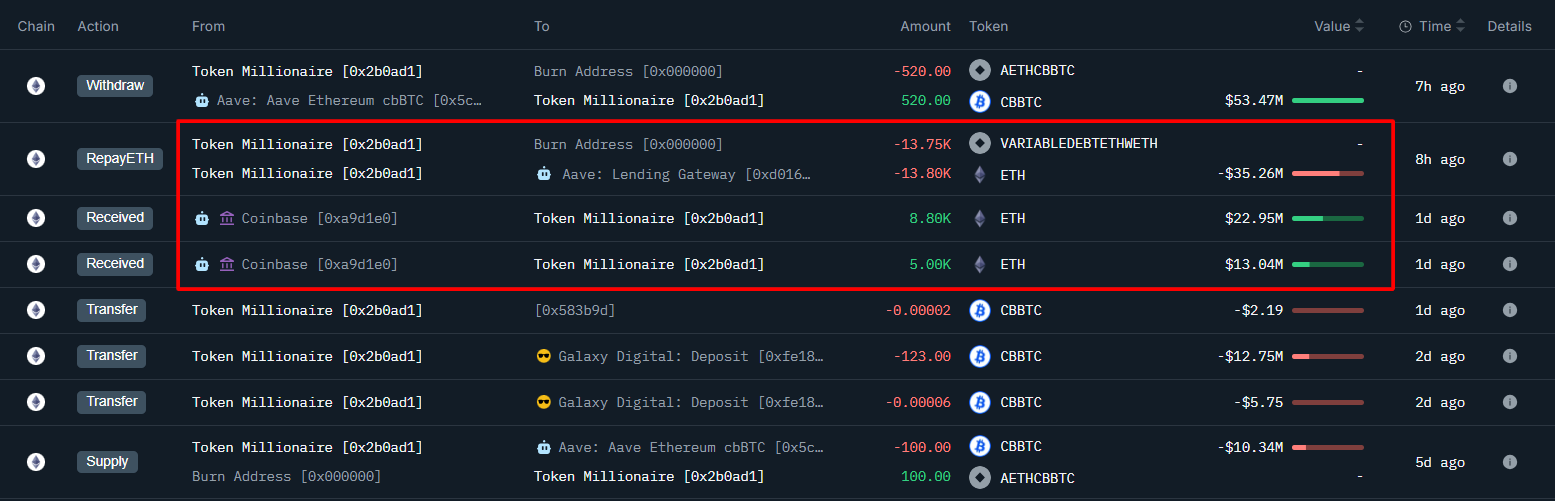

The unidentified pockets made a serious on-chain transfer by withdrawing 13,800 ETH from main US cryptocurrency exchanges. Coinbase. Based mostly on present costs, this withdrawal quantities to $35.26 million. Quickly after that, the identical handle repaid a portion of the excellent ETH mortgage on Aave.

Wallets labeled “0x2B0AD” used funds to repay variable charges Ethereum The debt borrowed in opposition to CBTC is a model of Bitcoin wrapped within the COINBASE platform. Blockchain information reveals that 13,750 ETH of the mortgage tokens had been burned and about 13,800 ETH was despatched again to Aave's lending pool.

Nonetheless, this reimbursement is partial. The pockets, which despatched again a considerable amount of ETH, nonetheless has an open debt of round $82.61 million in 32,377.6 Wes.

It turns into clearer over time whether or not this motion signifies a broader deleverization technique or dictates short-term adaptation. Both manner, it is going to cut back account publicity and maybe enhance its collateral place as a strategy to handle volatility and put together for additional market modifications.

Ethereum costs have fluctuated on the $2,600 stage, exhibiting momentum for restoration lately. that's proper ETH/BTC It's a pair, however it stays a long-term downtrend. The worth expectations or inside portfolio rebalancing that motivates this whale's exercise – remains to be unknown.

Thus far, no additional motion has been made by the pockets.