Ethereum went above $3,700 on August fifth, exceeding $3,700 as the buildup of whales and establishments intensified. Will I get better greater than $3,800 by the tip of the weekend?

abstract

- Ethereum has surpassed 148% for the reason that begin of the 12 months regardless of latest volatility.

- The brand new whale pockets scooped over $3 billion in two days.

- Macro uncertainty and ETF outflow proceed to extend the momentum of ETH rise.

In response to information from Crypto.Information Ethereum (ETH) , the main market capitalization Altcoin rose 5.7% to $3,730 on Tuesday, August fifth, returning to $3,650 at press. That value is at present over 148% year-on-year.

The latest surge got here weeks after Ethereum tried to surpass the $4,000 mark in late July, however was rejected at almost $3,900 as a result of macro headwinds that plunged into the institutional danger urge for food and the marked decline in whole worth locked throughout its ecosystem.

ETH updates whale accumulation and institutional inflow

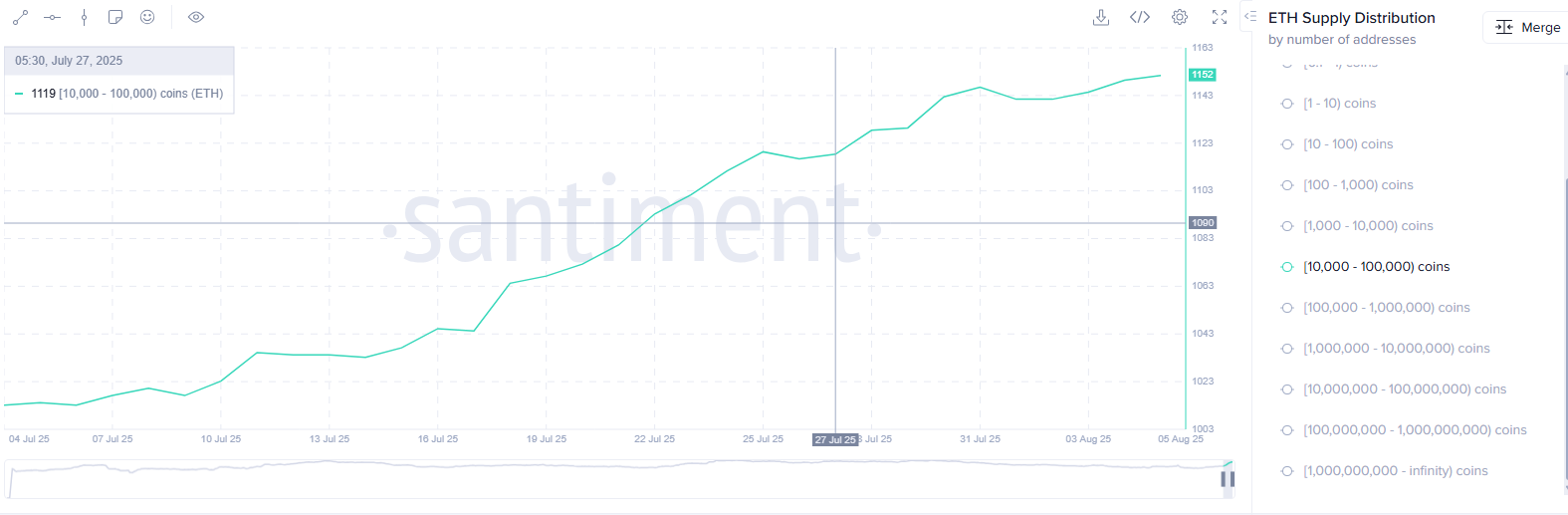

This week's Ethereum rebound seems to be intently linked to new accumulations by whales and huge teams. Knowledge from Santiment reveals that the variety of wallets above 10,000 ETH has grown considerably over the previous few days, indicating that giant holders are positioned for potential advantages.

Supply: Santiment

In the meantime, on August 4th, the 2 newly created addresses acquired round 40,000 ETH, price round $442 million, in accordance with LookonChain information. The shopping for pattern was strengthened on August fifth, when three extra wallets gathered a further 63,837 ETH for about $236 million.

In whole, Lookonchain experiences that 14 recent whale wallets collectively accumulate over 856,000 ETH.

The size of this accumulation, particularly from new wallets, is usually more and more convictions from the rich or institutional actors. These patrons are normally chargeable for long-term positions and accumulate earlier than the anticipated value rise. Their actions are additionally intently monitored by retailers who usually interpret such actions as bullish indicators.

You may prefer it too: ChainLink pronounces information streams for US shares and ETFs

Along with buying whales, institutional curiosity in Ethereum can be gaining momentum. There was a noticeable improve within the Ministry of Finance and structured merchandise, centered round ETH.

One of the notable developments is the expansion of the Strategic Ethereum Reserve (SER), which tracks institutional Ethereum holdings throughout key funds, the Treasury and asset managers.

Simply six weeks in the past, the managed SER whole belongings have been lower than $3 billion. That determine is at present surged above $10.8 billion, with the reserve controlling 2.45% of whole ETH provide from simply 1% in June.

In contributing to this surge, Sharplink, a NASDAQ-listed gaming firm and one of many prime holders in SER, added an ETH of about $66.663 million within the spare on August 4th.

What's subsequent for ETH?

Regardless of a major whale accumulation and renewed institutional purchases, Ethereum nonetheless lacks the momentum wanted to decisively break the $3,800-3,900 resistance zone.

Recent Capital has re-entered the market by new whale wallets and Treasury allocations, however these influxes haven’t but led to a widespread change in market sentiment.

