Freight Applied sciences Inc., a cross-border transportation logistics firm, has introduced it’s providing $20 million in stake to purchase Micro Strategic Treasury's Trump Meme Coin.

The corporate's justification for this transfer has little to do with Trump or ciphers. As a substitute, we concentrate on imminent US tariffs that might have a considerable affect on our enterprise.

Cargo know-how is investing in Trump

Because it first got here to the scene, Trump's meme coin with the identical identify has sparked a whole lot of controversy. A good portion of the president's web value is tied to crypto, with specialists and former regulators nervous about Trump's potential corruption.

The latest resolution to resolve on a $20 million Trump Treasury in cargo know-how has fueled these considerations.

Particularly, Freight's press launch sheds mild on why he’s investing $20 million in Trump. We are going to briefly clarify the corporate's curiosity in AI and Web3 growth, and clarify how freight organizes these purchases.

Nonetheless, generally, the press launch outlines how Trump's tariffs have an effect on the corporate's income.

“On the coronary heart of (our) mission is to advertise productive and aggressive industrial transactions between the US and Mexico. Mexico is the highest US commodity buying and selling associate. We imagine it’s an efficient approach to advocate Trump token official, balanced, free commerce.”

Cargo know-how is deeply concerned in cross-border supply with Mexico. That AI experiment is said to optimizing this transaction.

In brief, a commerce conflict with US southern neighbours may considerably undermine the corporate's potential to proceed functioning. However President Trump has already accepted a number of tariff sculptures for sure companies.

To be clear, the cargo assertion didn’t expressly enchantment to Trump for such sculpture. Nonetheless, reviews say some crypto corporations have claimed that they obtained direct or oblique authorized advantages from donating to the inauguration.

In response to lucksome corporations acquired this after a low donation of $100,000. Will $20 million appeal to his consideration?

It’s tough to make concrete claims, however freight actions concerning Trump's transactions appear uncommon. Nearly all of that reasoning for this buy revolves round US-Mexico commerce relations.

The corporate's press launch calls Trump a “nice approach to diversify the Cryptocurrency Division,” however that is the one justification for non-tariffs.

Nonetheless, if the cargo tries to petition the president, they could want that Mexico's tariffs will probably be eliminated totally. Whereas the tariffs stay, there’s nothing to counsel that it needs sculpture.

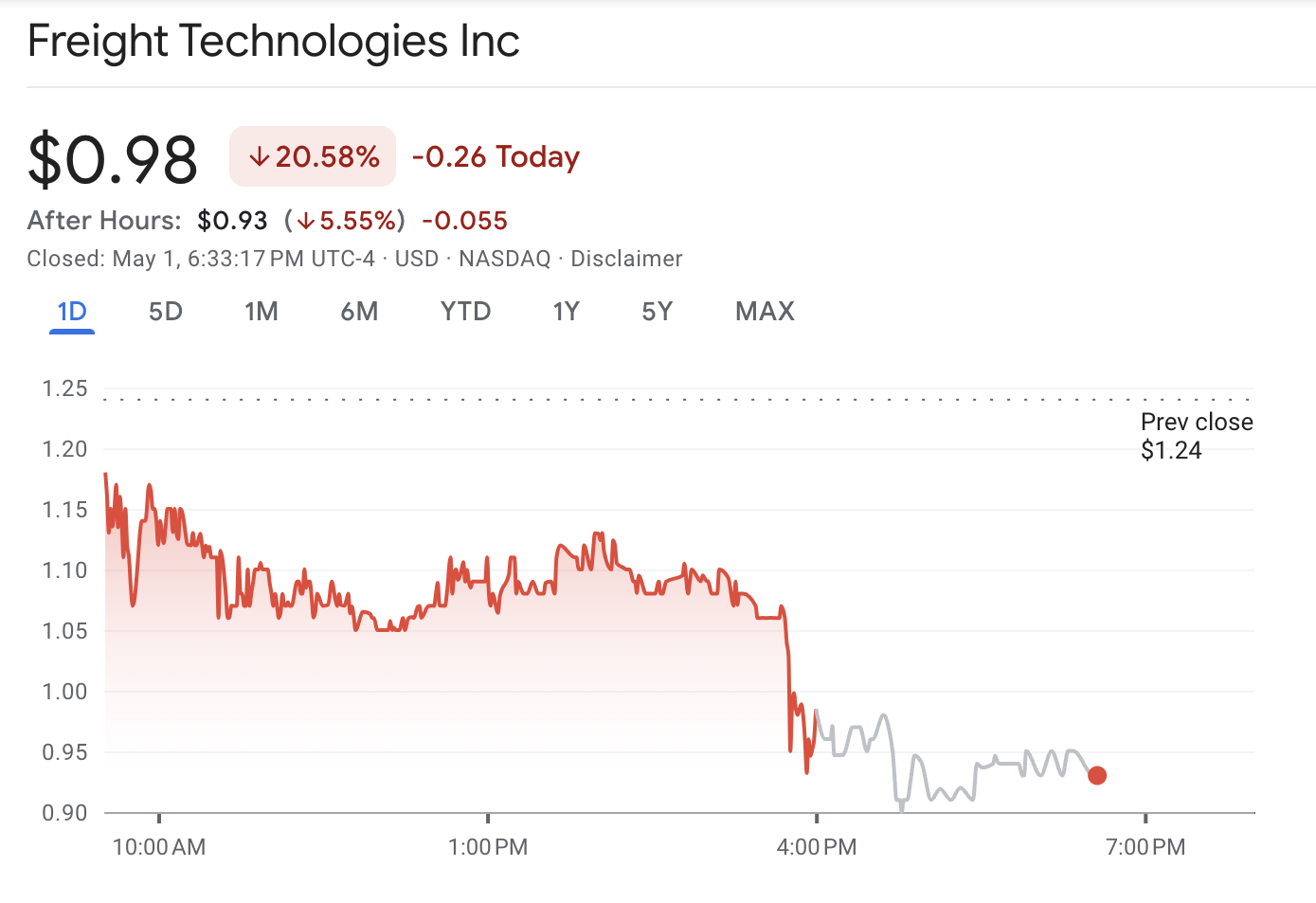

Both manner, this Trump buy may backfire as a result of freight inventory worth. The corporate first launched the press launch on April thirtieth, however started circulation on the afternoon of Might 1st by way of crypto-centric social media.

As information unfold throughout these circles, freight know-how shares fell by greater than 20%.

Cargo know-how inventory worth. Supply: Google Finance

As we transfer ahead, it's vital to control this story. The corporate has begun to develop micro-strategic type plans for belongings like Solana. Cargo know-how is to do it first with Trump, but it surely will not be the final.