Cryptocurrency funding merchandise recorded outflows for the third consecutive week, however the tempo of promoting slowed considerably as digital asset costs stabilized after a pointy decline.

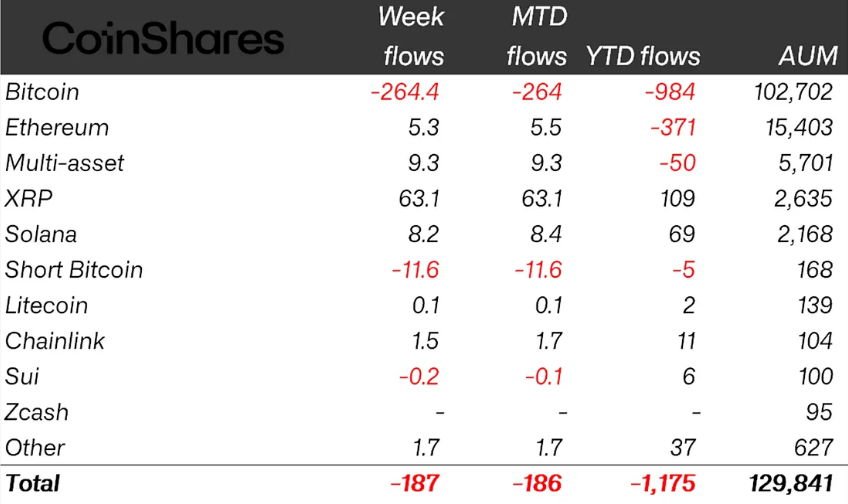

CoinShares reported Monday that crypto change traded merchandise (ETPs) recorded $187 million in outflows this week, down sharply from $3.43 billion within the earlier two weeks.

The slowdown was triggered by Bitcoin (BTC) falling to its lowest degree since November 2024, hitting $60,000 on Coinbase final Thursday.

“Fund flows usually transfer consistent with crypto costs, however adjustments within the tempo of outflows are traditionally extra informative and infrequently sign inflection factors in investor sentiment,” stated James Butterfill, head of analysis at CoinShares.

Bitcoin ETP will solely report massive losses, $XRP lead influx

Bitcoin funding merchandise had been the one group of ETPs to endure vital losses final week, with outflows totaling $264.4 million.

$XRP ($XRP) fund led the inflows, gathering $63 million, whereas different altcoin ETPs monitoring Ether (ETH) and Solana (SOL) posted modest positive factors of $5.3 million and $8.2 million, respectively.

Weekly crypto ETP flows by asset (in thousands and thousands of USD) as of Friday. Supply: CoinShares

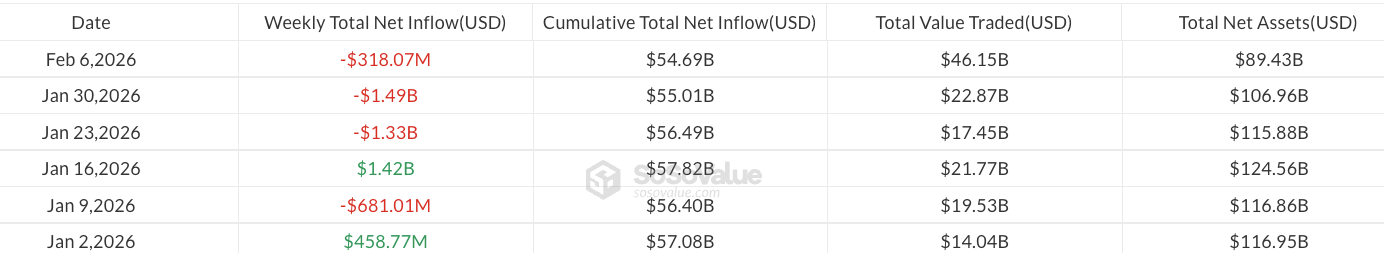

Spot Bitcoin exchange-traded funds (ETFs) accounted for almost all of Bitcoin ETP outflows final week, amounting to $318 million, based on SoSoValue knowledge.

ETP quantity reaches report excessive of $63 billion in weekly buying and selling

Referring to final week's slowing in outflows, Butterfill instructed that “we might have reached a possible market backside,” suggesting that an ETP backside might have shaped.

Regardless of the easing in capital outflows, final week marked a milestone in buying and selling exercise. In accordance with Butterfill, ETP buying and selling quantity reached an all-time excessive of $63.1 billion, surpassing the all-time excessive of $56.4 billion set in October final yr.

Associated: Amid the Bitcoin Crash, BlackRock's IBIT Hits a Single-Day Buying and selling Quantity File of $10 Billion

Bitcoin ETP property below administration (AUM) stood at $102.7 billion by the tip of the week, whereas ETF AUM was beneath $90 billion.

Weekly Bitcoin ETF flows year-to-date. Supply: SoSoValue

In the meantime, international crypto ETP AUM declined to $129 billion, the bottom degree since March 2025, Butterfill famous.

Attributable to three consecutive weeks of outflows, crypto ETPs have suffered a complete lack of $1.2 billion because the starting of the yr, whereas Bitcoin ETFs have misplaced $1.9 billion.

In different trade information, main cryptocurrency fund issuer 21Shares final week filed with the U.S. Securities and Trade Fee for an ETF monitoring Ondo (ONDO).

journal: How will cryptocurrency regulation change in 2025 and the way will it change in 2026?