Ethereum worth motion It was quiet, but it surely has been calculated over the previous few weeks. ETH, which has the $1,600 mark on the $1,600 mark, seems to kind the bottom, however are you prepared for a breakout or is it coming much more of a draw back? Necessary technical indicators line as much as tighten transferring averages, Ethereum could also be making ready for a essential transfer. Let's break down what the chart says to us and what occurs subsequent.

Ethereum worth forecast: What drives ETH's present worth motion?

Presently, Ethereum costs are buying and selling at round $1,595. It hasn't been explosive currently, but it surely exhibits resilience. The broader crypto market remains to be recovering from a unstable begin to April, with Ethereum costs no exception. Nevertheless, ETH avoids additional breakdowns and exhibits indicators of stabilization, suggesting that the vendor could also be shedding energy.

One of many clearest indicators comes from a each day chart the place ETH costs have moved sideways over the previous few periods in shut proximity. One of these compression usually precedes bigger actions. Merchants are watching rigorously, checking if the motion goes up or down.

Day by day Chart Abstract: A Quiet Battle between a Bull and a Bear

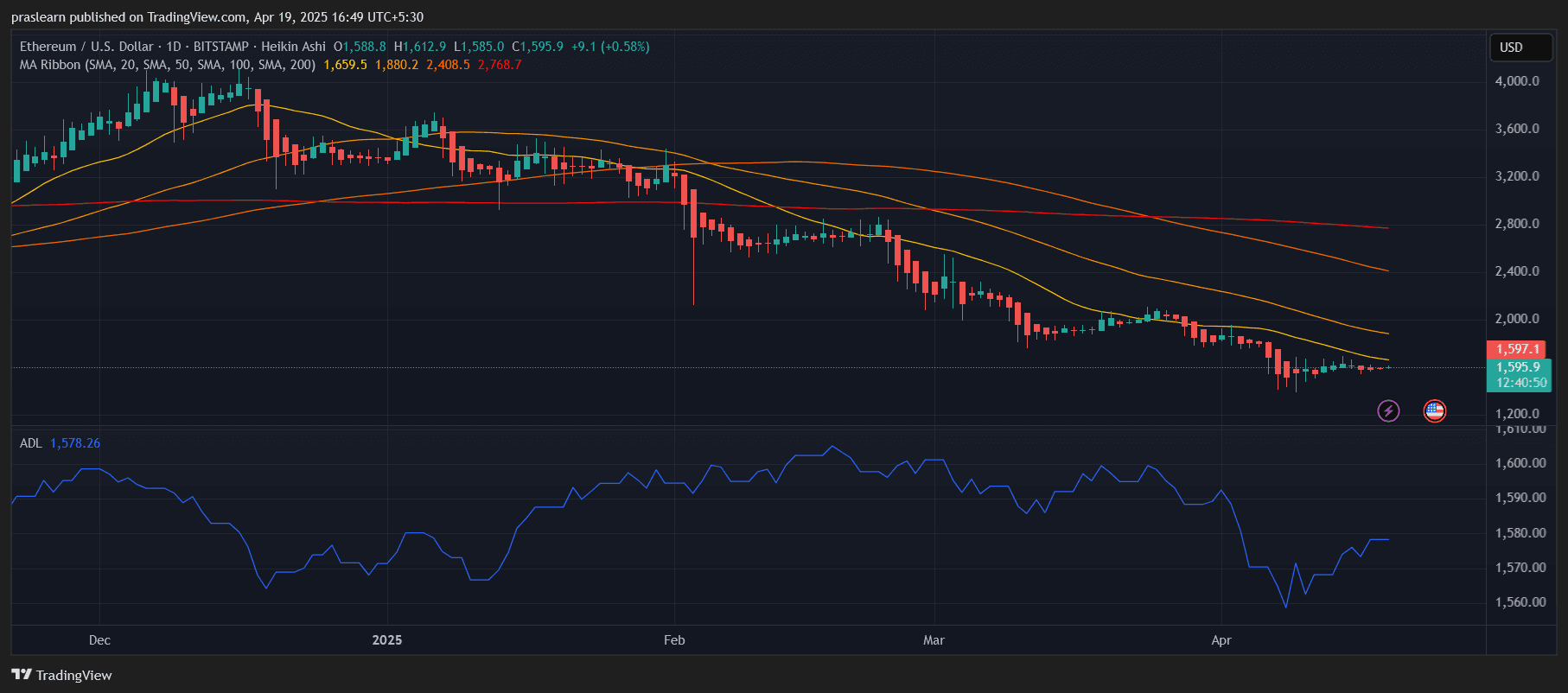

eth/usd each day charts – TradingView

Day by day charts draw photos of Ethereum that combine after weeks of decline developments. The worth is slightly below the primary transferring common cluster, together with 50-day, 100-day and 200-day SMA, and now serves as an overhead resistance. These far outweigh present costs and much outweigh the $1,880-$2,768 zone. So long as Ethereum trades under these, the long-term pattern stays bearish, however momentum seems to be altering.

Apparently, the buildup/distribution line (ADL) is once more dealing with upward, suggesting that bigger gamers could also be slowly accumulating ETH at present ranges. This distinction between worth and ADL means that gross sales strain can be weakened and that the breakout requires a correct catalyst. In case your ETH breaks past the $1,650 vary, it might speed up in the direction of $1,800 earlier than testing the heavier resistance zone above.

Hourly chart evaluation: Hold traces or lose steam?

