Ethereum costs have skilled a horrific crash because the second-largest cipher has misplaced greater than half its worth previously few months.

What's subsequent for ETH?

Technical Evaluation

By Edris Dalakshi

Day by day Charts

The Ethereum Day by day Chart has proven a transparent downward pattern over the previous few weeks, with costs persistently gaining decrease highs and decrease lows. The breakdown of a number of below-principal help ranges, together with the 200-day transferring common (DMA), reveals a shift in market sentiment in the direction of bearishness.

Just lately, ETH has examined a key help zone of beneath the psychological $2,000 degree and round $1,900. If gross sales strain continues, there shall be a further draw back to $1,600.

The RSI additionally hoveres into areas which can be oversold and offered, suggesting the opportunity of short-term bounce. Nonetheless, so long as your ETH is beneath the $2,400 key degree, your restoration may be non permanent. The Bulls might want to revive this degree and the 200-day transferring common to revive, however any additional weak point may result in a deeper correction.

4-hour chart

The 4-hour chart reveals the downward wedge formation. That is often a bullish inversion sample. Costs are presently testing a $1,900 help zone. If the extent is stored, you possibly can attempt to push increased in the direction of the resistance line at $2,000, and even $2,100. Nonetheless, in the event you can't rebound from $1,900, it could result in wedge breakdowns, which might make every little thing even worse.

Then again, a vital breakout on the wedge with a robust quantity might affirm a bullish reversal, however continuation of integration or rejection throughout resistance might point out additional downward strain.

Emotional evaluation

By Edris Dalakshi

Open curiosity

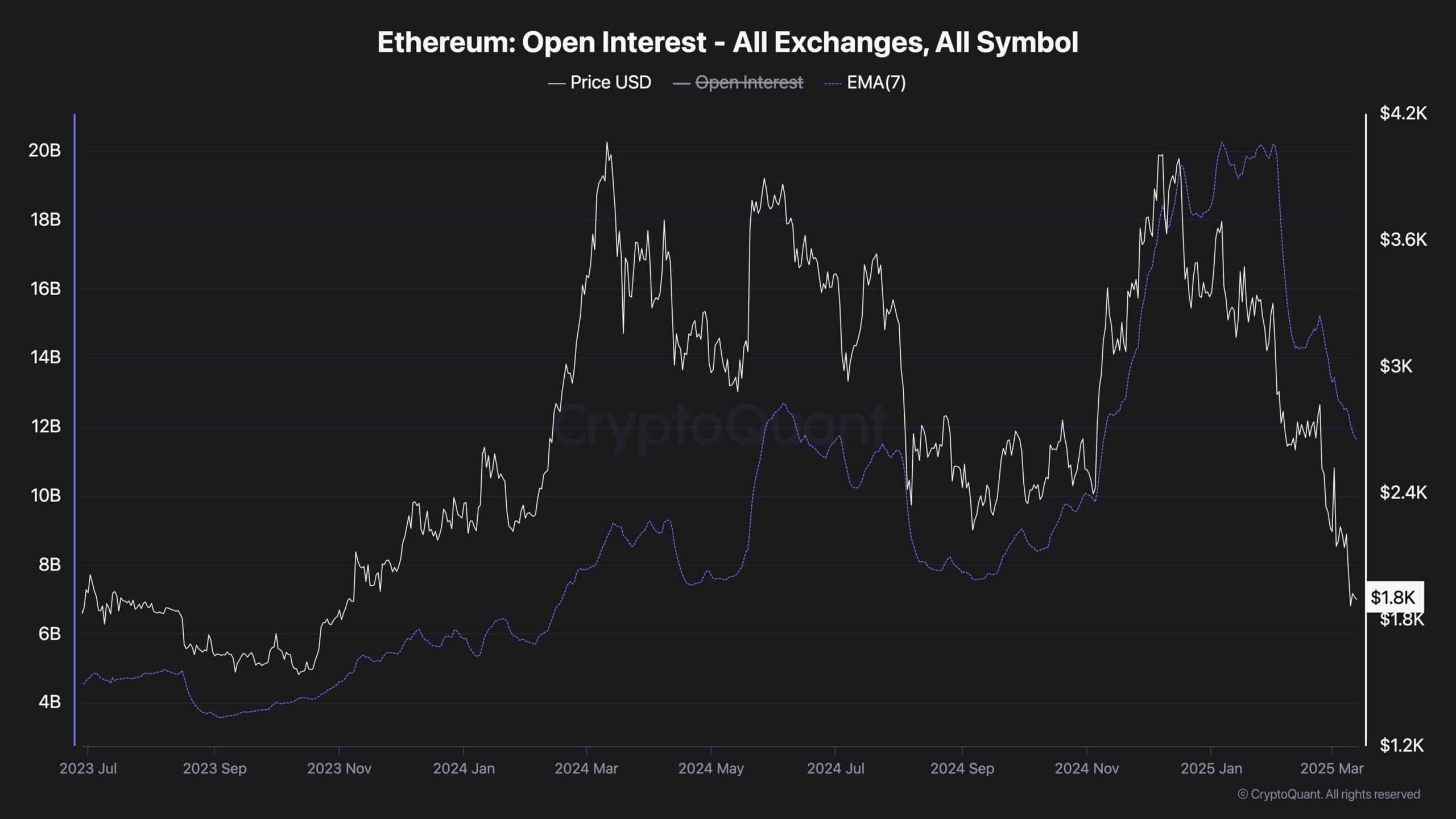

The Ethereum Open Curiosity (OI) chart supplies helpful perception into market positioning and dealer sentiment. It may be noticed that each the value and OI are considerably diminished, suggesting a robust deletion occasion.

Traditionally, it reveals that speedy drops have been settled, adopted by speedy drops in OI. There, the over-converted lengthy positions are washed away, typically resulting in much more downward momentum. Latest OI drops coincided with ETH destroying key help ranges beneath $2,000, dropping to $1,800.

Given this information, ETH could also be in a part of reducing hypothesis as merchants shut their positions amid uncertainty. That is in line with a technical evaluation by which ETH struggles to regain key resistance ranges. Nonetheless, stabilization of the OI signifies that the worst sale has ended and units the situations for a possible aid rally.

Nonetheless, for a sustainable restoration, open curiosity should begin to rise once more with costs. Till then, additional drawbacks are nonetheless potential, particularly if ETH can’t maintain a $1,800 help zone.