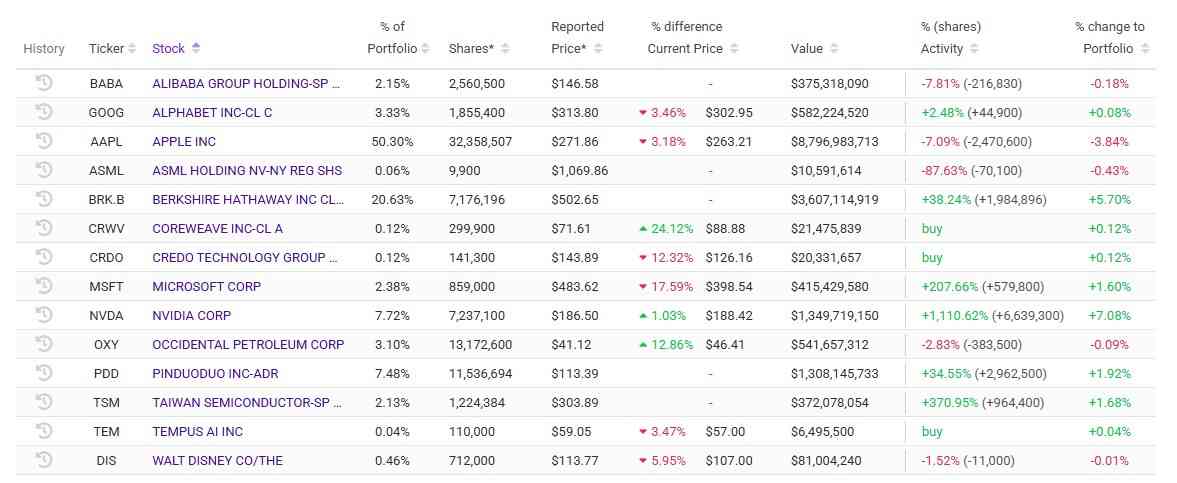

Duan Yongping, a distinguished investor and entrepreneur referred to as “China's Warren Buffett,” has filed his 13F submitting for This autumn 2025, offering an in depth snapshot of his newest portfolio.

This disclosure exhibits an fascinating mixture of aggressive place will increase and selective reductions, notably Yongping's perception in synthetic intelligence (AI) and blue-chip names.

Quite, it was the dramatic enhance for Nvidia (NASDAQ: NVDA), because the H&H Worldwide Funding Supervisor added over 6,639,300 NVDA shares to his portfolio, growing his whole inventory rely to 7,237,100 shares (roughly 7% of the portfolio).

This elevated the general variety of shares by 1,110.62% and the worth of the place was roughly $1.35 billion.

Duan Yongping portfolio replace

When it comes to new shares, the most important new buy was in Coreweave (NASDAQ: CRWV), the place Eihei purchased 299,900 shares price roughly $21.48 million.

Equally, buyers opened positions in Credo Know-how Group Holding (NASDAQ: CRDO) and purchased 141,300 shares price roughly $20.33 Million.

The third largest addition was Tempus AI (NASDAQ: TEM) with 110,000 shares valued at $6.5 million.

Main place will increase included Berkshire Hathaway (NYSE: BRK), which added 1,984,896 shares. This brings his whole holdings to 7,176,196 shares, a rise of 38.24% and a place price roughly $3.61 billion.

Discount of shareholding in H&H Worldwide Funding

Mr. Duan has decreased his publicity to a number of shares, notably Apple (NASDAQ: AAPL). He decreased his place by 2,470,600 shares, lowering the variety of shares by 7.09% and impacting the general portfolio by 4.29%.

He additionally considerably decreased his stake in ASML Holding NV (NASDAQ: ASML), promoting 70,100 shares, a lower of 87.63%.

Featured picture by way of Shutterstock