Actual World Property (RWA) Protocol Splice and Chintai have launched a brand new product in Solana, designed to permit retail customers to entry institutional grade tokenized securities.

The product is provided with a Strategic Token, or S-Tokens, which is able to present retail customers with publicity to the yields generated by Chintai. Whereas customers don’t immediately maintain Chintai's tokenized securities, S-Tokens act as “mirrors” by means of a mortgage construction backed by the underlying property.

S-Tokens is designed to broaden entry to RWA yields past institutional traders. Immediately, most establishments' RWA merchandise function as “walled gardens” with strict capital necessities and compliance hurdles, limiting retail participation, the corporate instructed Cointelegraph.

The S-Token mannequin goals to bridge this hole, permitting publishers to proceed to conform whereas offering retail customers with entry to institutional-grade yields.

Splyce permits customers to have interaction immediately with these property by way of their present Web3 wallets, and preserve an unauthorized expertise that normally defines Defi.

“There aren’t any jurisdictional restrictions on the place S‑ Tokens can provide. They aren’t allowed as a lot as USDC or USDT,” Splyce's chief advertising officer, Ross Blyth, instructed Cointelegraph. “That being stated, deposits will nonetheless be topic to plain KYC/AML monitoring, making certain anti-money laundering necessities.”

The primary iteration of S-Tokens contains Kin Fund, a tokenized actual property fund launched by Kin Capital on the Chintai community.

