Ethereum costs have skilled integration following deep revisions over the previous month. Nonetheless, key assist stays in entrance of the value, permitting for a bullish retracement stage.

Technical Evaluation

By Shayan

Day by day Charts

Ethereum has undergone deep fixes over the previous few months, finally reaching a crucial assist vary of $2,000. This stage has been serving as a robust assist zone since December 2023 and is of nice significance because it coincides with the essential optimum commerce entry (OTE) stage.

If ETH falls under this assist, a noticeable downward development could proceed. Nonetheless, given the historic calls for at this stage, the market is more likely to consolidate, doubtlessly a short-term bullish recession.

4-hour chart

Within the decrease time-frame, Ethereum's bear market construction stays intact. It’s characterised by low lows and low highs, signaling ongoing vendor domination. Not too long ago, the asset has proven an rising volatility across the space of $2,000, resulting in a significant liquidation of leveraged positions.

Nonetheless, bullish divergence seems between Ethereum costs and the RSI indicators, suggesting a gradual enhance in buying strain.

Given these elements, additional integration throughout the $2k to $2.5,000 vary might lead to elevated volatility and short-term worth rebounds.

On-Chain Evaluation

By Shayan

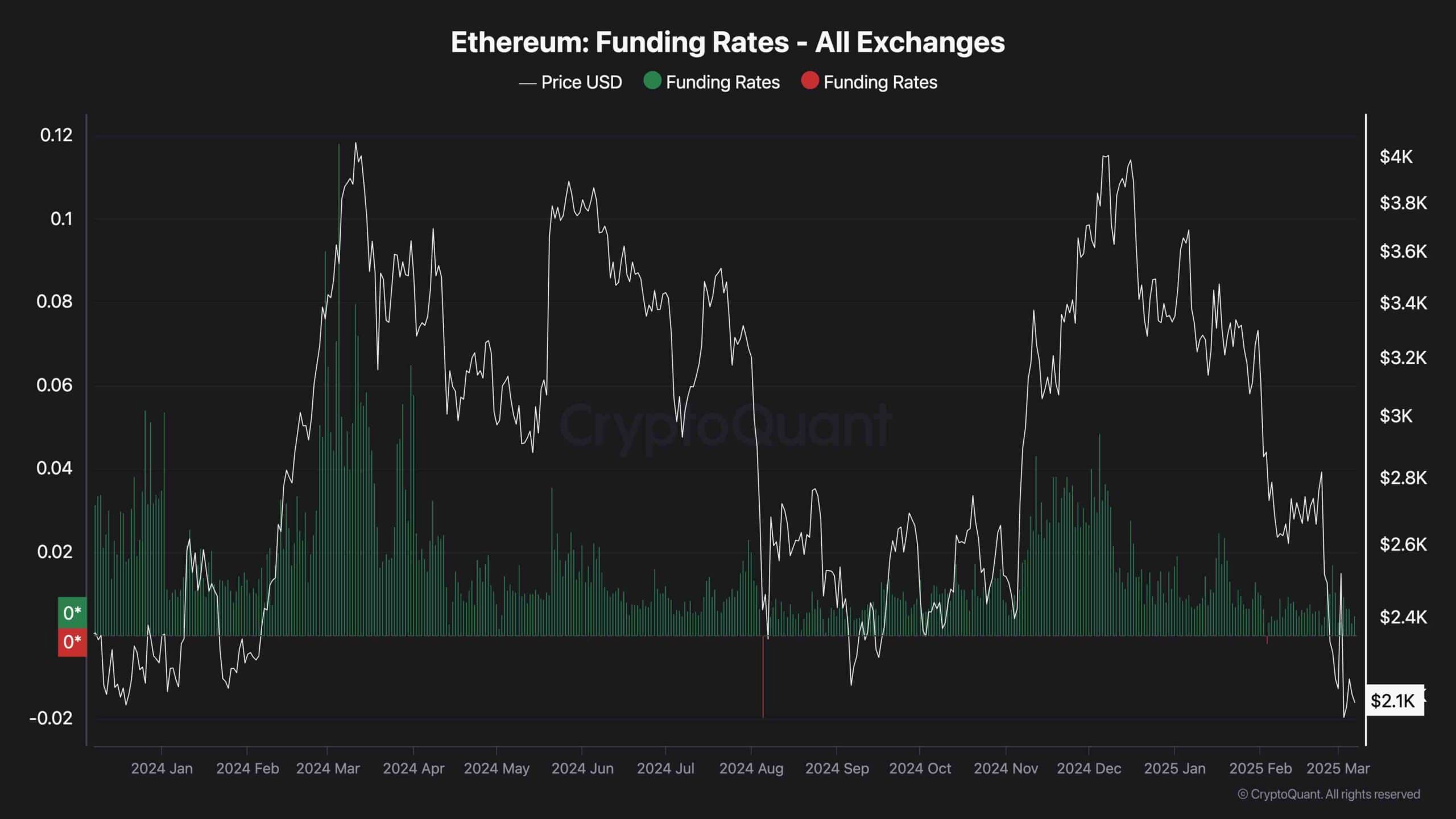

Funding price indicators are key indicators of patrons and sellers' management within the Ethereum futures market. Since peaking at 4K on the current peak of ETH, funding charges have declined, indicating a rise briefly positions and total bearish sentiment. This will increase the possibilities of steady market corrections within the brief time period.

Damaging funding charges often point out vendor management, however additionally they enhance the probability of a Shorts occasion. If Ethereum experiences even a modest bullish rebound, a wave of brief place liquidation might result in a speedy worth surge, pushing the market greater.

Ethereum's means to carry past $2K assist zone is essential in figuring out your subsequent main transfer: As soon as the ETH is steady, $2.5K and 3K$3K might pave the way in which for bullish inversion as the primary resistance ranges. Nonetheless, persevering with gross sales pressures present a deeper downward development when costs are pushed under $2,000. The following few days will probably be essential in figuring out Ethereum's short-to-medium trajectory.