Bitcoin enters the corrective section after the current document excessive, with costs consolidated with key help, indicating that on-chain knowledge is worthwhile. Market sentiment is cautious and the following transfer will decide whether or not the pullback can be prolonged or a contemporary sturdy eg will start.

By Shayan

Day by day Charts

The BTC failed to carry past the $124,000 mark, inflicting it to break down from the upward channel, resulting in a repair to the $110,000 help zone. This asset is at the moment beneath this degree and carefully aligns with the 100-day shifting common, making it an vital space for figuring out whether or not the current decline is a wholesome setback or a deeper pullback begin.

Rejections from the highest of the channel present weaker bullish momentum, indicating that sellers are gaining extra management within the brief time period.

The RSI is 43 and it’s sitting beneath the impartial 50 degree, making it a bearish momentum confirmed to be working. If Bitcoin can't climb above $110K, the following key help can be close to the $104,000 honest worth hole, adopted by a $90,000 zone, each serving as main demand areas.

The benefit is that re-filling on the $110K degree permits rebounds to be rebound in the direction of a top of $117K, and maybe a 124K ATH could be retested, however the momentum indicator means that patrons will want new power to push greater. The subsequent few days can be crucial in indicating whether or not BTC will stabilize or lengthen the repair.

4-hour chart

On the 4-hour chart, BTC is revising inside the downward channel after peaking at $124,000. The property have lately discovered that demand is round $108,000 and are at the moment testing midrange resistance of almost $110,000.

The drawn curves spotlight gradual adjustments available in the market construction, exhibiting how momentum shifted from a robust uptrend to a sequence of low and low highs. This means a managed pullback moderately than a sudden failure, suggesting that the market is within the cooling stage.

The RSI has additionally returned above 50 and is at the moment sitting at 56, together with his bullish momentum bettering within the brief time period. If the customer can escape the descending channel and regain $110K, it should see a structural shift to bullish state and open the door for one more try at 117K.

Nonetheless, if the value is rejected right here, the $104,000 honest worth hole stays the following main help that patrons could think about actively defending.

On-Chain Evaluation

Adjusted SOPR

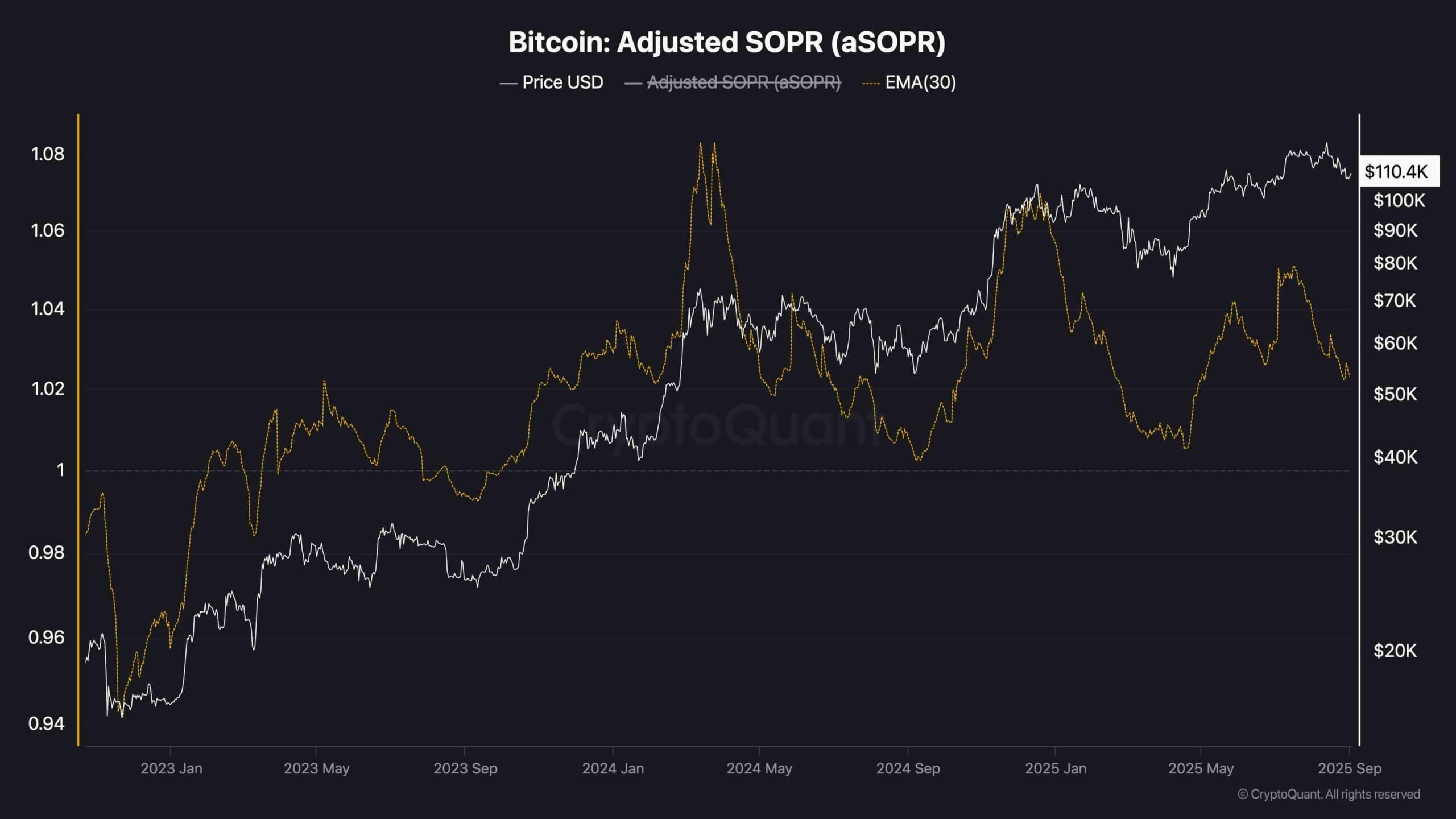

The adjusted SOPR (ASOPR) chart exhibits how earnings and losses from used output work in comparison with Bitcoin worth tendencies. Traditionally, sustained measurements above 1 point out that traders are promoting earnings at bullish phases.

On this chart, ASOPR has struggled to take care of its rise through the current revision, bringing the 30-day EMA development down. This means that the strain to earn earnings is outweighing contemporary inflow, which is per Bitcoin being pulled again from its excessive.

The important thing level is that the market seems to be in a cooling interval the place the holders are much less keen to remain via volatility and as an alternative notice earnings. Each time an ASOPR is rejected shut to at least one or solely a single, it signifies that the assembly is on sale, moderately than being expanded with new demand. Total, this chart implies that the market stays weak to additional corrective pressures.