At 8:45am within the jap half, Bitcoin hovered at $113,366 per coin, backed by a market capitalization of $2.25 trillion and a 24-hour buying and selling quantity of $44,9494 billion. Intraday worth ranges between $110,822 and $113,484, recording a day of measured integration inside a bigger bull restoration.

Bitcoin

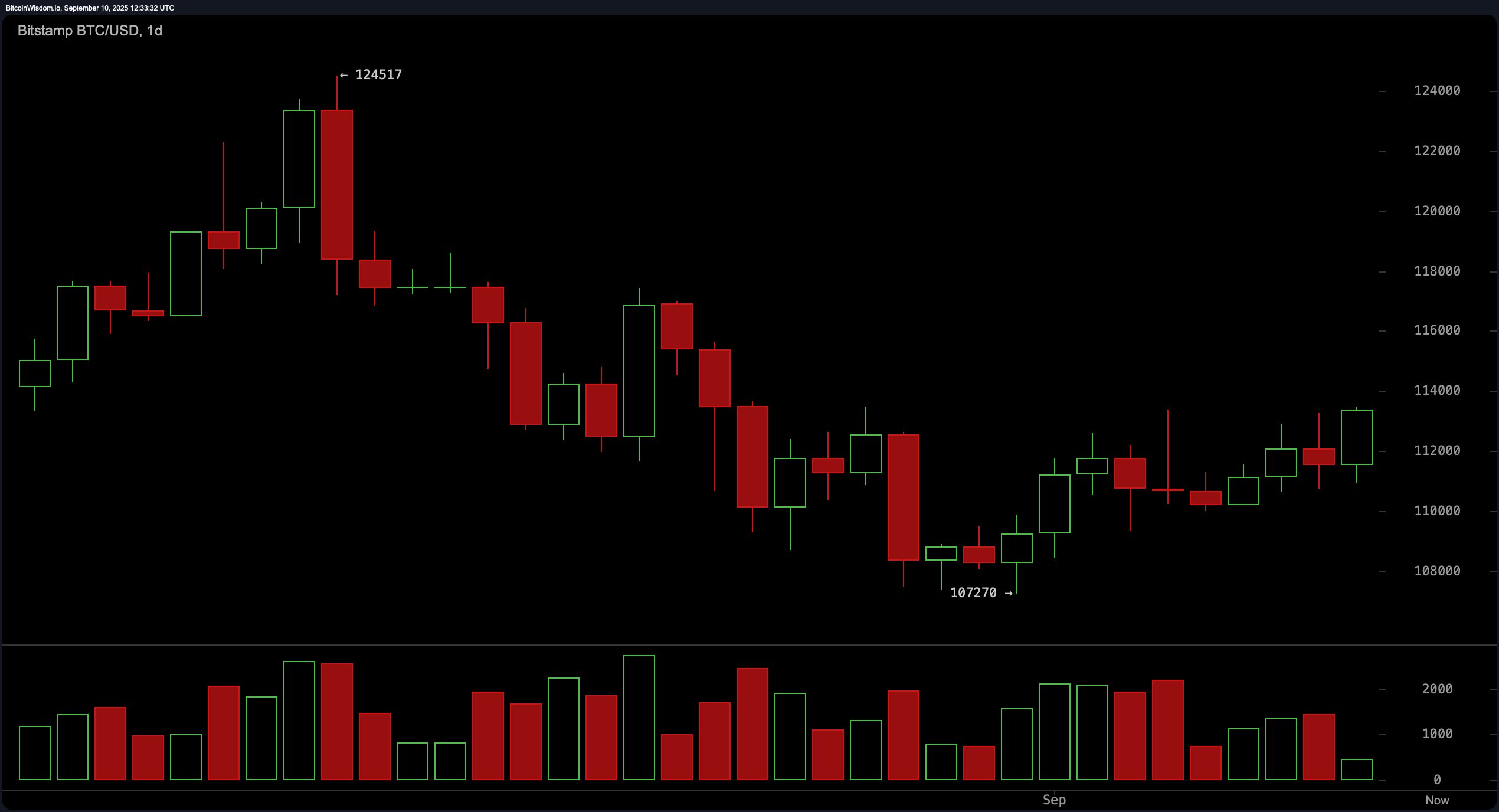

Brief-term momentum appears to be like cautiously optimistic as Bitcoin begins to recuperate from its current drawdown. Bitcoin's day by day chart-wide worth motion revealed a decline from the $124,517 area to a neighborhood backside of almost $107,270, adopted by a modest bullish reversal. The sample of fallen wedges and the wrapping of candles wrapped across the base counsel that there could also be structural help for this rebound. Main resistance is noticed within the vary of $113,500 to $114,000, whereas rapid help is near $107,000. A pullback to the $110,000-$111,000 zone might present a tactical entry level, particularly when accompanied by a lower in quantity, indicating a possible setup for retrying at increased ranges of resistance.

BTC/USD through BitStamp 1-Day Chart on September tenth, 2025.

On the 4-hour chart, Bitcoin reveals indicators of stabilization and accumulation. The double backside and $110,000, that are near $109,500, mark a technical base, adopted by a clear breakout through a downward worth construction. Quantity evaluation reveals that bullish makes an attempt have been supported by wholesome calls for, enhancing the validity of breakouts. Costs are at the moment within the profitable entry zone, starting from $111,800 to $112,200. Nevertheless, until volumes spike to see upward continuation, the $113,500 to $114,000 stage stays a big cap.

BTC/USD through BitStamp 4-Hour chart on September 10, 2025.

The 1-hour Bitcoin chart refers back to the integration part following the minor rally. Bitcoin just lately climbed from a dip of almost $110,768 and was decisively destroyed over $112,000, creating a better, decrease construction. This can be a frequent precursor of the continuation sample. Since then, worth motion has moved to round $112,500, suggesting that merchants are ready for a catalyst. Breakout merchants might contemplate entries above $112,600 when accompanied by quantity spikes, however conservative positioning might help accumulation of almost $111,800 with shut threat management. Revenue acquisition ought to be thought-about because the $113,700, which beforehand appeared by sellers, and as a lot as $114,000.