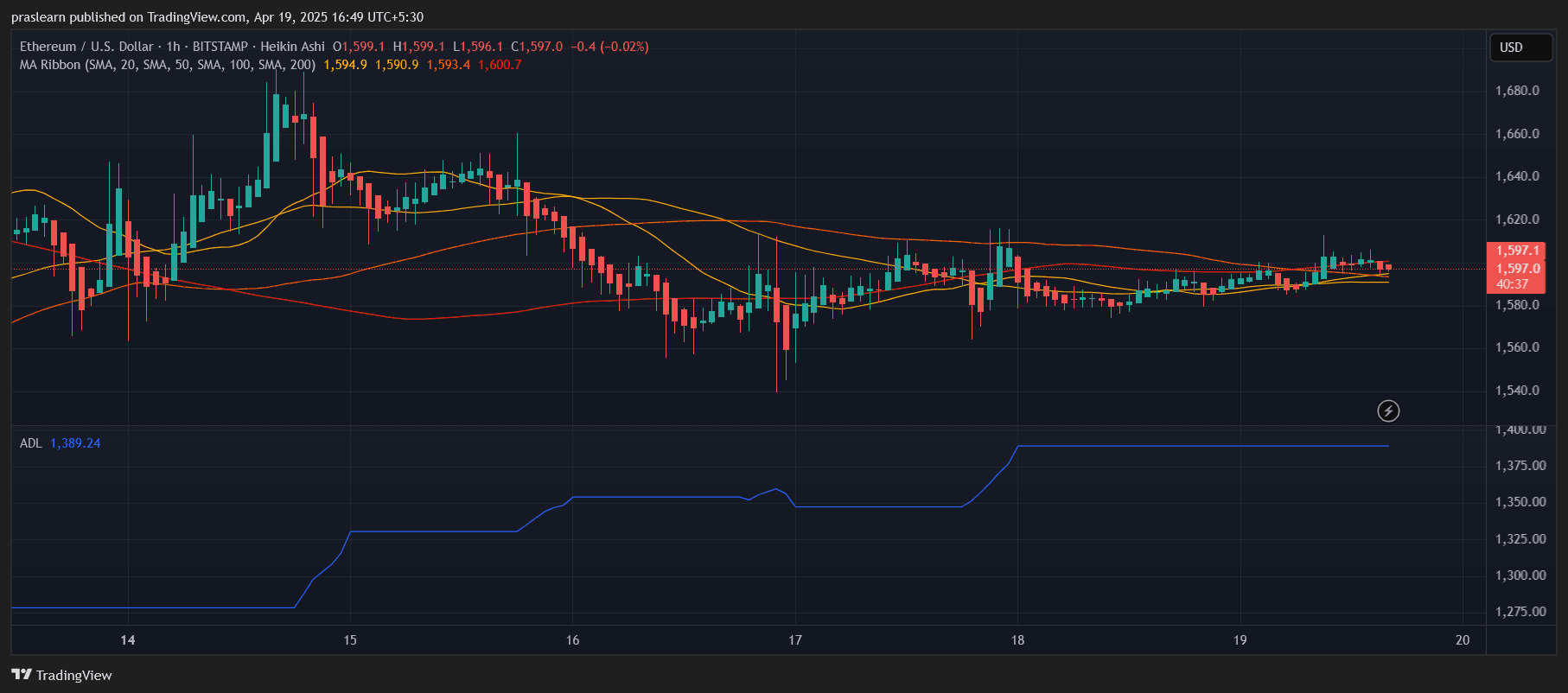

ETH/USD 1 hour chart – TradingView

Hourly charts present extra perception into short-term feelings. Ethereum has been buying and selling between $1,585 and $1,600 over tight horizontal channels for the previous few days. Regardless of the shorter daytime cores at each ends, the value respects these boundaries with minimal volatility. This calmness could also be deceived.

Trying on the hourly MA ribbon, the ETH is sandwiched between 20, 50, and 100 hours of SMA, all inside shut vary. These transferring averages start to flatten and point out that the momentum is impartial. The hourly time-frame ADL stays steady at practically 1,389, reflecting the steadiness of buying and selling actions. It's not sufficient to trigger developments, however sufficient to point out that merchants aren't shedding curiosity.

If patrons can surpass ETH costs in extra of the $1,605-$1,610 quantity, this could be a robust sign that the Bulls are regaining management. Conversely, a drop under $1,580 means that the bear remains to be in cost.

Ethereum worth forecast: Breakout brewing?

The tight vary of Ethereum could also be an indication {that a} breakout is approaching. Within the brief time period, merchants are trying on the $1,610 stage as their first hurdle. A break above this might flip ETH in the direction of $1,650, the place it faces extra extreme resistance from a better transferring common. This momentum continues and as soon as ETH exceeds $1,700, it will likely be potential to retest $1,880.

Nevertheless, if Ethereum Worth loses grip with $1,580 in assist, the value might slip into $1,520, making $1,460 a deeper assist zone. Whereas the broader drop nonetheless holds weight, present integration and climbing ADL recommend an elevated chance of bullish reversal, particularly when macro circumstances are steady.

Last Ideas: Wait or leap in?

Ethereum is at a technical intersection. It exhibits early indicators of power after an extended decline, however no bullish breakout has been confirmed. Day by day charts present potential accumulation levels, and hourly charts mirror sturdy assist, however the market requires clear actions of over $1,610, resulting in a essential shift in short-term momentum to favor bulls.

Traders and merchants have to carefully monitor this zone. A break at quantity might begin the rally in the direction of $1,800. However endurance is essential – till ETH costs clear these ranges, this stays a monitoring and response state of affairs, not a leaping second now.