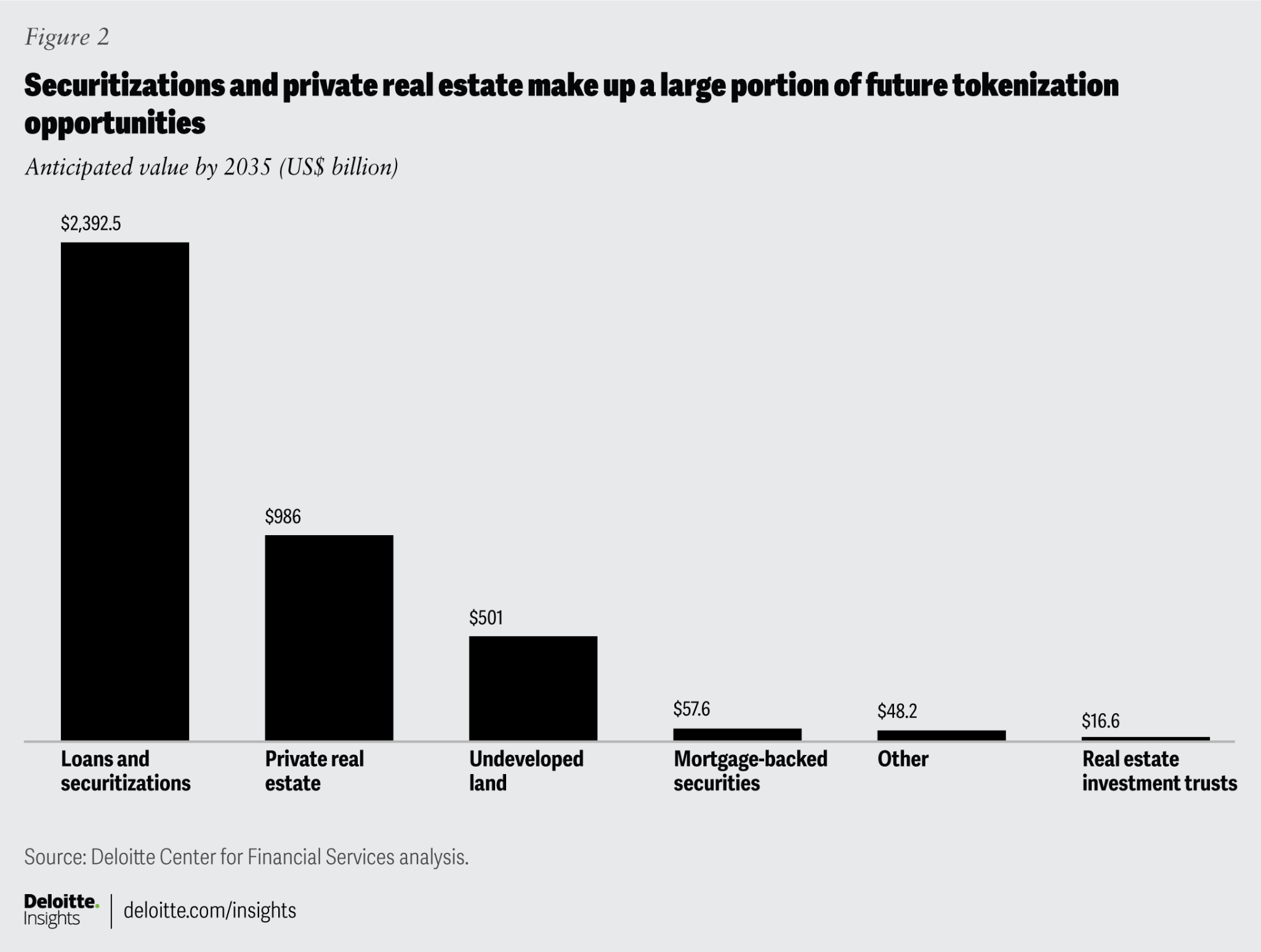

Deloitte has recognized loans, securitization and personal actual property as two of the most important potential tokenization alternatives for the following decade. sauce: Deloitte

“Distribution and liquidity have all the time been the most important hurdles for RWAS,” Josh Gordon, managing director of Chintai, instructed Cointregraph. “Quickly, facility-grade property can be traded throughout Solana's decentralized exchanges with the identical ease as tokens right now.”

Associated: VC Roundup: VCS Gasoline Vitality Tokenization, AI Knowledge Chine, Programmable Credit score

Risk to spice up Solana's RWA momentum

Identified for its excessive throughput, low charges and a robust developer ecosystem, Solana has gained outstanding traction in the true property sector.

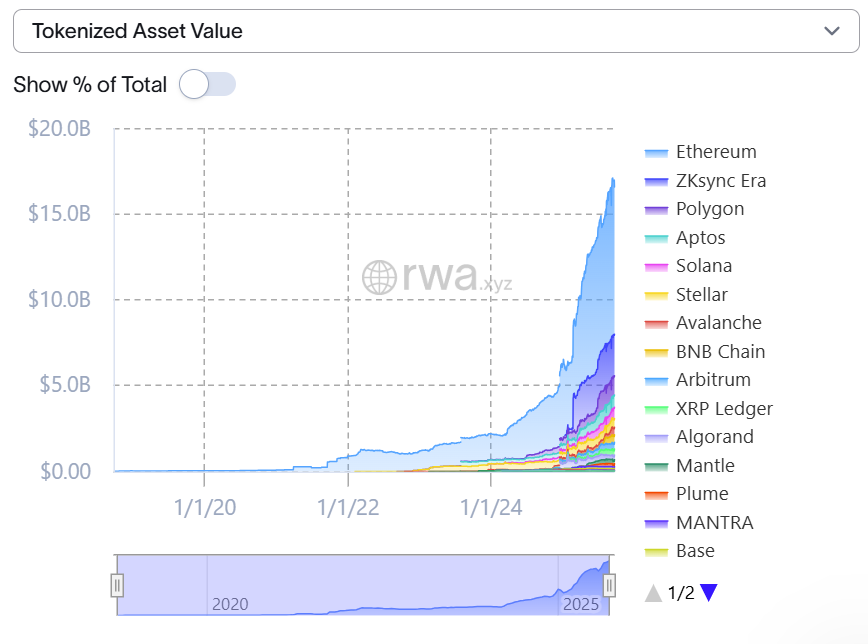

Trade knowledge exhibits Solana's tokenized property are at the moment valued at over $656 million. Solely 4 different networks, Ethereum, Zksync Period, Polygon and Aptos, at the moment assist greater ranges of tokenized property.

Tokenized asset values throughout main networks. sauce: rwa.xyz

Because the starting of the 12 months, the worth of Solana's tokenized property has elevated by greater than 260%. The community's largest unstable coin tokenized merchandise embrace the Ondo Brief-Time period US Authorities Bond Fund, which gives yields on Ondo US Greenback and tokenized entry to merchandise with yields such because the Brief-Time period US Treasury Division.

Moreover, BlackRock launched the USD Institutional Digital Liquitidity Fund (BUIDL) in Solana earlier this 12 months. Buidl shortly turned the dominant US Treasury product throughout blockchain, however its presence in Solana additional underscores the rising function of the community in adopting the institutional RWA.

Solana's greatest RWA merchandise are tailor-made primarily for certified institutional consumers or accredited traders, however options are rising, though they restrict retail entry. Ondo Finance has additionally introduced plans to broaden retail entry to Solana by means of a partnership with Alchemy Pay.

In the meantime, MEXC says Ondo's Aldecoin (USDY) is accessible to Stellar retailers.

These developments have emerged as a platform for tokenized shares, so the NASDAQ listed firm and the Ahead Trade, the proprietor of Solana Treasury, are planning to tokenize blockchain stock by means of a partnership with the regulated issuing platform SuperState.

https://www.youtube.com/watch?v=av4beooajdg

Associated: $400T TRADFI Market is a large runway for tokenized RWAS: Animoca