Over $155 billion, Tether's USDT has been main virtually synonyms for the Stablecoin marketplace for practically a decade.

Final yr, many individuals doubted that Stablecoin might compete, because of the asset supervisor becoming a member of Donald Trump's presidential minister, incomes probably the most transactional quantity of any crypto belongings, together with BTC itself.

However for the primary time in historical past, the world's largest stubcoin issuer is contemplating critical competitors within the type of circles.

Circle has been considerably pushing USDC this yr, with Protos compiling knowledge on three metrics which have gained the muse for Tether.

For the primary time in historical past, the world's largest Stablecoin writer is contemplating critical competitors.

Tether remains to be a market chief and holds a dominant share of excellent tokens, however retains search queries and buying and selling volumes, however the circle's development price highlights some areas during which it has acquired a place.

In spite of everything, crucial indicator that ranks Stablecoin publishers is their market capitalization share. As a result of this metric, USDT remains to be a pacesetter 61.5% of the $253 billion market.

USDC has a 24% share in second place.

Nonetheless, the expansion of the circle is spectacular.

Circle will win the bottom with tether in 2025

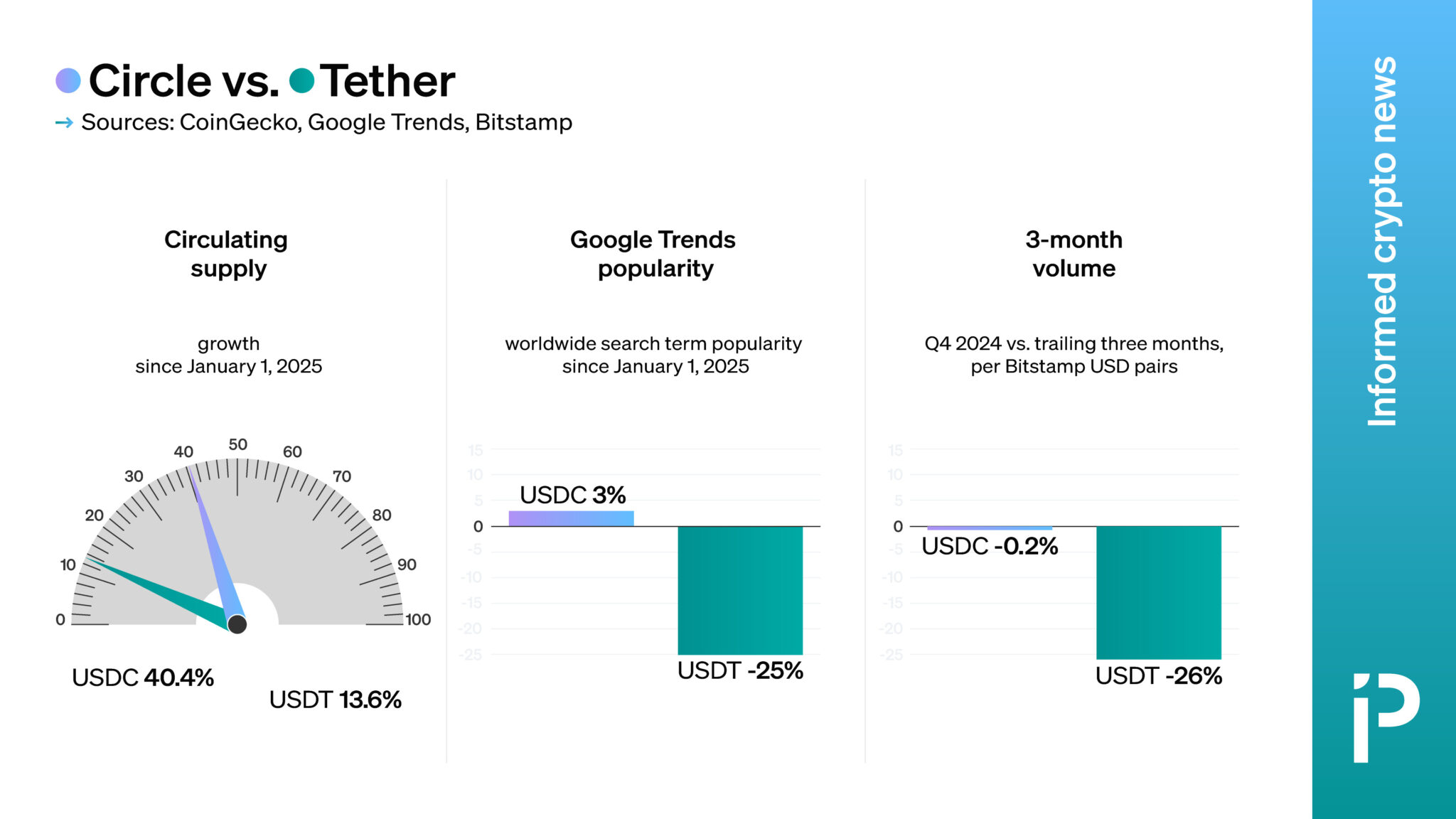

For the reason that starting of the yr, the circle has elevated its USDC distribution provide by 40.4%. That is akin to a 13.6% enhance in USDT over the identical interval.

Particularly, USDC distribution provide has elevated from over 43.7 billion to over 61.4 billion. USDT is great Rising from 137 billion to simply 155.7 billion.

That is the primary metric of outperformance for the circle.

Second, USDC's international Google search queries additionally elevated by 3% from 64 to 66 this yr. USDT is an absolute fashionable time period, with a 25% drop in recognition from Google Developments' 82-61 rankings.

Third, USDC additionally outperforms USDT in FIAT buying and selling quantity development. Whereas USDT stays probably the most massively traded digital asset, USDC gained a little bit of USDT's market share in 2025.

BitStamp's snapshot exhibits that the speed of USD buying and selling quantity decline because the fourth quarter of 2024 is way slower for the next three months within the case of USDC vs USDT.

Particularly, USDC volumes fell 0.2% from 107 million to 0.2% from 851 million to 628 million in comparison with a 26% decline in USDT.

Learn extra: Circle vs. Tether: What are the reserves?

Circle IPOs drive development in media and analysis

The Circle additionally attracted a disproportionate quantity of media consideration in 2025 in comparison with its main rivals. Since January, articles mentioning USDC have elevated by 75% from 24,169 to 42,455 per Muckrack knowledge.

USDT Media mentions grew from 55,473 to 78,680 to a extra modest 42%.

In fact, the expansion of the media is attributed to Circle's IPO. In reality, the corporate's valuation has elevated tenfold this yr from $4.79 billion to $48 billion. I’m primarily grateful for my US inventory market debut.

Learn extra: Evaluation: Is the Circle IPO value $31.6 billion?

Among the circle's development has gained share from Tether, however Tether is rising in worth in itself.

Nevertheless, non-public firms haven’t carried out funding to resume Tether's company rankings from the $7 billion Trump election score. In consequence, it’s not possible to match the evaluations of each firms.