Ethereum has regained power in latest classes, bounced again key help ranges and demonstrated resilience throughout technical and chain metrics. After a pointy protection of almost $3,820, the consumers rapidly established a sturdy base. With this restoration, ETH is positioned to problem a brand new zone of resistance, however trade actions recommend a better confidence amongst long-term holders.

The technical construction will strengthen roughly $4,300

On the four-hour chart, Ethereum regained a $4,182 stage. That is in keeping with the 0.382 Fibonacci retracement. Now, this space serves as speedy help and is vital to take care of momentum.

At the moment, ETH is testing resistance between $4,293 and $4,300 and is working with the 0.5 FIB zone. The decisive breakout opens the go to $4,406, with one other $4,565 on the 0.786 stage.

On the draw back, the help ranges are resting at $4,182 and $4,043. Under these ranges, $3,820 will focus as the principle demand zone.

XRP Key Technical Degree (Supply: TradingView)

The typical motion over the 20, 50, 100, and 200 intervals has been flattened, suggesting that the market is at a possible turning level. Subsequently, a worth motion of round $4,300 might decide the path of Ethereum within the brief time period.

Associated: Ethereum Value Prediction: Analysts Watch $4,359 Ranges as Quick Aperture Threatening Bears

Alternate stream highlights investor conduct

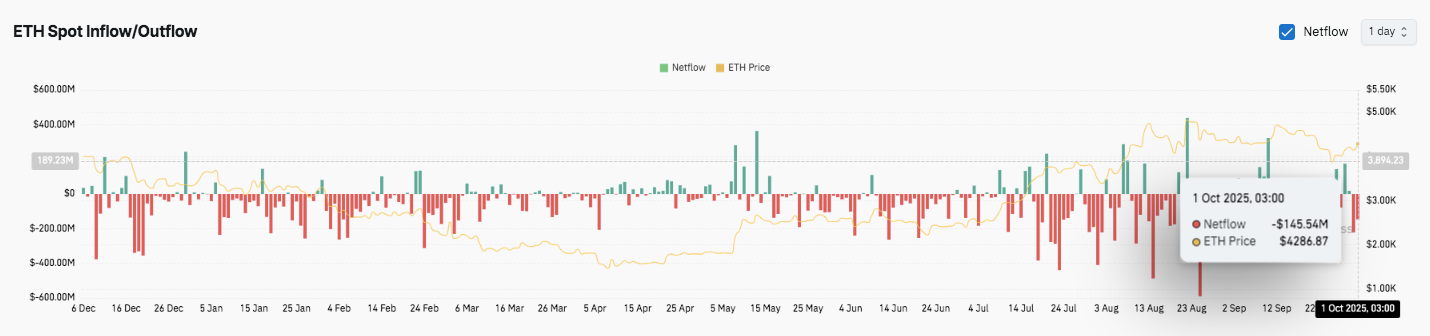

Past chart ranges, on-chain stream affords precious insights. Netflows has remained virtually detrimental over the previous few months, reflecting constant outflows from exchanges. This development means that traders desire to maintain ETH in non-public wallets and staking environments. This often reduces the availability out there for buying and selling.

Importantly, an enormous withdrawal of $145.54 million occurred on October 1, when ETH was traded almost $4,286.87. Such spikes usually scale back gross sales stress and match bullish undertones. There have been occasional influxes, however they’d much less impression in comparison with sustained outflows. In consequence, steadiness continues to tilt in the direction of accumulation.

Technical outlook for Ethereum costs

Quick-term Ethereum worth forecasts stay tied to a number of vital ranges.

- Upside Degree: $4,300, $4,406, $4,565.

- Drawback stage: $4,182, $4,043, $3,820.

- Development Pivot: The 20/50 EMA cluster was round $4,200, and the 200 EMA depth was near $3,900.

The lasting closest factor over $4,300 confirmed bullish continuity, protecting $4,406 and later $4,565. In the meantime, the breakdown beneath $4,182 takes the danger of $4,043, with $3,820 serving as a key demand zone.

Associated: ETH Value Evaluation: Can Ethereum beat $4,500 to focus on $10,000?

Do you push Ethereum excessive?

The path of Ethereum will depend on its potential to carry a band between $4,182 and $4,200. So long as this help cluster stays intact, analysts anticipate one other push to $4,300 and $4,406.

The trade stream provides weight to the bullish case. A sustained outflow suggests a lower in accumulation and gross sales stress, working with traders' belief at greater costs.

Nonetheless, in case you fail to defend $4,182, the momentum might return to the bear, inflicting a drop to $3,820. For now, Ethereum stays at a important intersection, and whereas regaining $4,300 can unlock it much more the wrong way up, dropping help is dangerous for a deeper retracement.

Disclaimer: The data contained on this article is for data and academic functions solely. This text doesn’t represent any sort of monetary recommendation or recommendation. Coin Version just isn’t responsible for any losses that come up on account of your use of the content material, services or products talked about. We encourage readers to take warning earlier than taking any actions associated to the corporate.