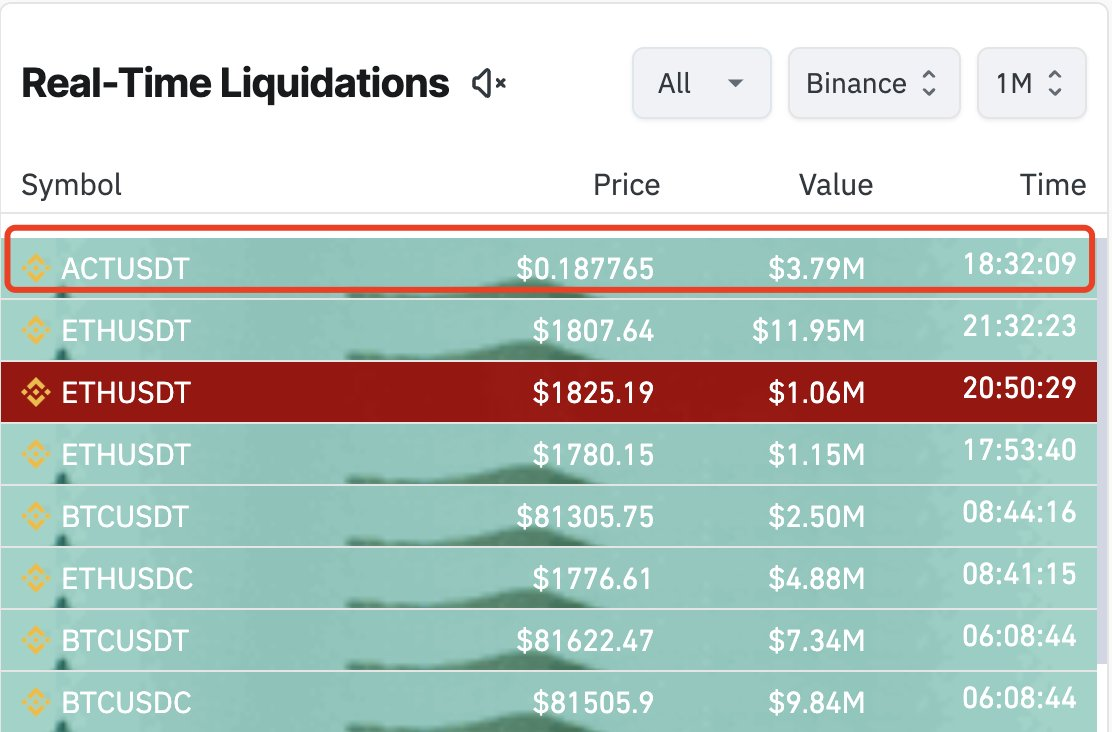

Cryptocurrency merchants suffered a lack of $3.79 million after unexpectedly updating the leverage and margin layer of chosen tokens.

One of many affected tokens was ACT I (ACT), with the dealer's $3.79 million place being liquidated at $0.1877. Lookonchain April 1st.

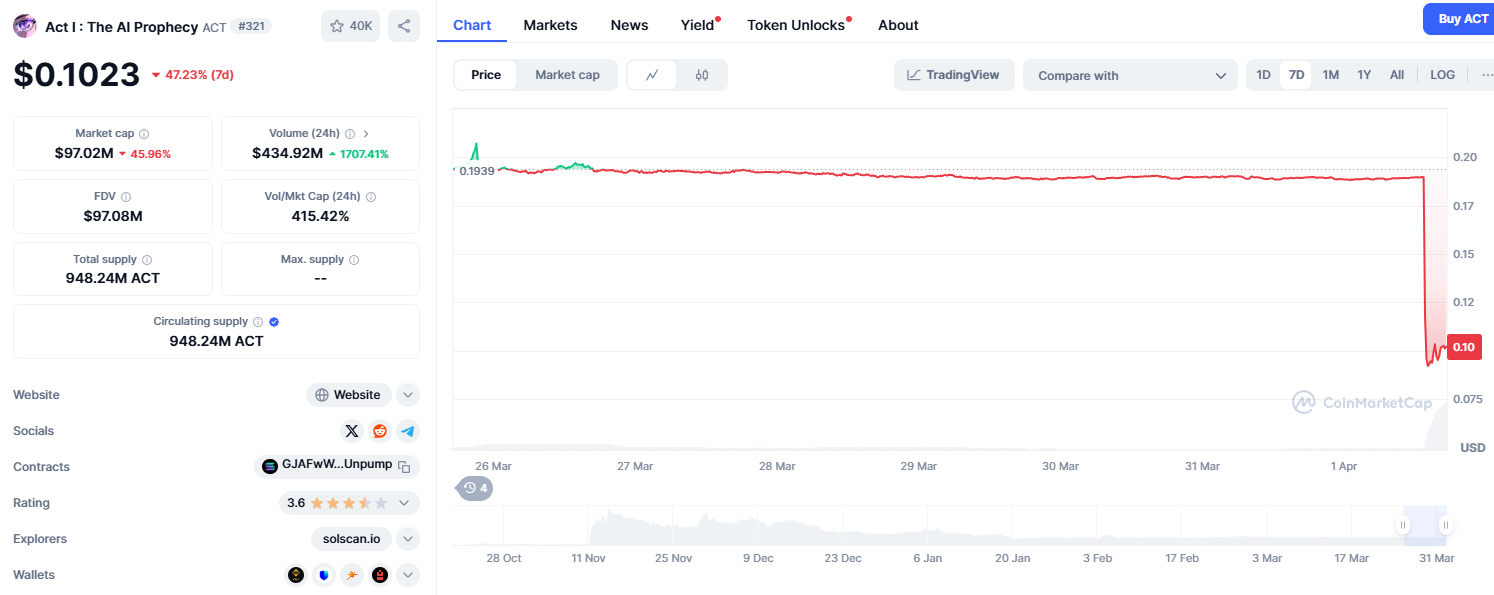

After the liquidation, one of many largest of the day, ACT, skilled a big worth drop. On the time of reporting, the token was buying and selling at $0.1018. It was down 46% over the previous 24 hours, nearly 50% within the weekly timeframe.

This worth collapse exacerbated the losses for these holding leveraged positions.

Particularly, the ripple results of ACT liquidation have expanded past the token itself, affecting the broader Altcoin market, significantly these associated to the Synthetic Intelligence (AI) mission.

Binance Futures Replace

The buying and selling platform has revealed modifications to its weblog submit and introduced leverage and margin tier updates for a number of USD-M everlasting contracts, together with 1000Satsudt, Actusdt, Pnutusdt, Neusdt, Neusdt, Neusddc, Turbousdt and Mewusdt. Particularly, the modifications supposed to regulate the chance parameters of futures buying and selling in these tokens got here into impact on April 1, 2025 at 10:30 UTC.

Nonetheless, updates include a warning that present positions can be opened earlier than the replace is affected, and futures working on the grid might expire resulting from new leverage and margin layers.

Apparently, the world's largest crypto buying and selling change suggested customers to assessment and alter their positions to keep away from potential liquidation. Due to this fact, it may be interpreted as a shock catching the whale dealer in query.

It’s noteworthy that leverage permits merchants to regulate bigger positions with much less capital, however it additionally amplifies danger.

The margin layer, however, determines the collateral required primarily based on leverage and place measurement. Exchanges like Binance alter these layers have an effect on leverage limits and liquidation thresholds. If the dealer's place not meets the necessities, it may be pressured to liquidate and result in additional losses.

Featured Pictures by way of ShutterStock