It is a section of the 0xResearch e-newsletter. Subscribe to learn the complete version.

A current report from Constancy Investments proposes to guage blockchains primarily based on GDP.

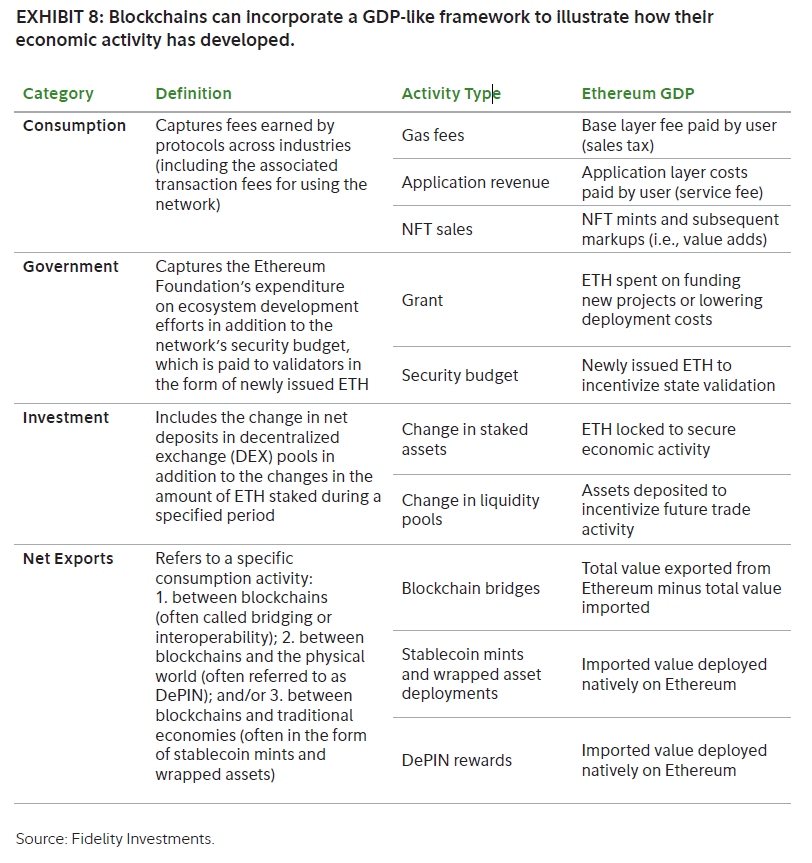

“…Due to the embedded foreign money, it could be higher to match decentralized blockchains with sovereign international locations and their economies, somewhat than web2 firms or merchandise.”

Right here is the GDP equation: C+I+G+(XM)

C is consumption, I is enterprise funding, G is authorities expenditure, X is export, M is import, XM is web export.

Constancy makes use of ETH for example. So, if you wish to transpose the GDP system into an Ethereum blockchain metric:

- c = what customers spend as fuel, use UNISWAP, construct NFTs, and many others.

- i = quantity of piling property or capital within the liquidity pool.

- G = Ethereum Basis expenditures issued an ETH to the validator.

- xm = some silly issues/burn of what was constructed, and bridges stream to different chains and depin rewards.

You’ll be able to see all the desk right here:

A complete effort by Constancy, however raises some questions.

GDP is a measure of home manufacturing. Consider it as “all the worth created right here.” When a rustic exports, it’s home manufacturing. When it’s imported, it’s expenditure. Subsequently, we are going to “web” import GDP.

However when hundreds of thousands of idiots are bridged to Ethereum that sucks up blockchain's “GDP” although nothing on-chain productive happens.

That’s in distinction to when Stablecoin is constructed on Onchain or when helium miners are paid in tokens to offer helpful cellular mobile companies. These are productive “imports” that depend correctly within the “GDP” of the blockchain.

So, whereas the measurement of “web export” by Bridge Flows is conceptually sound, in addition to Blockworks' Dan Smith appropriately identified, CEX chilly pockets sweep needs to be defined.

Loading Tweets…

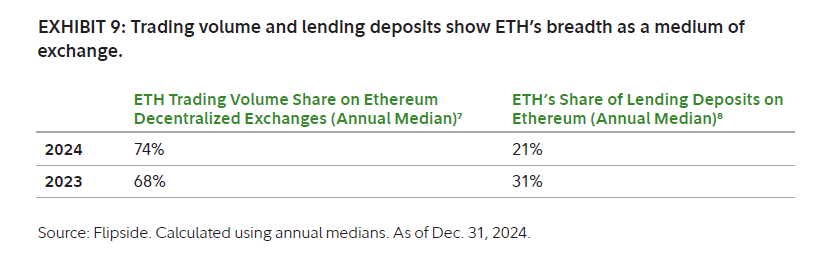

Constancy's valuation mannequin additionally claims that L1 tokens needs to be evaluated primarily based on “cash,” or extra particularly, alternate and storage of worth.

Constancy insists: “Ether is the dominant buying and selling pair of exchanges and serves as a significant asset to oppose it.”

At finest I justify the “medium of alternate” facet of cash, however I feel I'm silent in regards to the “unit of account” facet.

Early crypto traders query the flexibility of L1 tokens to behave as unit of accounts. As John Pfeffer wrote in 2017:

“So it's quite simple to imagine that individuals save what they use to make funds, somewhat than changing their worth shops by the fee railway in as few as doable with the precise quantity wanted when paying.”

Account Abstraction (ERC-4337) formalizes this actuality as you possibly can pay fuel charges with ERC-20 tokens. This significantly improves the person expertise, however requires storage of ETH, which undermines the “financial premium” of the L1 token.

Loading Tweets…

The ultimate facet of why I feel GDP analogy considers muddy ETH beneath the GDP “funding” bucket.

Staking locks current property, however doesn’t create new capability.