable to Apple, Microsoft, Amazon, and Alphabet. He’s additionally the tenth largest proprietor of the US Treasury Division.

Gold has additionally turn into a high heaven, with its worth rising to a file excessive of $3,240. This yr alone, there was a 24% improve from the pandemic low of 125%, and 24%. In distinction, the S&P 500 and Nasdaq 100 indexes are retreating in two digits.

You may prefer it too: This Week's Chart: Purchase Now or Wait? Excessive lipids, curved dao, fartcoin are the most well liked picks

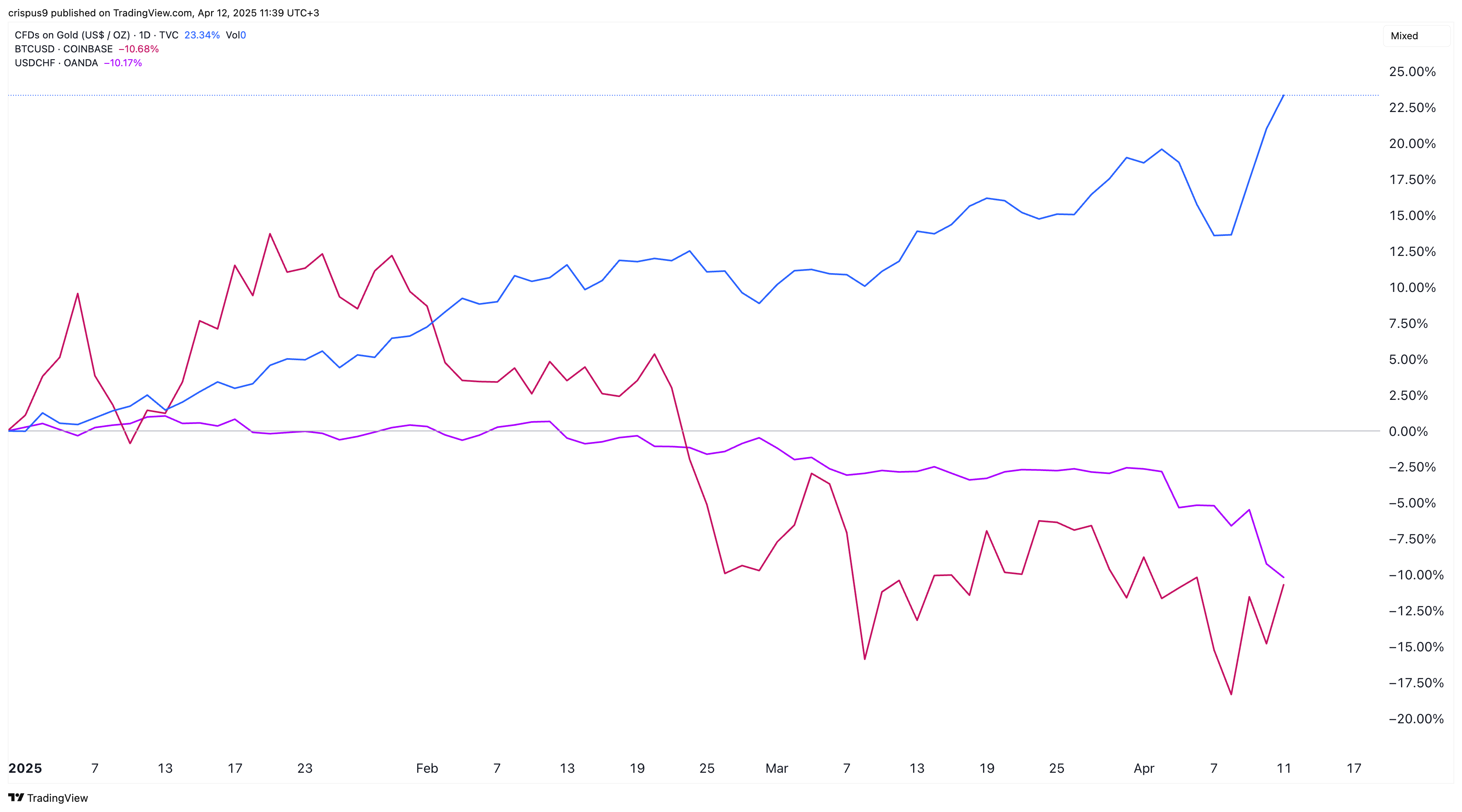

Gold and Swiss franc outweigh Bitcoin

Gold and the Swiss franc have defeated Bitcoin (BTC) protected shelters because the commerce warfare escalated. Bitcoin, usually thought of a digital model of gold, has slid from its annual excessive of $109,300 to $83,000.

Gold vs USD/CHF vs Bitcoin | Charts by TradingView

Bitcoin is usually thought of a shelter as a consequence of rising demand from Wall Road buyers, because it has a restricted provide of 21 million cash.

They’ve additionally completed higher than US bonds which have been beneath stress over the previous few weeks. On Friday, the benchmark 10-year yield rose to 4.50%, whereas the 30- and 2-year yields rose to 4.85% and three.97%, respectively.

World dangers proceed to rise this week, and analysts predict {that a} recession will happen this yr. Polymarket Information has positioned a 60% probability of a recession this yr, however BlackRock's Larry Fink believes the US is already one.

Moody's chief economist Mark Zandy has raised the chances of the recession to 60%, citing heavy tariffs between the US and China. He additionally famous the ten% US primary tariff on all imports and the 25% assortment on metal, aluminum and autos.

Equally, economists at corporations comparable to Morgan Stanley, BNP Paribas and UBS have warned that US GDP will fall this yr and unemployment will rise to five%.

You may prefer it too: Rebound, Bitcoin cheats for $84,000 as commerce considerations ease