Necessary factors

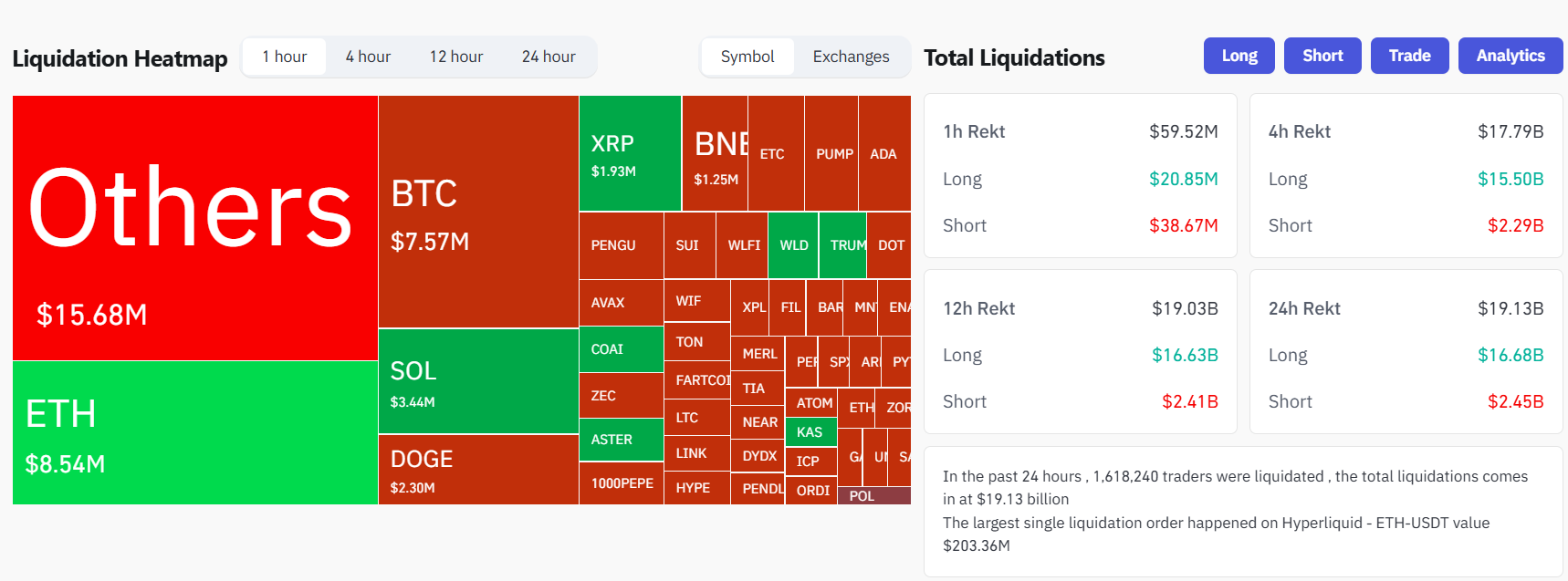

- Over $19 billion in leveraged cryptocurrency positions had been liquidated in 24 hours, making it the most important single-day elimination in digital asset historical past.

- Lengthy positions in Bitcoin and Ethereum had been hit the toughest, with greater than 1.6 million merchants throughout main exchanges affected.

Roughly $19 billion of leveraged crypto positions have been liquidated following the brutal sell-off that took Bitcoin to $102,000. That is the most important single-day wipeout ever recorded within the digital asset market, in accordance with CoinGlass information.

A lot of the liquidations had been on lengthy positions, with whole losses of $16.6 billion, in comparison with $2.4 billion on quick positions.

Greater than 1.6 million crypto merchants had been liquidated throughout main exchanges, with lengthy positions in Bitcoin and Ethereum severely impacted throughout Friday's US buying and selling hours.

The liquidation cascade was triggered after President Donald Trump proposed main tariff hikes on imports from China, and shortly thereafter introduced 100% tariffs on Chinese language items in response to China's deliberate export restrictions on uncommon earth minerals.

Following this information, Bitcoin plummeted from over $122,000 to round $102,000. Ethereum fell beneath $3,500, and small-cap altcoins posted double-digit losses as liquidity evaporated.

On the time of writing, Bitcoin had recovered from its earlier lows and was buying and selling above $113,000, however was nonetheless beneath the day's excessive of $122,500, in accordance with information from CoinGecko.