Final week, Ethereum-centric ETFs noticed a complete of $129 million spills. This means that mainstream traders are nonetheless hesitant, and macroeconomic uncertainty continues to weigh dangerous belongings, starting from dangerous commerce conflict danger to considerations in regards to the US labor market.

And not using a clear narrative or short-term catalyst, the present gatherings stay weak to reversal.

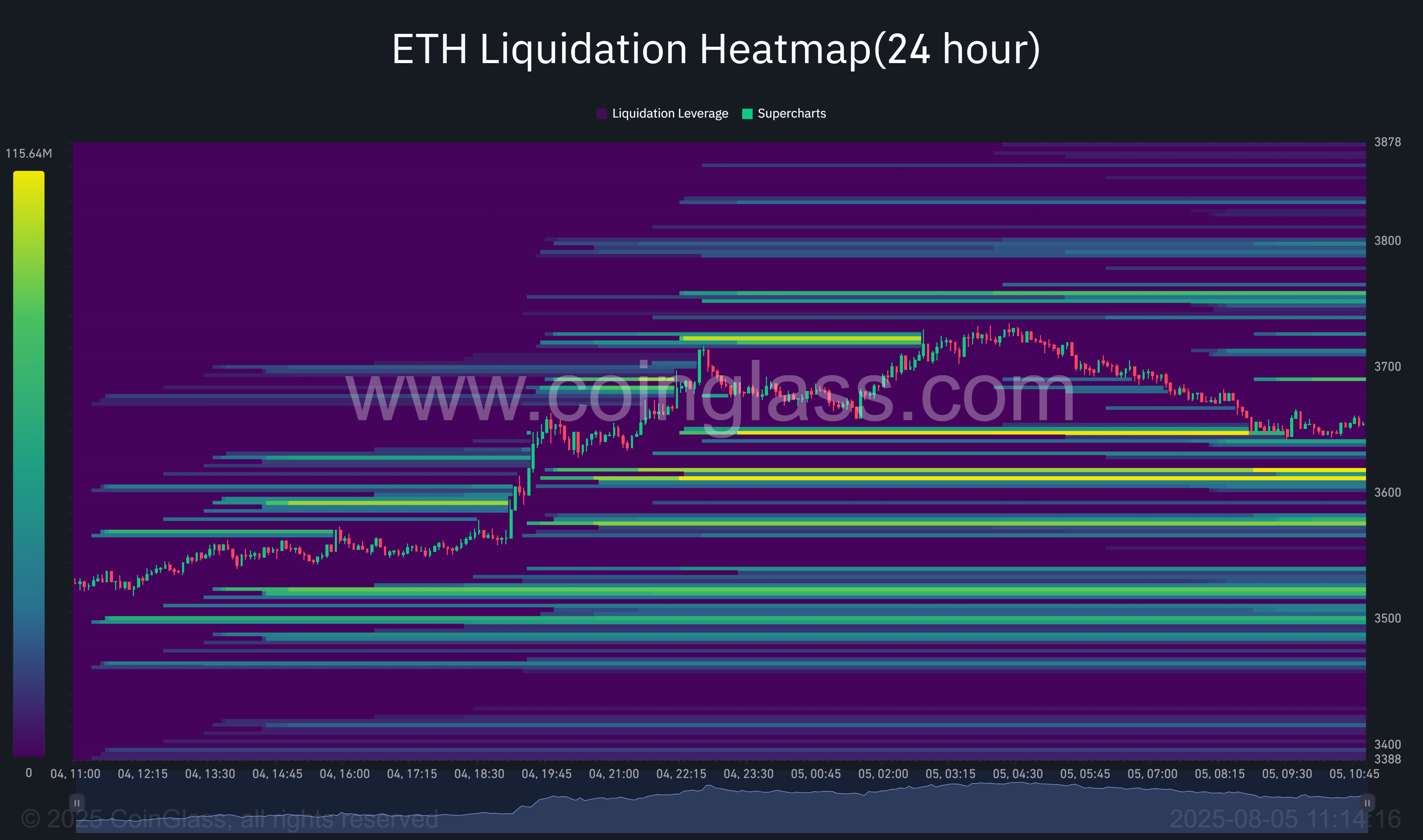

Coinglass information means that Ethereum is traded volatilely in dense clusters with lengthy liquidation ranges starting from $3,620 to $3,660. This zone is illuminated with excessive depth bands on a 24-hour warmth map, representing a multi-concentration, lengthy place of multi-concentration, which could possibly be expelled if the ETH glides additional.

ETH Clearing Map: Supply: Coinglass

This setup introduces short-term destructive facet dangers. If Ethereum can not maintain greater than $3,650, the transition from $3,620 to a pocket of $3,660 might set off a cascade liquidation.

Such a state of affairs is prone to improve gross sales strain, pushing up a secondary liquidity pool of almost $3,580 or ETH of almost $3,540. These ranges act as flowable magnets. Because of this costs could also be drawn in the direction of them to “harvest” the open place earlier than rebounding.

Conversely, if the Bulls defend their present help zone and trigger short-term rebounds, Ethereum might goal short-settled clusters close to $3,730-$3,780.

Nevertheless, some market watchers are hoping for $4,000 to get better Ethereum, supported by bullish expertise.

$ETH WEEKLY Chart gives BTFD vibes.

Excellent help has been retested and now the client is intervening.

Submit ETH over $4,000 now. pic.twitter.com/a2gdbxtpio

– Ted (@tedpillows) August 4, 2025

learn extra: The growth of the Bitpanda Eyes market reaches document profitability

Disclosure: This content material is offered by a 3rd get together. Neither Crypto.Information nor the creator of this text ends with the merchandise listed on this web page. Customers ought to conduct their very own analysis earlier than taking any motion associated to the corporate.