BTC/USD through BitStamp 1-Hour Chart on September tenth, 2025.

From an indicator perspective, the oscillator stays largely impartial. The relative energy index (RSI) is 50, the stochastic oscillator reads 76, and the commodity channel index (CCI) registers at 35. The imply directional index (ADX) is 14, confirming that there isn’t a sturdy tendency. Nevertheless, the kinetic oscillator reveals a studying of 4,128, with a transferring common convergence divergence (MACD) of -879, each implying a flashed bull sign and potential rise.

The transferring common breakdown displays the market within the midst of a transition. The short-term common provides stable indicators, together with a 10-day exponential transferring common (EMA) of 111,384 and a 20-day EMA of 111,890. Nevertheless, medium-term averages, such because the bear sign of the 30- and 50-day transferring common flash, counsel that resistance is overhead. Lengthy-term indicators together with easy, exponential transferring averages for 100 and 200 days all present a broader bullish construction, highlighting steady restoration.

As Bitcoin integrates underneath resistance, quantity turns into an essential variable that determines whether or not the market will face a better rejection or a rejection. Merchants are inspired to look at fastidiously the areas between $113,500 and $114,000. If Bitcoin can't stab this stage with confidence, the reversal might proceed. Conversely, the confirmed breakouts above might pave the way in which for retesting earlier highs from $114,500 to over $115,000, dominating bullish momentum.

Bull Verdict:

Bitcoin stays within the bullish restoration part following its current backside, supported by favorable short- and long-term transferring averages, constructive chart patterns, and optimistic momentum indicators. When you see breakouts which have a quantity above the $113,000-$113,500 resistance vary, the trail to retesting the $114,000 stage and probably excessive ranges stays open.

Bear Verdict:

Regardless of Bitcoin's restoration, the key resistance between $113,500 and $114,000 has but to be breached with a compelling quantity. The oscillator stays impartial, with the midrange transferring common persevering with the flash gross sales sign. If it doesn't rise, it could possibly be denied and exposes Bitcoin to a retreat in the direction of a help zone of between $110,000 and $107,000.