Ethereum faces main resistance with sturdy bullish momentum, however liquidation information highlights ongoing market volatility.

Within the first week of 2026, Ethereum (ETH) was buying and selling at $3,253.44, down simply 1.2% previously 24 hours. With a steady market capitalization of $392.7 billion and a stable 24-hour buying and selling quantity of $28.85 billion, ETH maintains its primary place on the earth. A stable 2nd rank.

Ethereum is up 9.5% over the previous 7 days and 11% over the previous 14 days, reflecting sturdy optimistic momentum.

CoinGecko’s chart reveals optimistic momentum, particularly after January 6, with the worth rising sharply till stabilizing above $3,240. Given the bullish pattern, Ethereum value may rise maintain risingparticularly if it breaks out of the instant resistance degree above $3,300.

Ethereum value evaluation

Ethereum is at present testing a serious Fibonacci retracement degree because it approaches potential resistance at $3,303, which coincides with the 0.786 Fibonacci degree. Though latest value motion reveals a powerful rally, ETH faces challenges at this degree, which may act as overhead resistance.

Ethereum every day chart

The following essential resistance degree is the $3,447 space, which is the highest of the present vary. If Ethereum is ready to shut above $3,303, it may verify a breakout and goal even larger ranges, pushing it in direction of the $3,400 to $3,600 zone.

On the draw back, ETH has set $3,190 as potential help marked on the 0.618 Fibonacci retracement degree. If Ethereum declines, this space is more likely to act as an essential ground and supply shopping for help. A break under this degree would open the door for additional decline in direction of the following essential Fibonacci ranges at $3,100 or $2,980.

The Superior Oscillator additionally helps this, and so long as the market stays above these help zones, the inexperienced bars point out bullish momentum.

Ethereum liquidation information

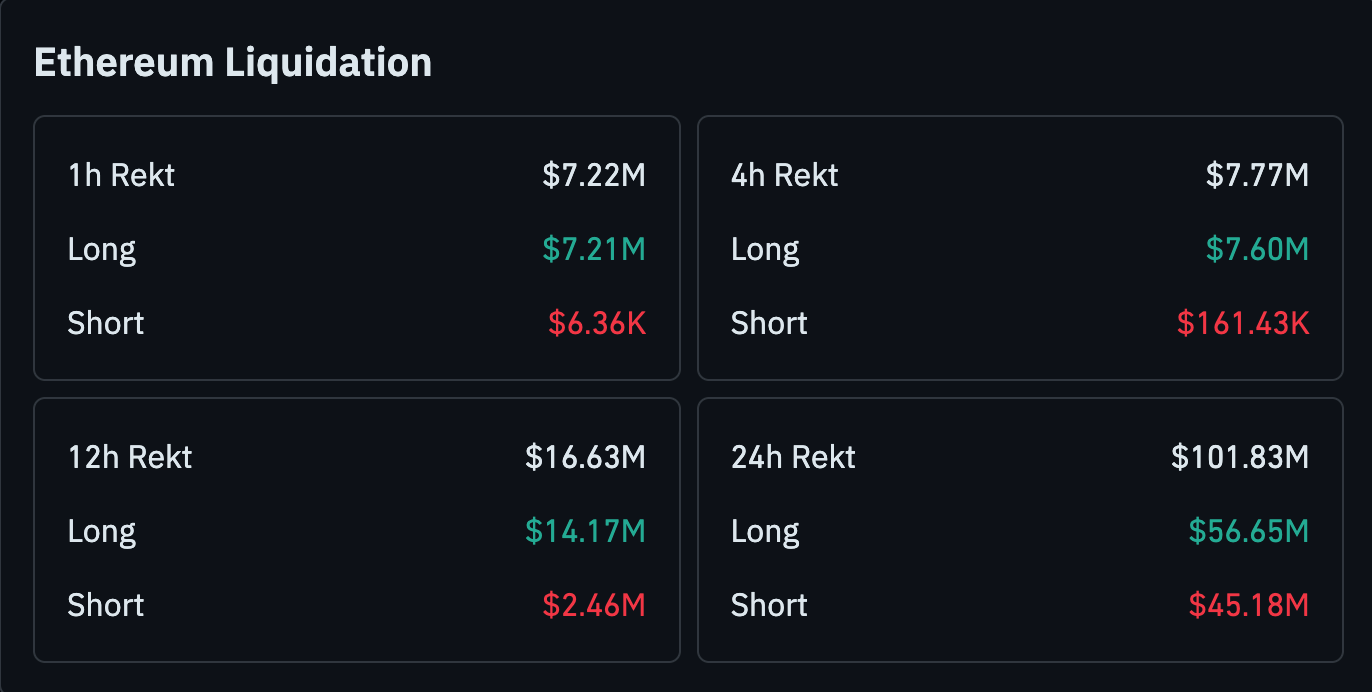

The Ethereum futures market continues to be displaying important volatility and the potential for value swings, though the state of affairs is towards the bulls. A complete of $101.83 million in liquidations occurred previously 24 hours, of which $56.65 million got here from lengthy positions and $45.18 million from quick positions.

Ethereum liquidation

On shorter time frames, lengthy positions constantly lead liquidations. For instance, on the 4-hour and 1-hour time frames, lengthy positions value $7.6 million and $7.21 million have been liquidated, respectively. Vital strain on lengthy positions suggests a bullish bias in Ethereum value motion, whereas excessive liquidation quantities are an indication of warning.