Canaan Inc. (CAN), an modern mining and knowledge heart firm, rose to a six-month excessive. The corporate introduced a brand new mining heart in Canada with 2.5MW capability utilizing surplus gasoline flares for cryptocurrency mining.

Canaan, Inc. (CAN) has launched a pilot program to harness surplus pure gasoline flares for vitality to mine cryptocurrencies. The corporate will construct a 2.5MW knowledge heart appropriate for 700 Avalon A15Pro miners. The info heart goals to attain an working charge of 90% whereas using surplus pure gasoline.

Canaan needs to make use of the surplus vitality for extra duties and swap between mining and AI calculations. Canaan will associate with Calgary-based Aurora AZ Power.

An enormous milestone for Canaan!

We formally launched our gas-to-compute pilot in Calgary, Canada. This converts stranded and flared gasoline into clear vitality for Bitcoin mining and AI computing.

– 700 Avalon A15 Professional miners

– 2.5MW capability

– Cut back CO₂ by 12-14,000 tons per 12 months

– 90% uptime…— Canaanio Co., Ltd. (@canaanio) October 13, 2025

Fuel flares are one of many much less widespread vitality sources for BTC mining. Canaan Mining delivers gear on to gasoline effectively sources to immediately convert gasoline to electrical energy at beneath business prices.

“By integrating localized pure gasoline technology with our modular computing techniques, we’re changing beforehand wasted assets into productive vitality. ” Canaan CEO Nangeng Zhang stated within the announcement.

Extra energy is used for mining and computation, or offered to the facility grid throughout knowledge heart downtime.

Canaan shares stay unfazed by tariff negotiations

Canaan Mining has demonstrated its skill to adapt to totally different market circumstances. CAN inventory has been buying and selling because the firm's IPO in 2019, permitting the corporate to make a footprint within the US. As reported by Cryptopolitan, Canaan Mining has been profitable in securing income from rig gross sales and direct mining.

The mining firm achieved 9.3 EH/s as of September. Moreover, the corporate offered greater than 50,000 A15 Professional models to US-based corporations regardless of earlier tariffs on merchandise and components from China.

Canaan Mining ranks among the many prime 15 corporations that mix mining, knowledge facilities, and extra BTC vaults. The corporate is a runner-up in ASIC manufacturing and stays common with its Avalon model. Canaan was additionally the producer of the primary ASIC chip that ushered in a brand new aggressive period in BTC mining.

CAN inventory rises to six-month excessive

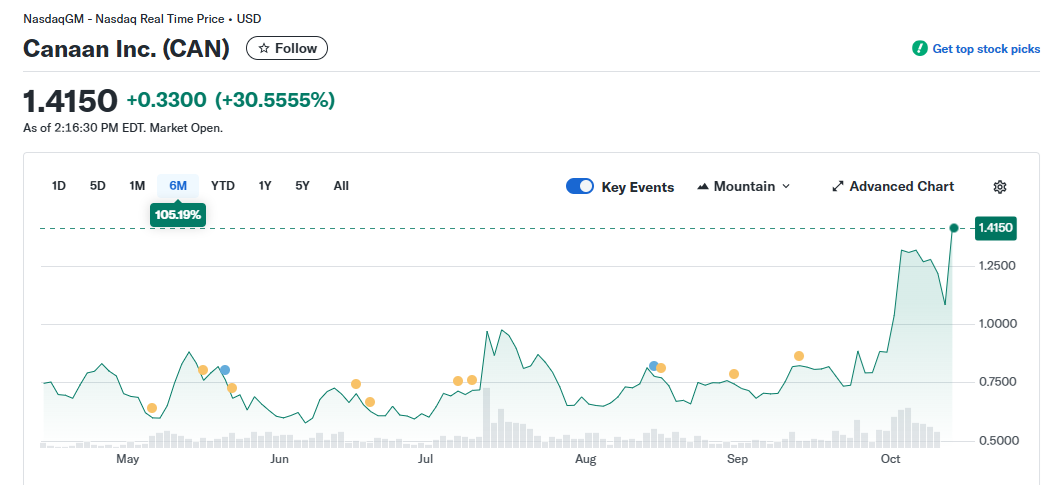

CAN inventory rose on information of mining success and monetary progress. CAN widened to $1.42, returning to ranges not seen since February.

CAN rose to a six-month excessive on information of a brand new partnership in gasoline flaring mining. CAN has rebounded together with different mining shares as the specter of a brand new commerce battle with China has light. |Supply: Yahoo Finance

Canaan inventory rises considerably 28%is increasing quicker in comparison with different mining corporations with further reserve narratives.

Mining rig producers have been centered on mining and didn’t immediately profit from the monetary firm frenzy. Canaan is just not a “technique” firm and isn’t looking for further purchases of BTC. Nevertheless, Canaan nonetheless holds the thirty ninth largest BTC vault. 1,547BTC Occurred as of October 2025.

CAN additionally adopted the overall development amongst massive mining corporations, increasing by greater than 10% on common over the previous day. Different mining shares additionally rose throughout the board, rebounding rapidly because the possibilities of one other commerce battle with China turned much less probably.

Over the previous few months, new knowledge facilities have been established and BTC mining has continued to broaden regardless of looming considerations of tariffs on parts and ASIC rigs.