MicroStrategy's newest Bitcoin buy instantly got here underneath intense scrutiny. Simply in the future after the corporate revealed its main acquisition, Bitcoin plummeted.

On December 14th, MicroStrategy introduced that it had acquired 10,645 BTC for about $980.3 million, paying a median worth of $92,098 per coin. On the time, Bitcoin was buying and selling close to native highs.

Badly timed buy, at the least within the quick time period

It was unhealthy timing. Simply in the future after Technique reported its buy, Bitcoin fell in direction of the $85,000 degree and at one level traded even decrease. As of this writing, BTC remains to be beneath $80,000.

Technique acquired 10,645 BTC for about $980.3 million at roughly $92,098 per Bitcoin, leading to a 24.9% BTC yield as of 2025. As of December 14, 2025, it acquired $671,268 BTC at roughly $74,972 per Bitcoin for about $50.33 billion. $MSTR $STRC $STRK $STRF $STRD $STRE https://t.co/VdAz7pqce1

— Michael Saylor (@saylor) December 15, 2025

Bitcoin's decline occurred amid broader macro-driven declines, pushed by considerations a few Financial institution of Japan rate of interest hike, leverage liquidations, and danger aversion by market makers. The MicroStrategy acquisition got here simply earlier than that chain.

Bitcoin worth decline was brought on by liquidations, not bodily gross sales

“On this context, this transfer must be seen as an occasion of structural deleveraging slightly than a collapse in basic demand.” – through @xwinfinance pic.twitter.com/i1DSrt2Ttw

— CryptoQuant.com (@cryptoquant_com) December 16, 2025

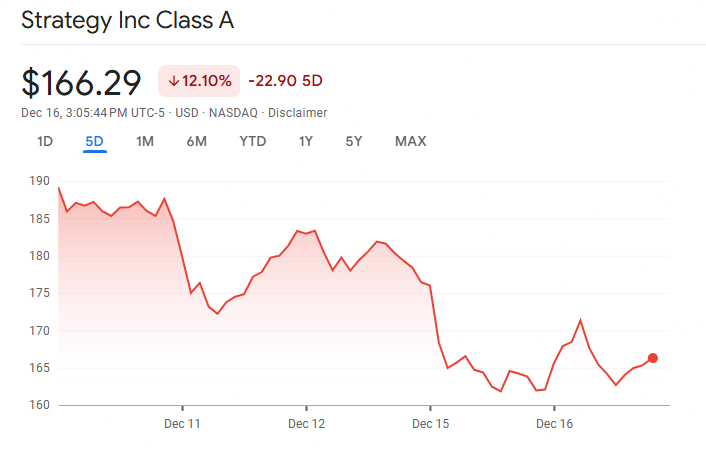

As Bitcoin fell, so did MicroStrategy inventory. The inventory has fallen greater than 25% over the previous 5 buying and selling days, considerably underperforming Bitcoin itself.

Though the inventory worth has rebounded barely immediately, it’s nonetheless effectively beneath the extent it was in earlier than the deal was introduced.

MSTR inventory worth over the previous week. Supply: Google Finance

The numbers behind the considerations

At the moment, MicroStrategy holds the next: 671,268BTCobtained at approx. $50.33 billion at common worth $74,972 per coin.

In the long term, the corporate stays extremely worthwhile.

Nonetheless, short-term optics are vital. With the value of Bitcoin reaching practically $85,000, the newest tranche is already lifeless on paper.

MicroStrategy's mNAV is presently round 1.11, which means the inventory worth is just round 11% costlier than its Bitcoin holdings. That premium rapidly compressed as Bitcoin fell and fairness traders reassessed their dangers.

MicroStrategy mNAV. Supply: Sailor Tracker

Why did the market react so harshly?

Buyers don’t have any doubts about MicroStrategy's Bitcoin concept. They query timing and danger administration.

The macro dangers that triggered Bitcoin's decline have been effectively communicated. The market had warned about this. Chance of Financial institution of Japan rate of interest hike and the risk to the yen carry commerce for a number of weeks.

Bitcoin has traditionally been aggressively bought across the Financial institution of Japan's tightening cycles. This time was no exception.

Critics argue that MicroStrategy couldn’t look forward to macro clarification. Amid tight international liquidity circumstances, the corporate appears to have aggressively purchased shares close to resistance ranges.

🚨Japan will crash Bitcoin inside 5 days!!!

Individuals are vastly underestimating what Japan goes to do with Bitcoin.

The Financial institution of Japan is anticipated to boost rates of interest once more on December nineteenth.

That will not sound like a giant deal… keep in mind this:

Japan is the biggest holder… pic.twitter.com/0a9Aimfn88

— NoLimit (@NoLimitGains) December 14, 2025

Was it actually a mistake?

It is determined by the timeframe.

From a buying and selling perspective, this buy looks as if unhealthy timing. Bitcoin instantly fell, and shares compounded losses as a result of leverage, sentiment, and decreased NAV premiums.

From a method perspective, MicroStrategy has by no means aimed for the underside of time. The corporate continues to plan its purchases round long-term accumulation slightly than short-term worth optimization.

CEO Michael Saylor has repeatedly asserted that: Proudly owning extra Bitcoins is extra vital than entry accuracy.

The true danger shouldn’t be the acquisition itself. That's what occurs subsequent.

As soon as Bitcoin stabilizes and macro pressures subside, MicroStrategy's newest acquisition will doubtless fade in long-term value foundation. Nonetheless, if Bitcoin falls additional, this resolution will stay a spotlight for critics.

MicroStrategy could not have made the worst Bitcoin buy of 2025. probably the most disagreeable factor.

Did MicroStrategy make the worst Bitcoin buy of 2025?The submit appeared first on BeInCrypto.