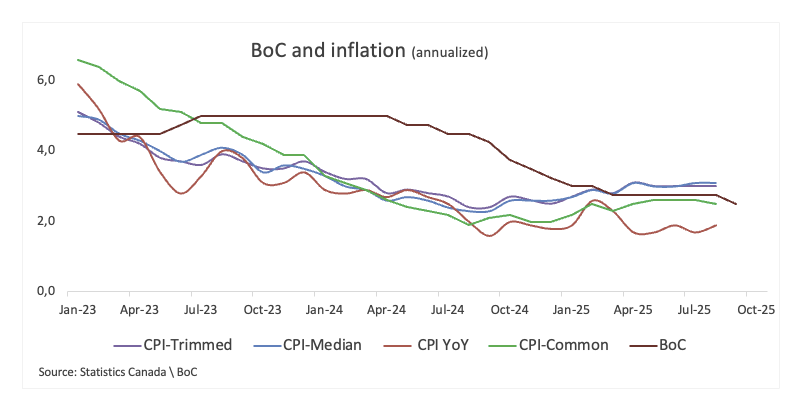

Statistics Canada will launch inflation statistics for September on Tuesday. The numbers will give the Financial institution of Canada (BoC) a brand new evaluation of worth pressures because it considers its subsequent transfer on rates of interest. The central financial institution is predicted to chop rates of interest by 25 foundation factors to 2.25% at its Oct. 29 assembly.

Economists count on the headline shopper worth index (CPI) to rise 2.3% in September, following a 1.9% annual rise in August, exceeding the central financial institution's goal. On a month-to-month foundation, costs are anticipated to say no by 0.1%, matching the destructive vary recorded within the earlier month.

The central financial institution may even look to its favored core measures of eradicating extra unstable meals and vitality parts. The index elevated by 2.6% in August in comparison with the identical month final 12 months, and was flat in July.

Analysts stay cautious after inflation accelerated in August. The looming risk of U.S. tariffs pushing up home costs provides uncertainty to the outlook. For now, each markets and policymakers are prone to stay cautious.

What can we count on from Canada's inflation fee?

The Financial institution of Canada minimize rates of interest by 25 foundation factors to 2.50% in August, a choice that was according to market expectations.

On the rally, Gov. Tiff Macklem struck a cautious tone in her traditional press convention. He mentioned the inflation state of affairs had not modified a lot since January, pointing to blended indicators and additional recession.

When will Canadian CPI knowledge be launched and what influence might it have on USD/CAD?

Markets are maintaining a tally of Statistics Canada's September inflation report on Tuesday at 12:30pm Japan time. Merchants are cautious of the danger of renewed worth strain.

A stronger-than-expected studying would heighten considerations that tariff-related prices are starting to trickle all the way down to customers. This might result in a extra cautious coverage stance from the Financial institution of Canada, probably resulting in a state of affairs the place it helps the Canadian greenback (CAD) within the brief time period whereas paying shut consideration to commerce developments.

FXStreet senior analyst Pablo Piovano notes that the Canadian greenback has entered a strong theme on the prime of its latest vary, simply above the important thing hurdle of $1.4000. In the meantime, additional upside appears probably so long as the worth stays above the essential 200-day SMA close to 1.3960.

Piovano suggests {that a} resurgence of bullish momentum might inspire USD/CAD to problem the October ceiling of 1.4080 (October 14th) forward of the April excessive of 1.4414 (April 1st).

In the meantime, Piovano means that an essential subject has emerged on the essential 200-day SMA at 1.3963, forward of the interim help ranges at 55-day and 100-day SMAs at 1.3861 and 1.3781. A loss on this area might set off a possible transfer in direction of the September benchmark of 1.3726 (September seventeenth). A deeper retracement might immediate a check of the July trough at 1.3556 (July 3), which might reappear on the horizon.

“Moreover, the momentum indicators are trending bullishly. The relative energy index (RSI) is hovering round 66, whereas the typical directional index (ADX) is above 36, indicating a powerful pattern,” he says.

The submit Canadian CPI anticipated to rise in September, placing strain on central financial institution easing plans appeared first on BeInCrypto.